12 Epic Financial Failures

1) “Zyzzyx Road”

Hollywood has always had flops, really big flops, and then it’s had “Zyzzyx Road.” This 2006 thriller starring Katherine Heigl and Tom Sizemore had a budget of $2 million, but grossed only $30.00 in its U.S. release.

To be fair, being a terrible film wasn’t the only reason the film only grossed $30. “Zyzzyx Road” was only shown in the U.S. six times — once a day for six days at a single theater. This was done intentionally by producers to fulfill their obligation to the Screen Actors Guild, which required a U.S. release before foreign distribution. Film producers believed releasing the film abroad before U.S. release would build momentum for a bigger re-opening later on in the United States. Unfortunately for the producers, the film failed miserably when released abroad, earning a paltry $368,000. This failure condemned the film to never being widely released in the United States.

2) Spruce Goose

In 1942, the United States Department of War faced an escalating need for transportation of war material as German U-boats caused heavy losses of supplies carried by ships. One proposed solution was to commission an aircraft that could carry a huge payload. The Hughes Aircraft Company was given the contract. Henry Kaiser teamed with the famed aircraft designer Howard Hughes to create the largest aircraft ever conceived (for its time), designed to be capable of carrying 750 troops, or one M4 Sherman tank.

The Department of War furthered the demand by restricting the use of metal, a scarce resource, meaning the aircraft would have to be constructed almost completely from wood. The initial contract called for three aircraft to be completed within two years, but development was continuously delayed. The project wasn’t finished until 1947, too late for use in the war. At a cost of $23 million, the plane ended up being a financial fiasco for Hughes and the United States Department of War. Only a few test flights were ever done, with the Spruce Goose reaching an altitude of 70 feet, not high enough to prove that it was truly airworthy.

3) Webvan

Hailed as one of the biggest dot-com disasters, at its inception Webvan.com had lofty goals. Founded by Louis Borders, the co-founder of Borders Bookstores, Webvan wanted to dominate the grocery delivery market by offering delivery of groceries within 30 minutes of order. Although Webvan was popular, the money the company spent on its infrastructure greatly exceeded its sales growth.

Webvan placed a $1 billion order to build warehouses, bought a fleet of delivery trucks, ordered 30 Web servers, hundreds of computers, and even purchased 115 Aeron® chairs at a cost of more than $800 each. This massive spending, coupled with unforeseen logistical roadblocks (failing to consider most customers would want delivery at night), resulted in the company going bankrupt just 18 months after it opened its digital doors. The company that once had $800 million in venture capital ended with nearly $830 million in losses. The Web site, now owned by Amazon.com, continues a modified version of the service, selling nonperishable food items online.

Vintage Webvan ad:

4) :CueCat

:CueCat, developed by the Digital Convergence Corporation in the late 1990s, was a handheld tool that allowed users to scan barcodes and open a Web page without the user entering a URL. The product was a massive failure and suffered criticism from many authorities, including being dubbed one of the “25 Worst Tech Products of All Time” by PC World. Additionally, many critics asserted that the product didn’t address any current consumer needs.

The product’s marketing strategy was almost as big a failure as the product itself. :CueCat spent millions of dollars sending out free :CueCat devices to readers of popular tech magazines such as Wired. This strategy backfired when the tech-savvy audiences of these magazines realized data about their usage habits were likely being collected and recorded. Further damage was done when the :CueCat Web site suffered a security breach, leading to hundreds of thousands of customer data being leaked. :CueCat quickly burned through its $185 million initial investment and is now defunct. In 2005, :CueCat devices were being sold in bulk by liquidators for 30 cents each in lots of 500,000 or more.

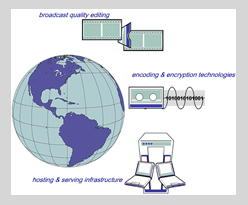

5) Pixelon.com

Pixelon.com was an Internet video firm founded in 1998 by Michael Fenne. The company promised a revolutionary technology for better distribution of high-quality video content over the Internet. Unfortunately, this technology never actually existed.

The company quickly failed after it was discovered that Michael Fenne was actually Paul Stanley, a convicted felon who had previously been involved in stock scams. Before Stanley’s ruse was exposed, he managed to raise more than $16 million in funding. He spent the bulk of the money on a Las Vegas launch party, which included acts such as Tony Bennet, Kiss and The Who. The company went completely bankrupt in 2000.

6) Final Fantasy: The Spirits Within

Despite its title, “Final Fantasy: The Spirits Within” bore no relation to the popular series or video game. Instead, the film was a standalone, with an original storyline and characters. The brainchild of Hironobu Sakaguchi, creator of the Final Fantasy franchise, “The Spirits Within” was the first animated film to attempt photorealism.

Despite success in creating a very good-looking film, it was a box office bomb, making only $85 million worldwide, of which the production company took half. With a budget of $137 million, the production company, Square Company, lost $94 million, nearly resulting in bankruptcy.

7) Tacoma Narrows Bridge

In July of 1940 the Tacoma Narrows Bridge opened in Puget Sound near Tacoma, Washington, and in November of the same year, it collapsed. When it was built, the Tacoma Narrows Bridge was one of the longest suspension bridges in the world (beat only by San Francisco’s Golden Gate Bridge and New York’s George Washington Bridge). Due to financial and time constraints, the bridge was constructed with significantly fewer materials than a typical bridge of similar magnitude. The lack of support that resulted from this engineering error sealed the fate of the bridge before it ever opened.

From the start, the bridge became notorious for its movement. A mild to moderate wind could cause alternate halves of the center span (about 2,500 feet long) to visibly rise and fall several feet over 5-second intervals. This flexibility was experienced by the builders during construction, and by the drivers as soon as the bridge opened, earning it the nickname “Galloping Gertie.”

On November 7, 1940 at 11 a.m., 40 mph winds caused the bridge to sway for a prolonged period of time. It finally collapsed due to the wear and strain on the fragile structural support. The only loss of life due to the bridge collapse was a dog named Tubby. Aside from the money lost by its destruction, significant losses were unable to be recouped by insurance claims. Only half of the bridge’s insurance was collected, with the rest being lost due to the state’s insurance agent fraudulently pocketing the insurance premiums. As if to keep old wounds open, the Tacoma Narrows Bridge is used as a frequent example in colleges and universities of how not to build a bridge.

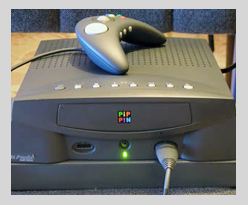

8) Apple Pippin Game Console

During the mid ‘90s, Apple Inc. (formerly Apple Computer Corporation) attempted to make and sell an inexpensive and fast multimedia platform. Instead, what they developed and had a hard time selling was one of the most expensive and worst computer/video game consoles of all time. Apple’s Pippin game console was a flop. Its goal was to play CD-based multimedia games and programs as well as function as a networking computer.

They advertised a fast operating system at an affordable price. When it was released in the U.S., the Pippin sold for about $600, which easily made it the most expensive console on the market at that time. But the Pippin’s operating system was incredibly slow when in use offline as a game console, and even slower as a networking computer. On top of that, there were literally no releases for it, and it arrived late into the console generation of that time, which was already dominated by the Nintendo 64.

Apple made about 100,000 of the Pippin model, but they only sold less than half (about 40,000). The Pippin has frequently been featured on Web sites listing the ten worst game consoles ever made and the 15 worst tech products of all time.

9) IndyMac Bank

Once one of the nation’s largest home lenders, IndyMac Bank was shut down and taken over by federal regulators in July 2008. From the start, IndyMac had specialized in what was considered to be “low-risk” loans to residential mortgage borrowers. Two years ago, the IndyMac stock began steadily falling, and by early 2008, it had lost around 95% of its value. Billions were lost, and IndyMac stocks dropped to 28 cents a share.

The failure occurred as a result of IndyMac’s practice of not requiring necessary earnings information from borrowers to justify receiving loans, so most borrowers never acquired the means to pay them back. The problem should have been addressed after the company lost $84.2 million in one quarter, and then over $600 million in the following quarter. The loss resulted in the firing of nearly 53% of the original IndyMac workforce. Unable to reverse the situation, IndyMac was forced to give up control to the federal government. Fixing the financial disaster created by IndyMac Bank will cost the government up to $8 billion. IndyMac Bank became the third largest bank to fail in U.S. history.

10) The Ford Edsel

Creating a new automobile for mass consumption comes at a high cost and with a great deal of risk. The hope is that despite the staggering cost to develop a new model, if the public falls in love with the design, all money (plus a profit) will be recouped.

The Edsel is considered by many to be one of Ford Motor Company’s most spectacular failures, costing them over $350 million. Besides being more than just unpopular because of its design and craftsmanship, the Edsel’s failure has often been considered one of the worst product marketing disasters of all time.

The marketing strategy for the Edsel was one of mystery, mystique and hype. Advertisements featured blurred-out images and other teasers, and prepared consumers for a “brand new kind of car.” When the Edsel arrived, it became clear that it wasn’t dissimilar from other Ford models of the time, and was shunned for its failure to impress, live up to the hype, or offer anything new and exciting. These factors, coupled with the recession of the late ’50s, and a nonsensical pricing structure that didn’t fit the features or benefits of the model, positioned the Edsel as one of Ford’s most memorable flops. “Edsel” has since become synonymous with identifying failures .

11) Amp’d Mobile

Amp’d Mobile takes the crown for money-burning with $360 million in losses, and being forced to finally file for bankruptcy protection in June 2007. The company’s major problem was that its young customers weren’t able to pay their bills.

When the company started out with Verizon Wireless as its operating partner, chief executive Peter Adderton ignored the standard 30-day waiting period after signup (that customers were given to prove they could pay their bills) and gave them 90 days instead, to attract more customers. Amp’d also created a large-scale marketing campaign that appealed to young people, many of whom had low credit scores. So before too long, they had loads of new customers.

Between November 2006 and February 2007, Amp’d had more people signing up for their service than any other provider had ever experienced. As the company began tallying their profits, they found it to be an amazing idea — at least for the first 90 days. When the 90-day mark rolled around, Amp’d started checking on their clients’ abilities to pay. That’s when they discovered that nearly half of their new customers would not be able to pay their bills — the official report places the number at 80,000 of the company’s 175,000 customers.

12) “Delgo”

“Delgo,” an animated feature film that was released in 2008, was one of the biggest theatrical flops of all time, and it holds the current record for the lowest “wide release” opening earnings in the history of the movie business.

The film’s plot is of the familiar David vs. Goliath variety, with the hero a teenaged boy named Delgo. The film stars the voices of a number of well-known actors, including Burt Reynolds, Kelly Ripa, Val Kilmer, Chris Kattan, Jennifer Love Hewitt, Freddie Prinze Jr. and Michael Clark Duncan. The film, produced by Fathom Studios, was eviscerated by critics, and while the producers of the film considered it revolutionary to the children’s animation genre, its plot and marketing efforts failed to capture anyone’s attention.

The $40-million fantasy film brought in an amazingly low $511,920 at its opening. Most viewers saw the film as a boring animated rip-off of classic stories like “The Lord of The Rings.” Despite its high production costs, viewers were equally unimpressed with the production quality of the film, and less- than-stellar animation.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.