There's never been a better time to get Quicken Simplifi

No matter where you're coming from, better budgeting is just a few clicks away.

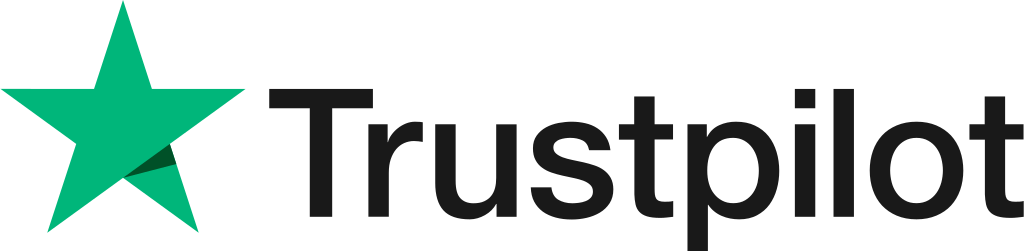

Better budgeting, plus so much more

Import your data automatically

Guided onboarding with Simplifi 123

Manage your finances, not just your credit

All Quicken plans

Find the right plan for your financial goals

Personal

Business

Select the best fit for your finances

Quicken Simplifi

Starting at$2. 39 $3.99 40% off /monthBilled annually.

- Best for Mint & Credit Karma switchers. Easily import your data.

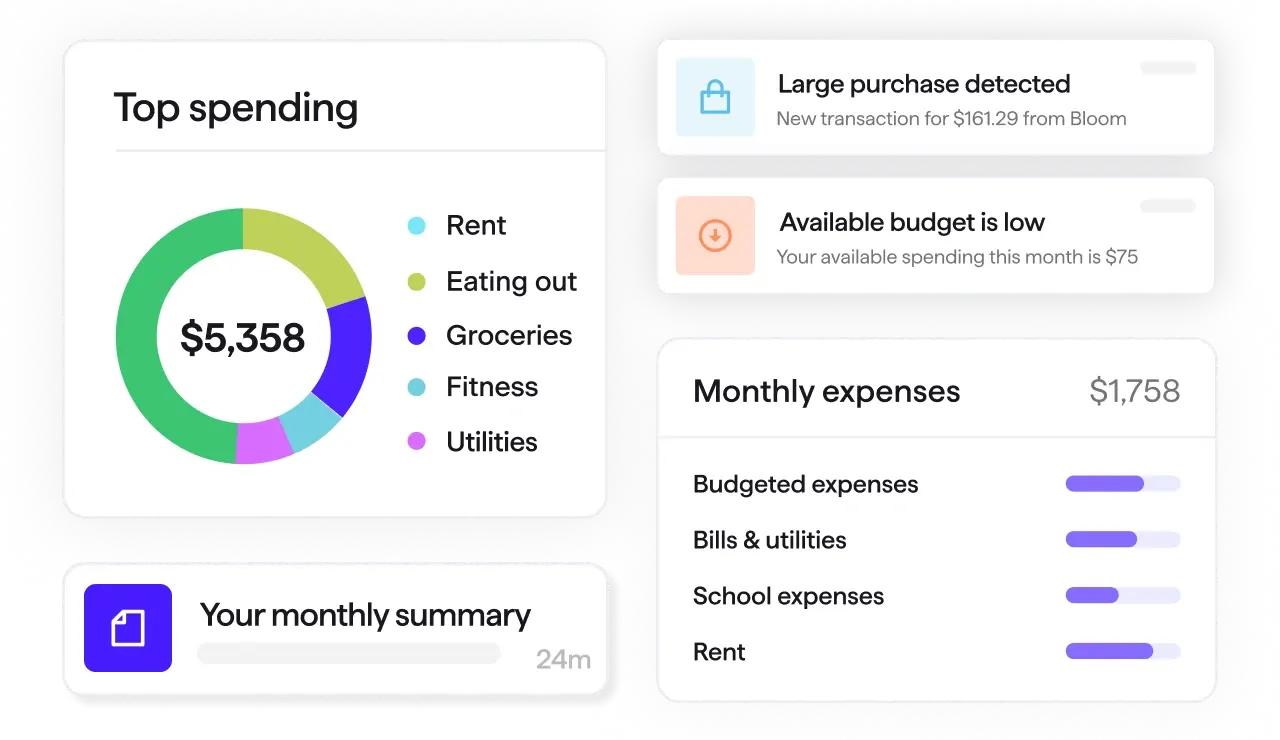

- Save more money

- Always know what you have left to spend or save

- Get insights with real time alerts & reports

- Customize your transactions

Quicken Classic

Choose a version

Premier

Deluxe

Starting at$4. 19 $6.99 40% off /monthBilled annually.

Starting at$2. 99 $4.99 40% off /monthBilled annually.

- Best-in-class investing tools

- Built-in tax reports

- Reconcile to the penny

- Track & pay bills in Quicken

- Set budgets, manage debt, create a retirement plan

- Manage & reduce debt

- Create a secure retirement

- Make tax time easy

- Create multiple budgets

Quicken Classic Business & Personal

Starting at$5. 99 $9.99 40% off /monthBilled annually.

- Manage business, rental & personal finances

- Optimize for taxes

- Keep documents organized

- Reports: P&L, cash flow, tax schedules, and much more

Over 20 million better financial lives built, and counting

Trusted for over 40 years

#1 best-selling with 20+ million customers over 4 decades.Bank-grade security

We protect your data with industry-standard 256-bit encryption.