Investment Property Loans: Everything You Need to Know

Investing in real estate requires capital, whether you’re buying a vacation condo to rent out, a single-family home for leasing, or a multi-story apartment building. Rental property loans can provide the capital you need, but they’re not exactly the same as conventional home mortgages. It’s important to understand the nuances of these loans before you sign on the dotted line.

Why Use an Investment Property Loan?

The first and most important reason to seek financing is because you don’t have enough cash for the full purchase price; however, there can be other benefits to taking out a loan.

Borrowing—or leverage, as the financial experts call it—allows you to make a bigger investment with a smaller initial outlay. That means that any returns would be magnified, whether they come from rental income or rising real estate prices. A 10% increase in your property’s value becomes a 20% increase if you’ve only put half down. That’s the power of leverage.

Borrowing also increases risk, though. A drop in the value of your property will hit you harder if you’ve borrowed to buy it. If the economy slows down and vacancies rise, you’ll still be on the hook for loan payments and interest, as well as operating expenses, even though less money is coming in.

Real Estate Investment Loan Considerations

Real estate investment loans are inherently riskier than conventional mortgages because it’s easier to walk away from an investment than your primary home. As a result, you’ll face some constraints:

- Interest rates are typically one to three percentage points higher for rental properties than primary home mortgages.

- Lenders will demand larger down payments. Mortgage insurance isn’t available on investment properties, so you’ll probably have to put down at least 20%. Down payments of 25% to 30% aren’t unusual.

- You’ll have to pay all closing costs upfront.

- You’ll need to have cash reserves on hand, as well as a down payment. Most banks ask to see enough money to pay housing costs, like loan payments, insurance and taxes for six months.

- It may take longer than a home mortgage to get approved—and you’ll likely need more documentation. Investment lenders typically ask to see your credit report, assets, cash reserves and income statements. In some cases, they may ask for a business plan projecting rental income and capital appreciation for your investment property.

- There are limits on how many mortgages you can have at one time. Conventional lenders limit borrowers to four mortgages, though Fannie Mae has a program that can finance up to 10.

Types of Investment Property Loans

There are several different types of loans available.

Conventional mortgages

These are just like your regular home mortgage, except that they may require larger down payments, charge higher rates and ask you to demonstrate significant cash reserves, as described above.

Fix and flip loans

Sometimes called “hard money” loans, these are short-term financings designed for people who flip houses—that is, buy them cheap, fix them up and sell them for a profit within a year or two. They’re short-term loans with terms of six to 36 months typically and they carry higher interest rates than conventional mortgages. You should only take out this kind of financing if you’re sure you can sell the property within the term of the loan.

Home equity

Many real estate investors use equity built up in their homes to finance investment purchases, either through a home equity loan or a home equity line of credit. This type of financing is typically less expensive than other loans and may require a smaller down payment or no down payment at all. It is secured by your primary home, however, so if you default, you risk losing your house.

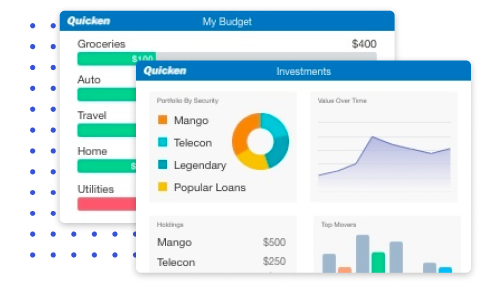

- Customize invoices & store documents

- Generate Schedule C, E & other tax reports

- Track leases, deposits, and more

What you’ll need to apply

You need to provide documentation to apply for an investment loan, including:

- Your credit report

- Bank statements

- Investment and retirement account statements

- Pay stubs

- Driver’s license

- Social security card

Self-employed borrowers will also need

- Two years of tax returns

- A business or occupational license

- Business bank statements

- Cash flow and asset statements

Investing In Real Estate With Borrowed Money

Used prudently, loans can be an essential part of your real estate investment strategy, enabling you to purchase more property for a smaller initial investment. Like any loan, investment property mortgages involve some risk, so think carefully about how much you want to borrow and how readily you can pay it back. By borrowing moderately, you could boost your returns from both rental income and appreciation, and increase your chances of investment success.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.