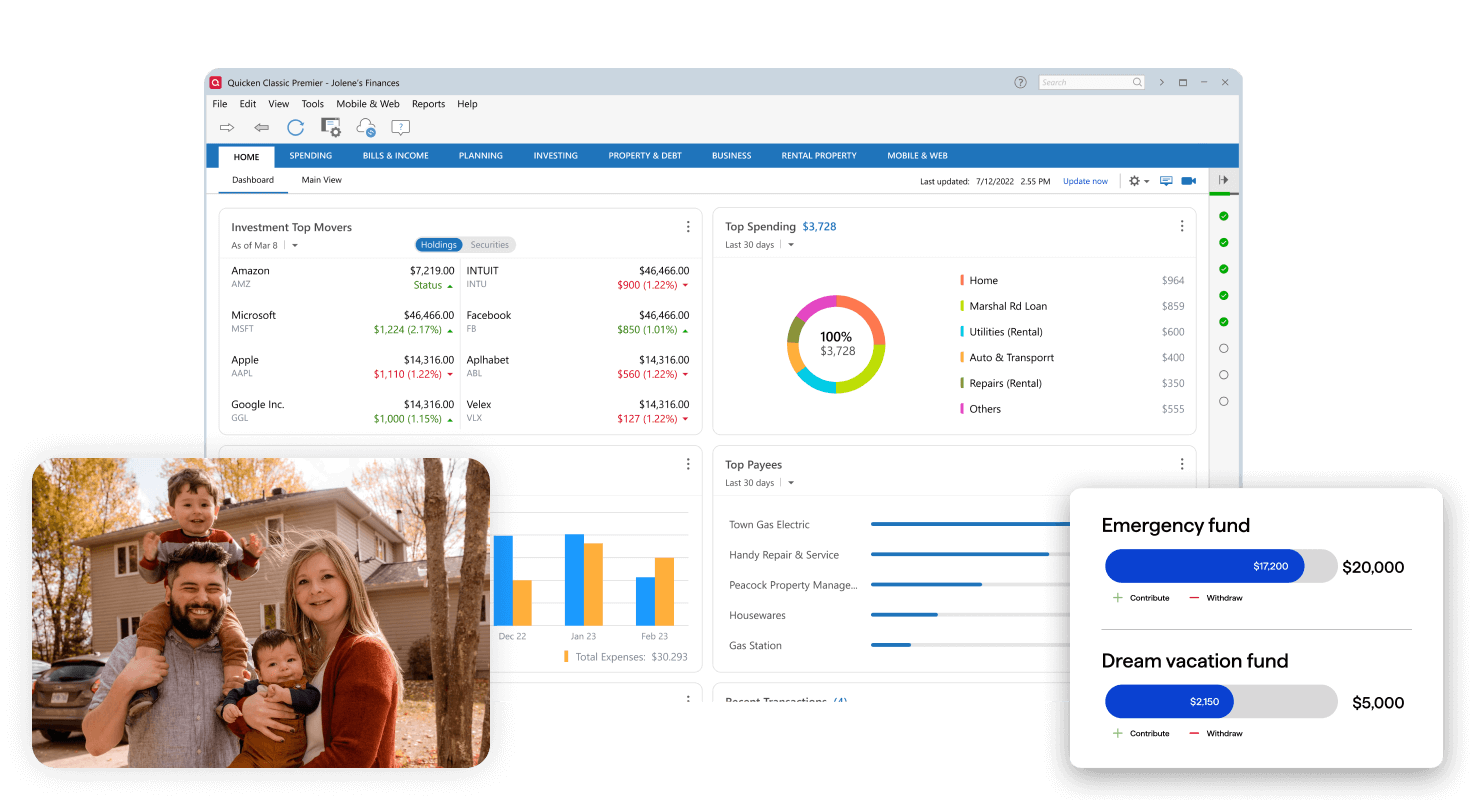

Take control of your finances

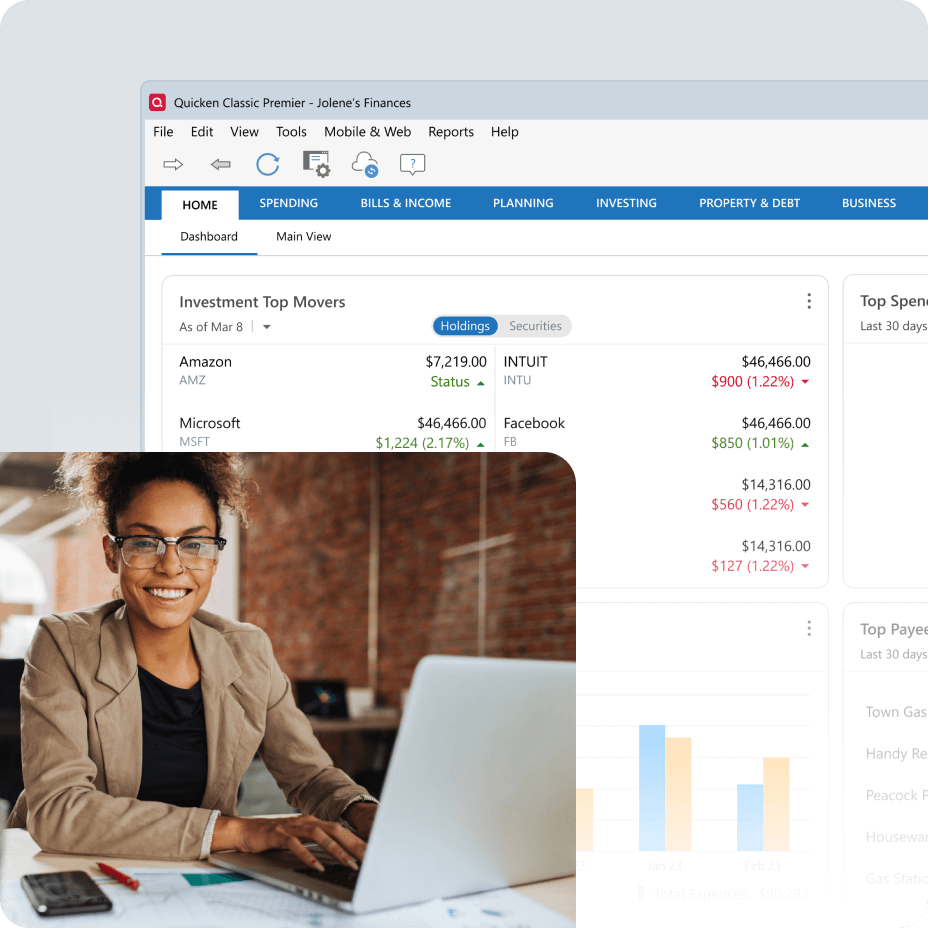

“A top choice for power users who want the most feature-rich software available.”—PCMag

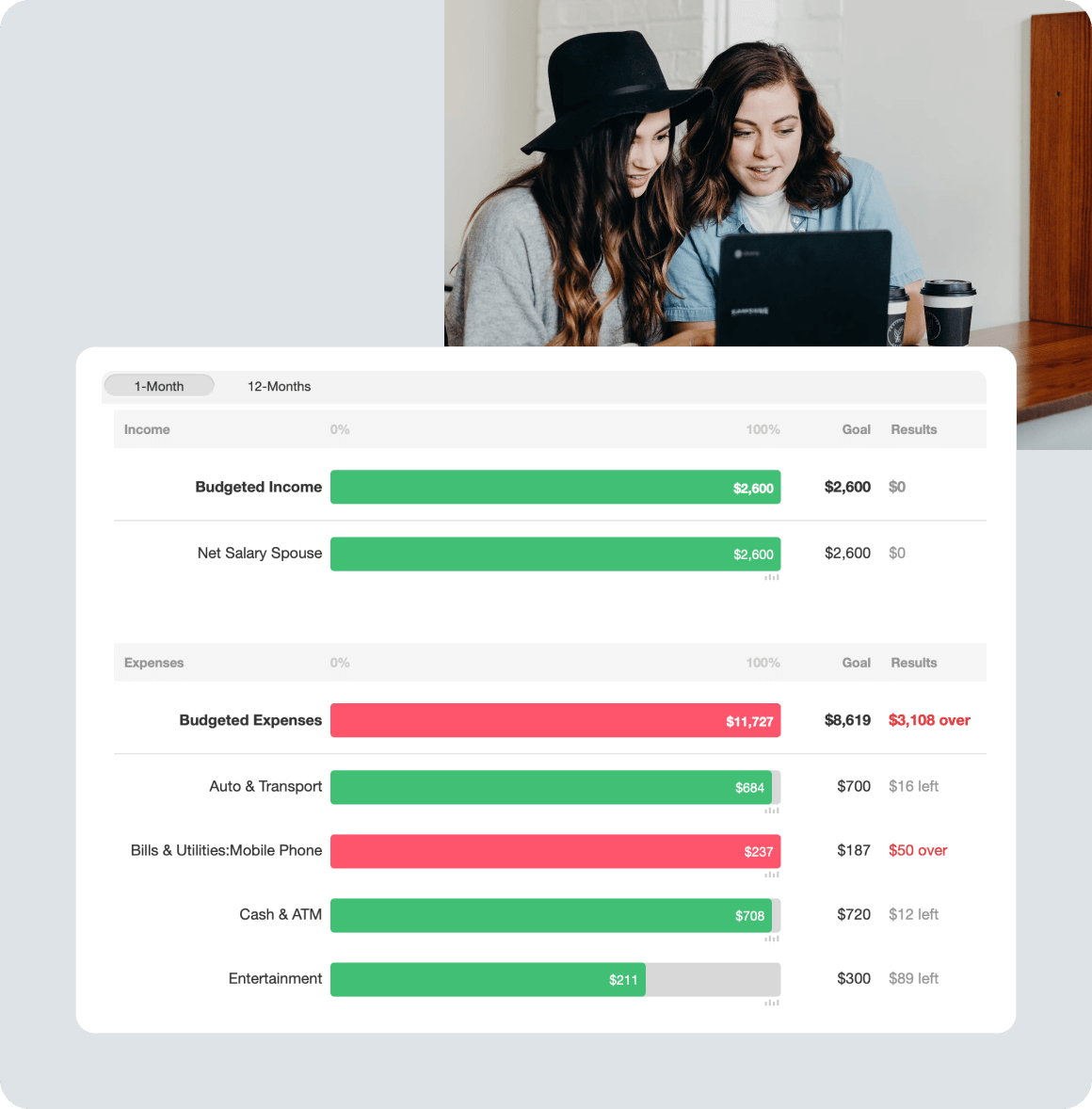

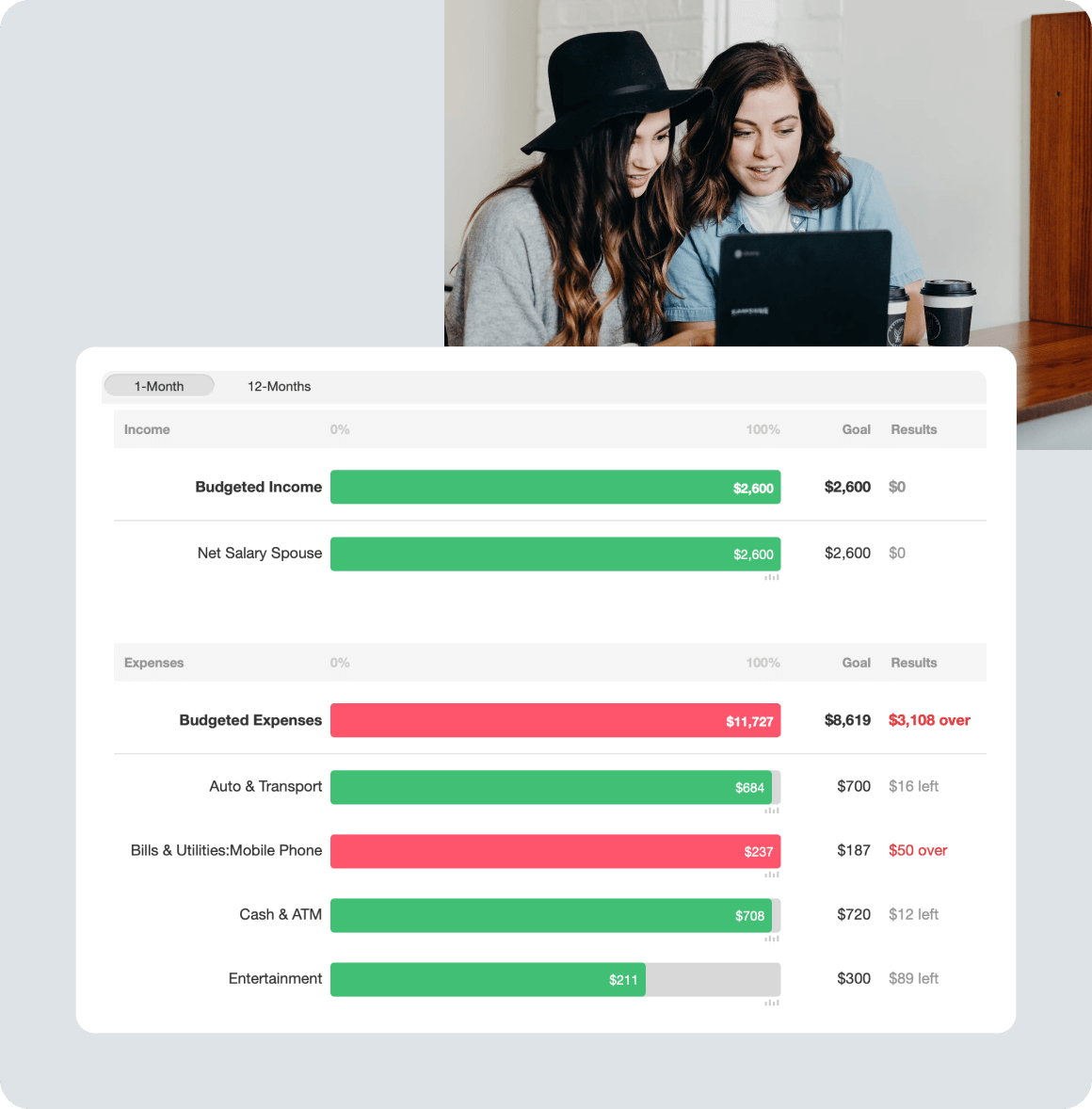

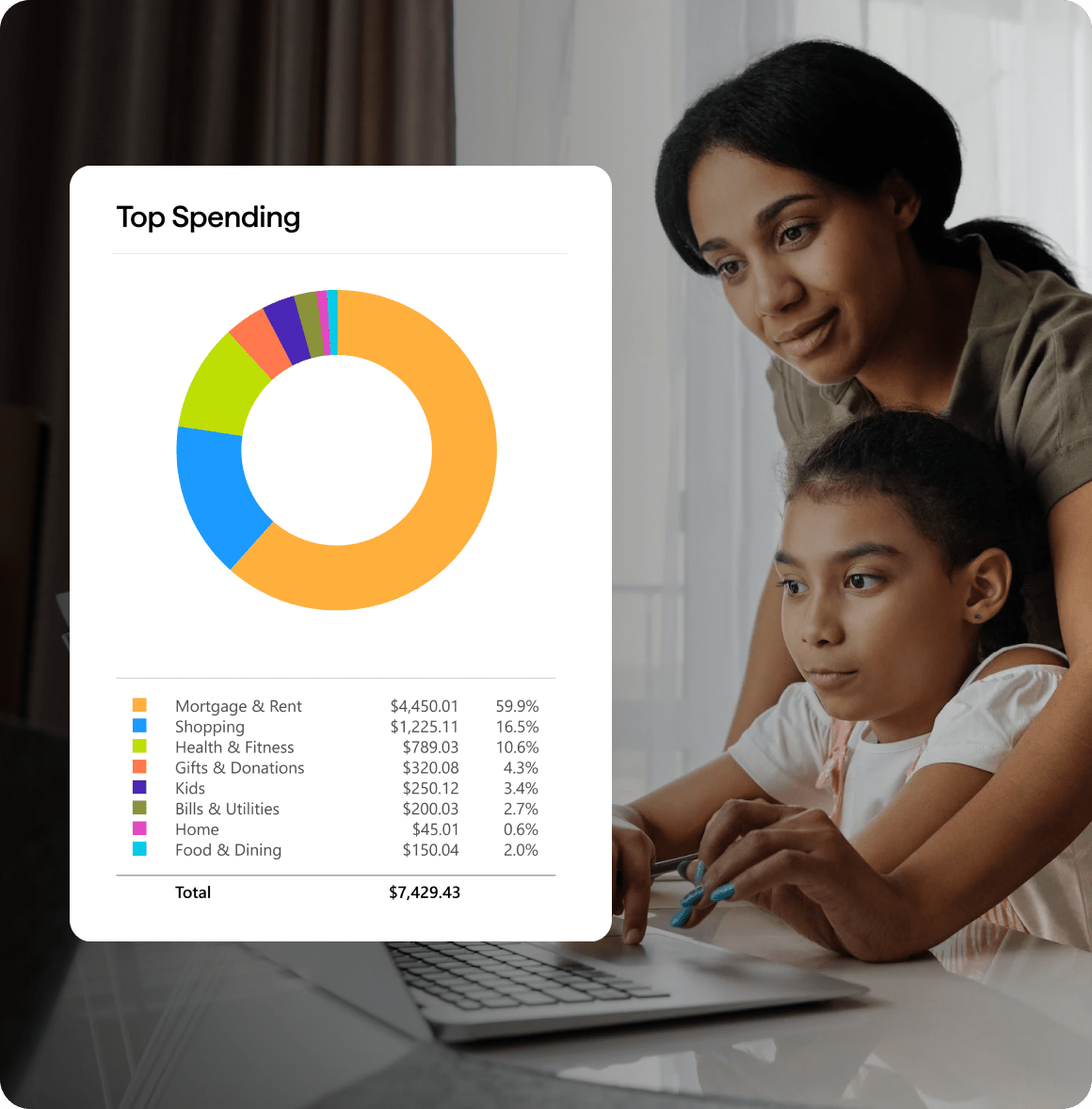

Budget for your home, and budget for work. Or create a separate budget for the holidays. Month by month or all year round, create a bundle of budgets for every purpose.

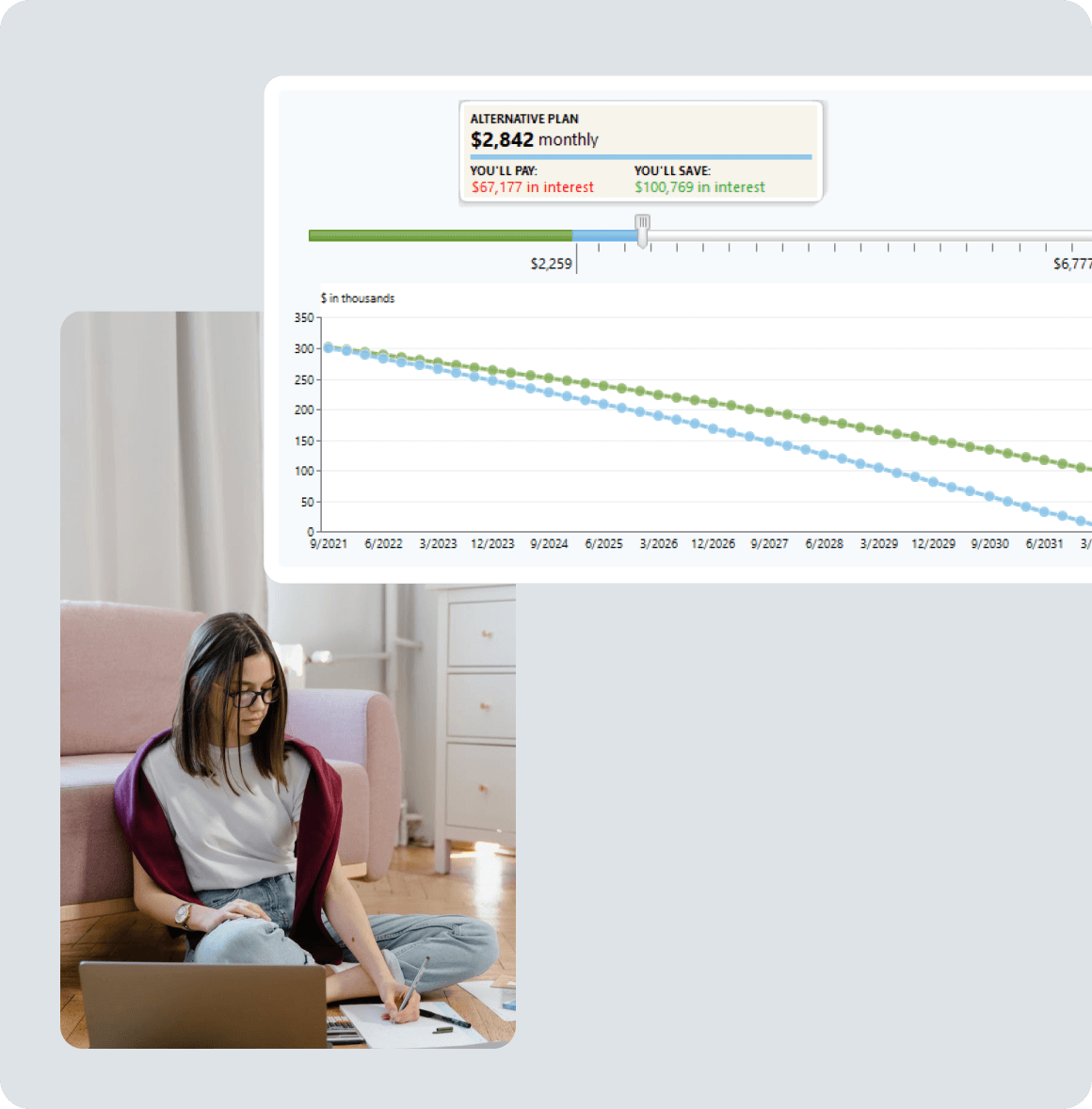

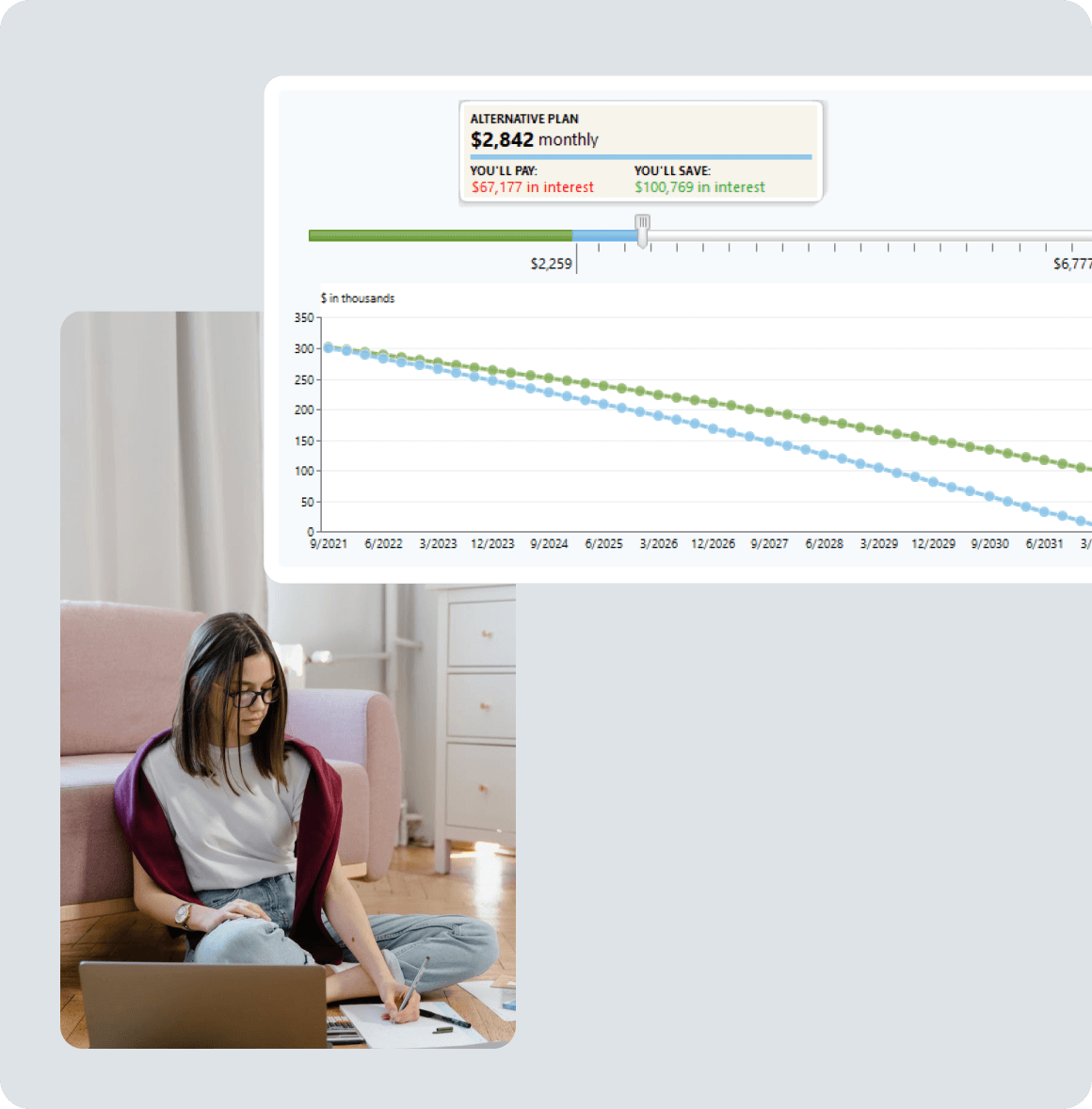

Run scenarios to see what you can save on interest & how much sooner you can pay off your debt. Create a plan that works for you, and make your debt history.

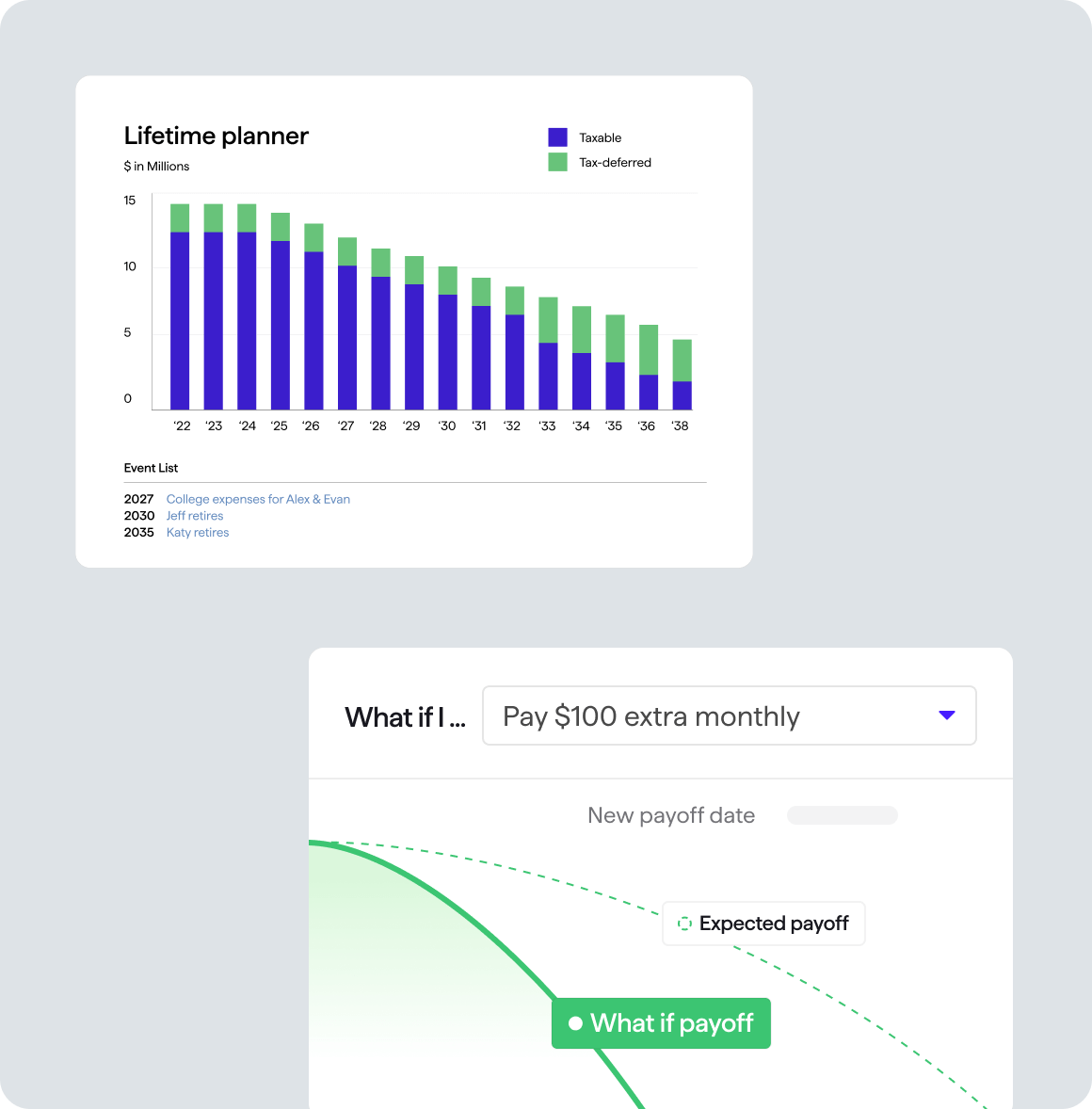

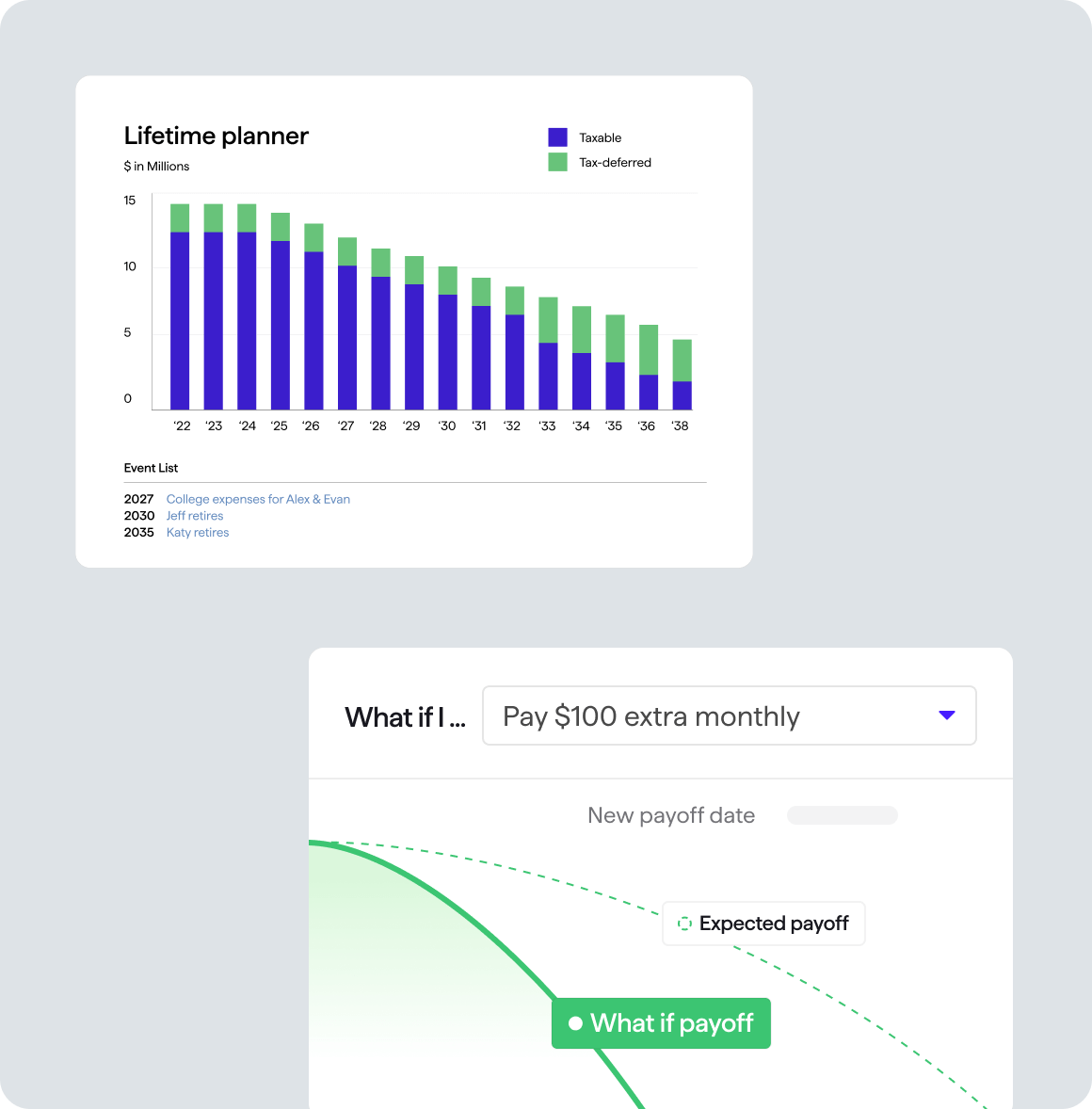

Specialized calculators. “What-if” tools. An exclusive Lifetime Planner. All uniquely tailored to you and your finances. Predict the outcome of any and every financial decision.

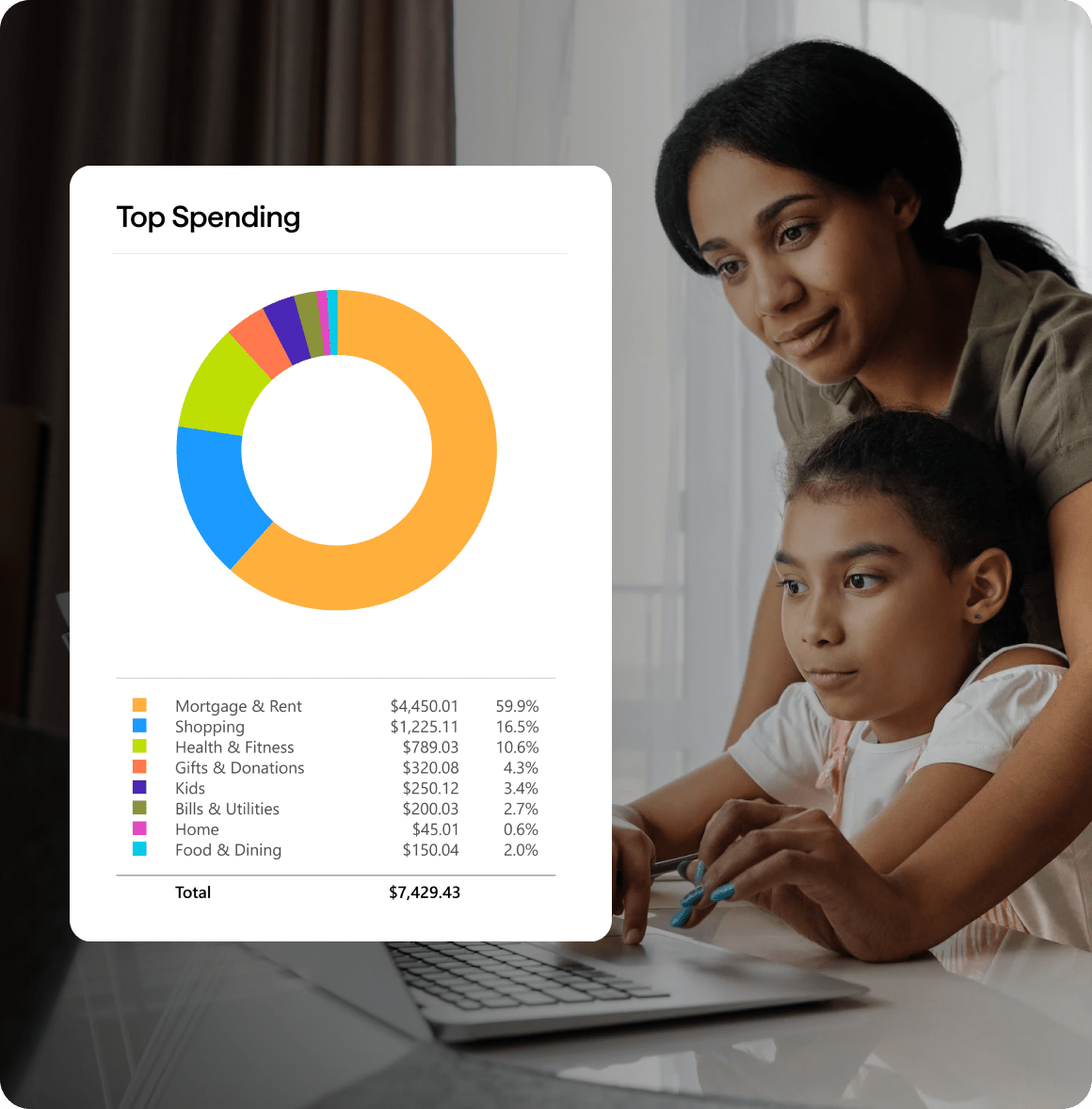

Check every transaction against your records—and your budget—automatically. Catch everything that doesn’t add up, and make sure nothing falls through the cracks.

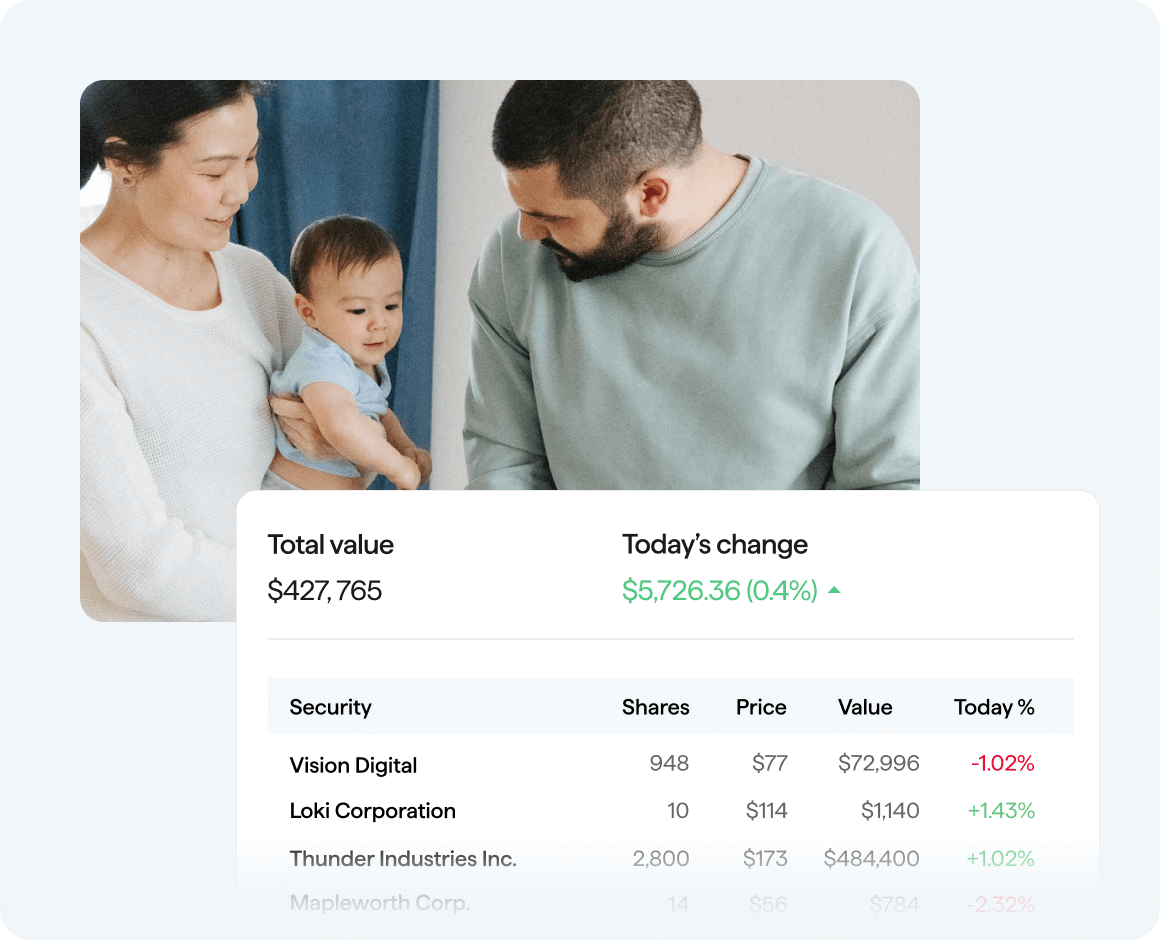

Make the most of your income today while securing your future with smart analysis tools. Create a detailed roadmap for your retirement and project scenarios with Quicken’s Lifetime Planner.

Quicken Classic

Choose a version

Deluxe is a great introduction to a more comprehensive & customizable view of your finances. Its main uses are to:

Create fully customizable 12-month budgets & track spending

Manage & reduce debt with “what-if” tools and calculators

Plan for retirement & secure your future with the Lifetime Planner

Easily reconcile accounts, ensuring down to the penny precision

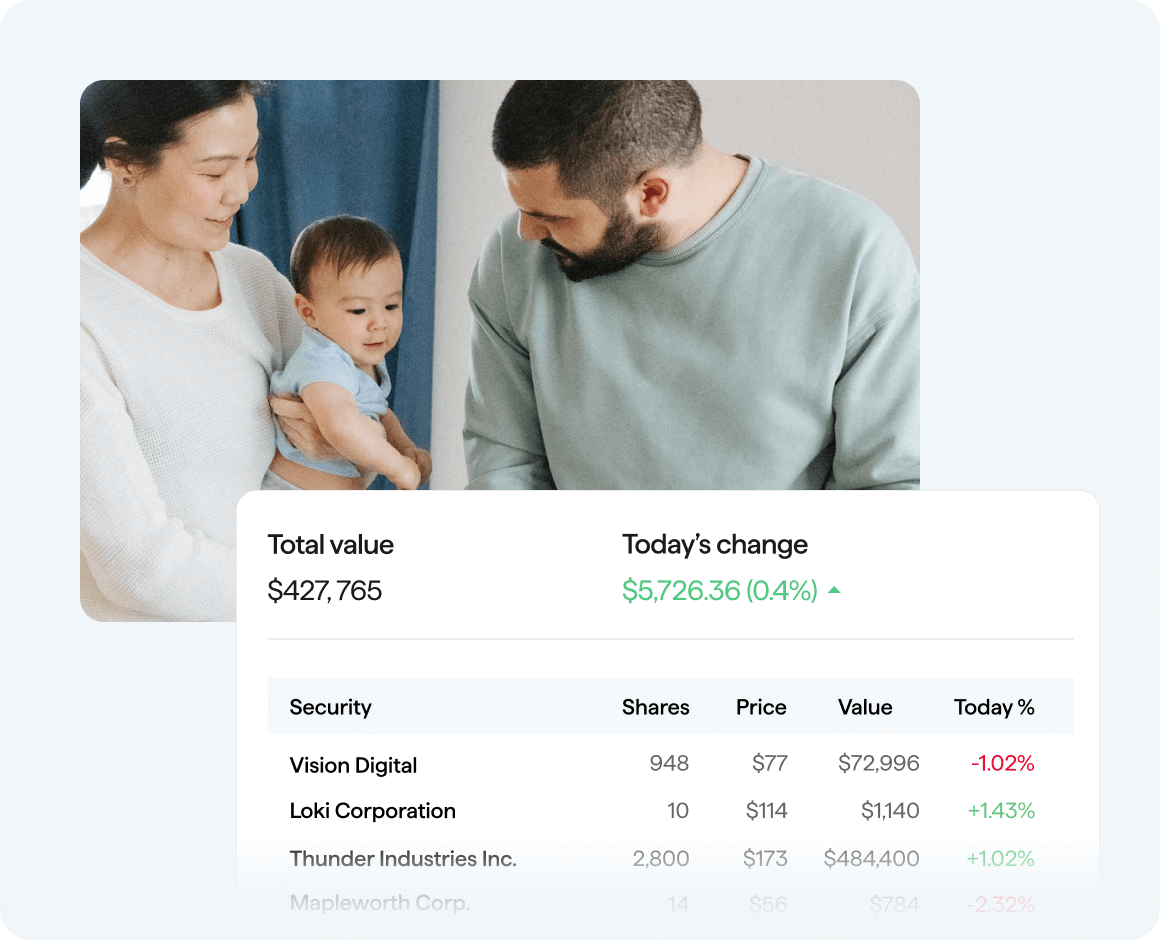

Our Lifetime Planner includes “what-if” scenarios and projected calculations for your long-term plans. See how the choices you make can impact your retirement timeline — 401(k) and savings contributions, your retirement age, or even buying a new home. Plus, with a comprehensive view of your holdings and investment portfolio, you’ll always know where you stand when it comes to your retirement savings.

Of course! Make tax prep easy by generating the financial reports you need. Customize them any way you like, then export your data to TurboTax or email your reports to your accountant.