Built by Mac users for Mac users

Runs natively on Apple M1, M2 & M3 processors

Get everything you need to take control of your business, rental & personal finances. Connected when you want it, separate when you need it.

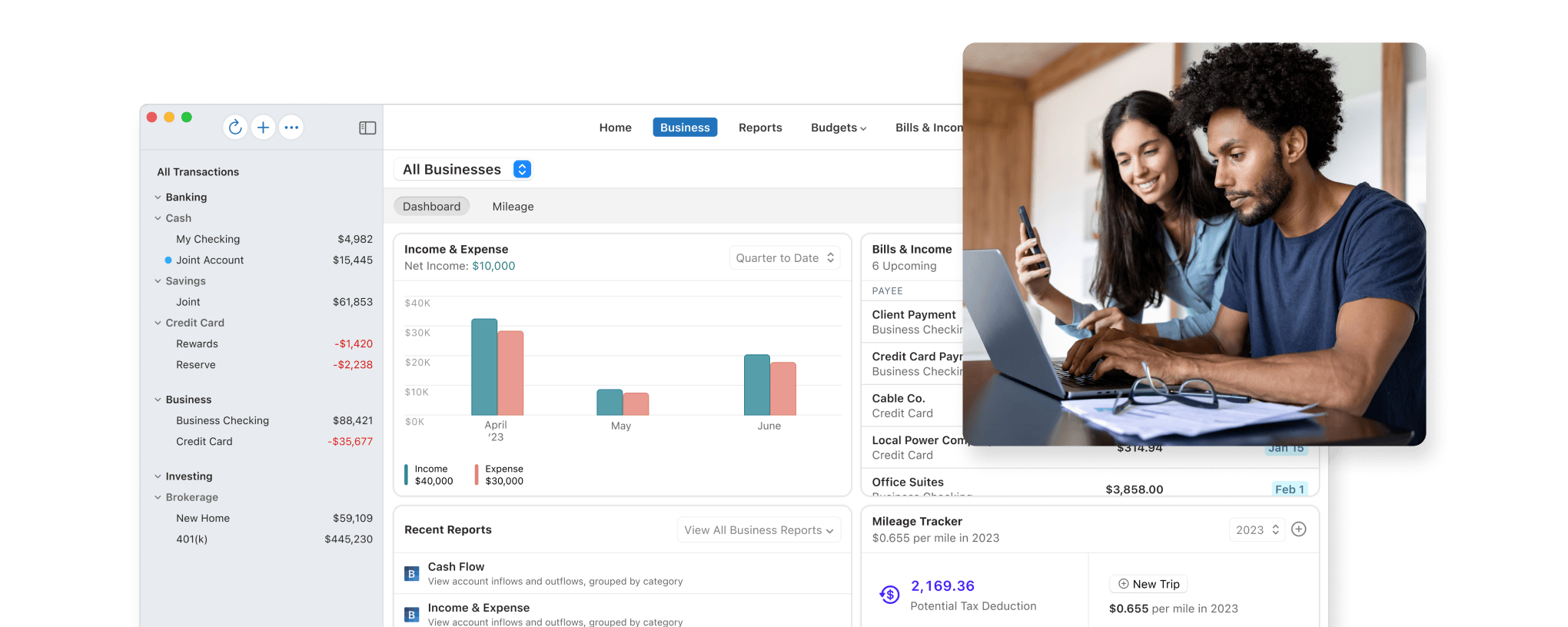

See all your budgets and cash flows with a dedicated business dashboard. Get a bird’s-eye view of your business for your most important items.

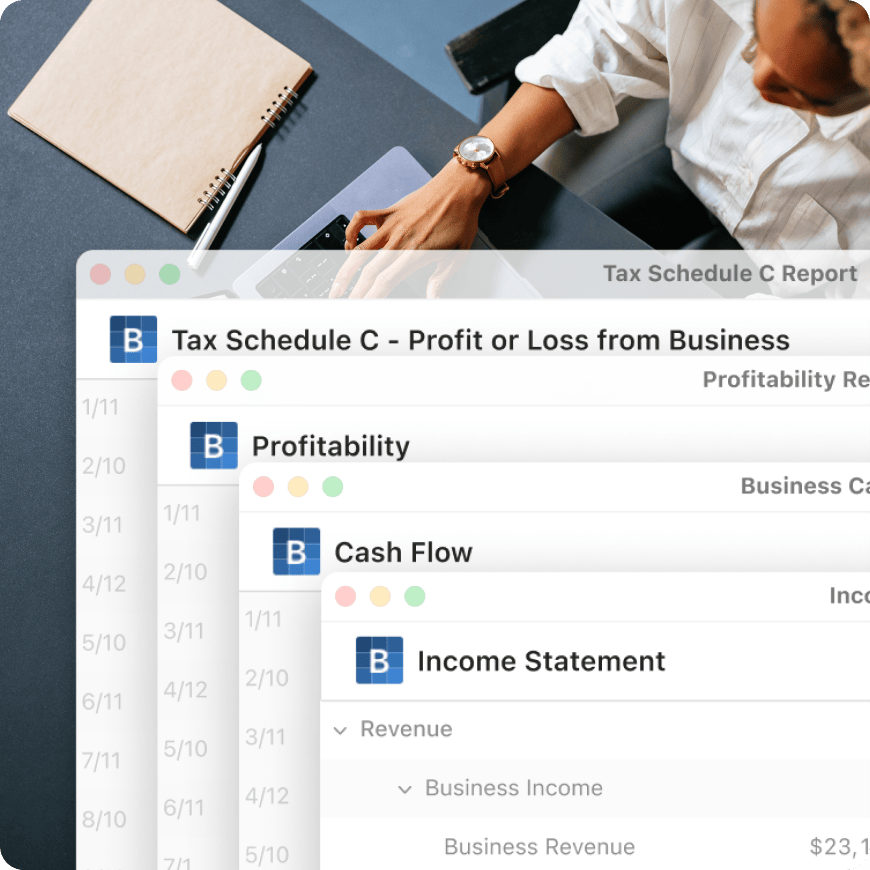

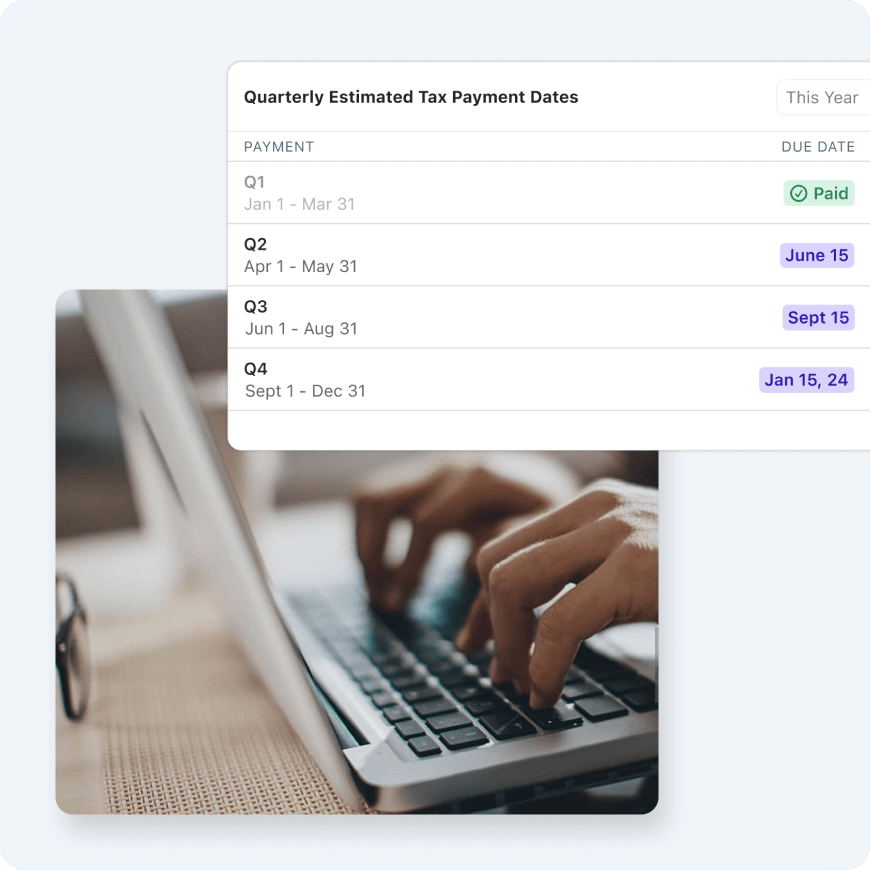

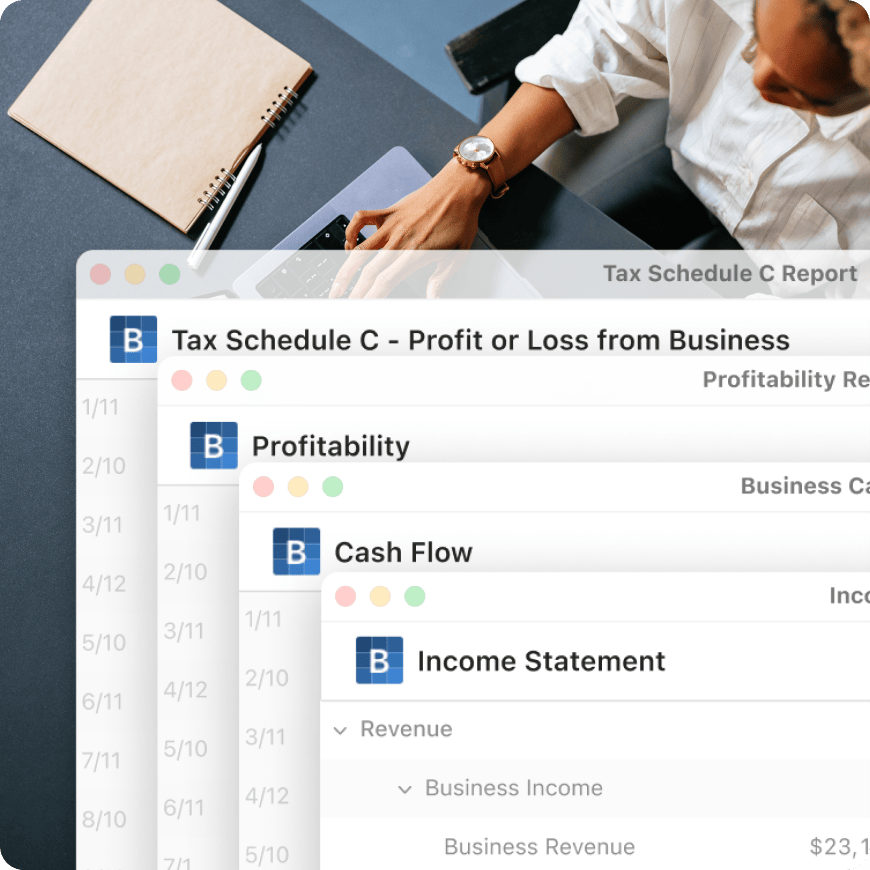

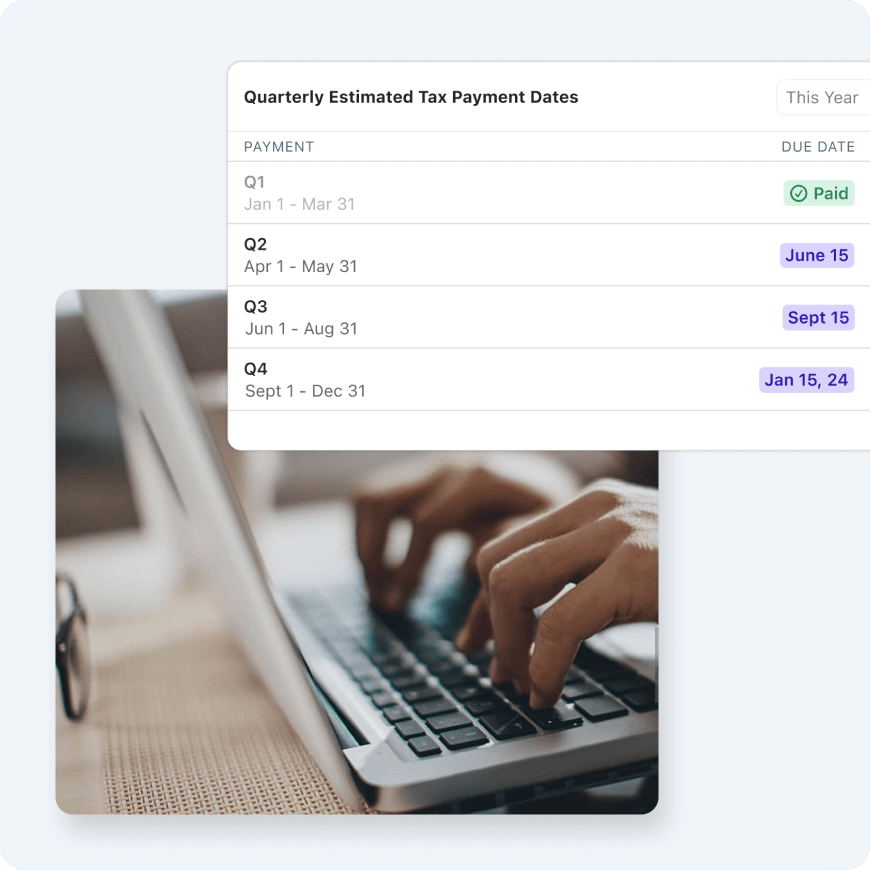

Maximize tax deductions across both business & personal finances. Save time with built-in reports for tax Schedules A through F. Plan your taxes with a quarterly tax calendar and export your data to TurboTax for tax season.

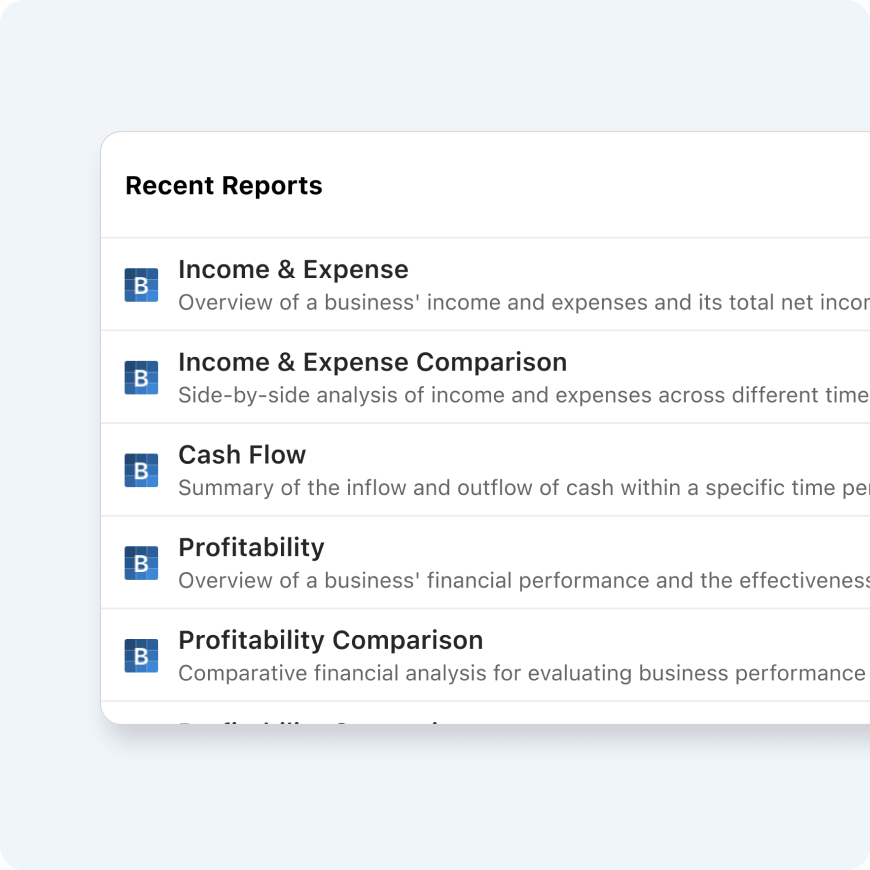

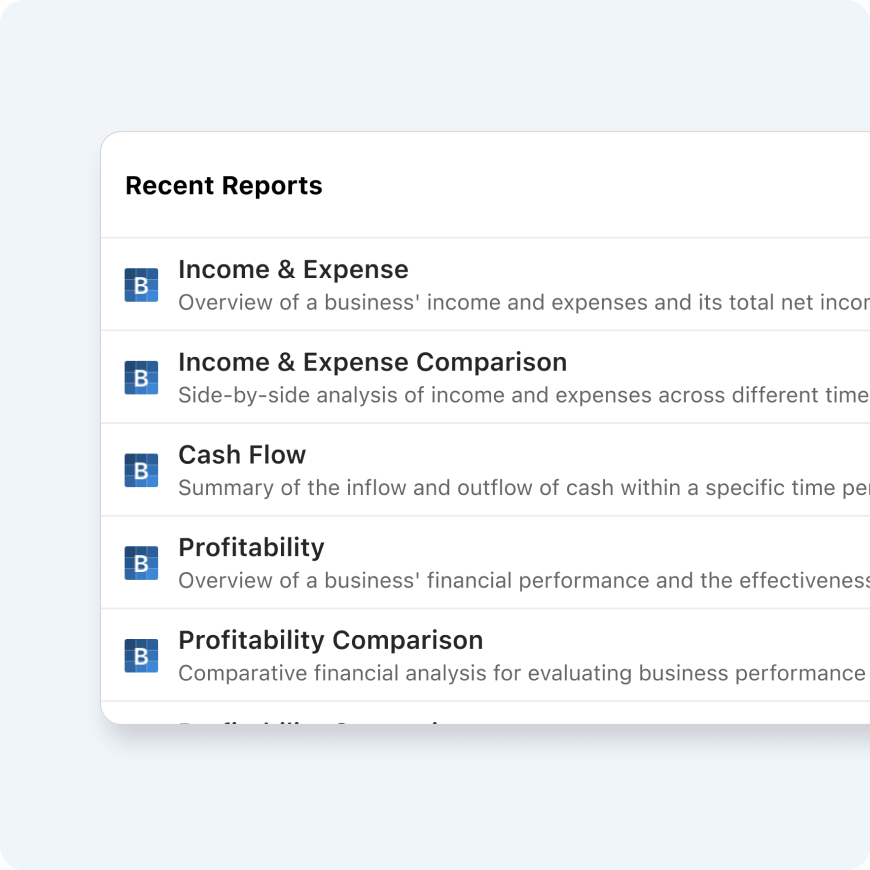

Enjoy unlimited reports for your business & personal finances, and even build your own. Explore profitability, cash flow, income statement, investments, debt, asset accounts, and more.

Enter your business & personal mileage and view it on the dashboard so you can easily include it in your tax deductions.

Quicken Classic Business & Personal

Business & Personal for Mac includes every tool and feature from our entire Classic for Mac line, and more — adding features for small business & rentals:

Manage your business & personal finances together, with perfect separation

Get Schedule C, E & F tax reports, profitability, income statement, cash flow, and more

Store business documents and receipts where you need them

Track business & personal mileage for tax deductions

You can use report filters to see your business and personal finances however you want—one business, all businesses, or business & personal together or separately, even if income or expenses are from the same account.

You can manage all your debt in one place — from your personal mortgage to your business loans. “What-if” tools let you compare options to see your best plan, whether that’s paying off small balances first or attacking high-interest loans.