How a Sinking Fund Can Keep Your Holiday Budget Afloat

As we head into the last few months of the year, holidays like Halloween, Thanksgiving, Hanukkah, and Christmas hold the promise of food, family, travel, and gifts. But if you’re not paying attention, those “fun” holiday expenditures can add up quickly, blowing your budget and sending your financial goals careening off-track.

“A lot of people panic this time of year because they don’t have enough saved for the upcoming holidays,” says Quicken user Lauren Tucker, who runs the personal finance blog An Organized Life.

Fortunately, Tucker offers a solution that doesn’t require you to rack up expensive debt or forego the fun altogether: Start a sinking fund.

“I’m a huge fan of sinking funds,” says Tucker, who cops to having 13 sinking funds in her arsenal (see “Uses for a sinking fund,” below). In fact, Tucker has been utilizing this smart strategy for about seven years—right about the time she paid off all her debt and caught the budgeting bug.

So what is a sinking fund, and how can it save your holiday fun without sacrificing your long-term financial goals? We asked Tucker to share the ins-and-outs of her favorite holiday—and year-round—savings strategy.

What is a sinking fund?

A sinking fund is a strategy where you’re putting money away for future planned expenses. The idea comes from a corporate term used by companies that set aside money to pay off a debt or bond. Lucky for the rest of us, personal finance experts like Dave Ramsey recognized it as a savvy budgeting strategy for individuals and families, as well.

“A sinking fund is basically taking a large amount of money that you’re going to spend maybe once or twice a year, then breaking that number down into smaller chunks that you can save for monthly,” says Tucker. “For example, if you know you want to save a certain amount for holiday expenses, you would divide that total cost by the number of months you have remaining, and then save each month to meet that goal.”

In addition to breaking up a big expense, another benefit of a sinking fund is that you can keep the money in a high-yield savings account, where it earns interest until you need to use it.

Sinking fund vs. emergency fund

At first glance, a sinking fund sounds a bit like an emergency fund, which also fits the description of ‘money set aside for future expenses.’ The difference is that sinking funds are for planned expenses, whereas emergency funds are for unplanned expenses.

For example, personal finance experts recommend having three months of expenses saved in an emergency fund. For sinking funds, however, the amounts will vary based on how much you expect to spend on each category.

Uses for a sinking fund

“A sinking fund can be so many different things that you want it to be,” Tucker explains. In fact, she uses sinking funds to cover 13 planned expenses throughout the year, including categories like holiday spending, travel, car and home maintenance, and birthdays.

If you’re just getting started with sinking funds, Tucker recommends holiday savings as a great way to dip your toes. “Write down all the holidays you celebrate throughout the year, including birthdays, then decide how much to budget toward each one,” she suggests. Don’t forget to include food for big family meals, decorations, and, of course, gifts.

Starting a Christmas sinking fund— in December

So what if you want to spend $1,000 on holiday gifts and meals, but you only have a month to get the money together?

“If it’s late in the game, don’t panic,” advises Tucker. “Start by evaluating what you’re spending money on during the holidays, and decide whether it’s really necessary or if it’s more consumer-driven.” If you’re spending a lot on material things, she suggests an alternative like hosting a family potluck (keep the memories, lose the holiday spending hangover).

Of course, cutting back on presents can be a tough pill to swallow, but if you’re serious about reaching your financial goals, it’s also a necessary one. “If you’re just starting your budgeting journey, you’ve got to learn that you’re going to have to make sacrifices—and material stuff will be at the top of that list.”

Tucker’s biggest piece of advice? Start a sinking fund anyway—right now! The sooner you start, the more prepared you’ll be for next year’s holidays (not to mention other big expenses).

Cash vs. digital sinking fund

There are two ways to manage your sinking funds: cash or digital.

With a cash sinking fund, otherwise known as the envelope method, you’d make an envelope for each expense on your list, then put the cold hard cash monthly into each envelope every month.

For security and simplicity purposes, Tucker prefers a digital version. Instead of using envelopes and cash, set up a separate “sinking fund” savings account, calculate how much you need to save each month to meet your goals, then set up an automatic monthly transfer of that amount. When you need the funds, simply transfer them back to your regular checking account.

There’s some debate about whether to set up a separate savings account for each sinking fund. Tucker prefers to have just one fund and keeps track of the separate categories on a spreadsheet (see “How to set up a digital sinking fund,” below). Ultimately, you should choose the method that will be easiest for you to manage.

How to set up a digital sinking fund

Step 1: Create an annual budget, listing all the costs outside of your monthly expenses that tend to happen at least yearly.

Step 2: Decide how much you want or need to spend on each category. (Tucker’s tip: Look for places to save money and slash expenditures that aren’t in alignment with your values or long-term financial goals.)

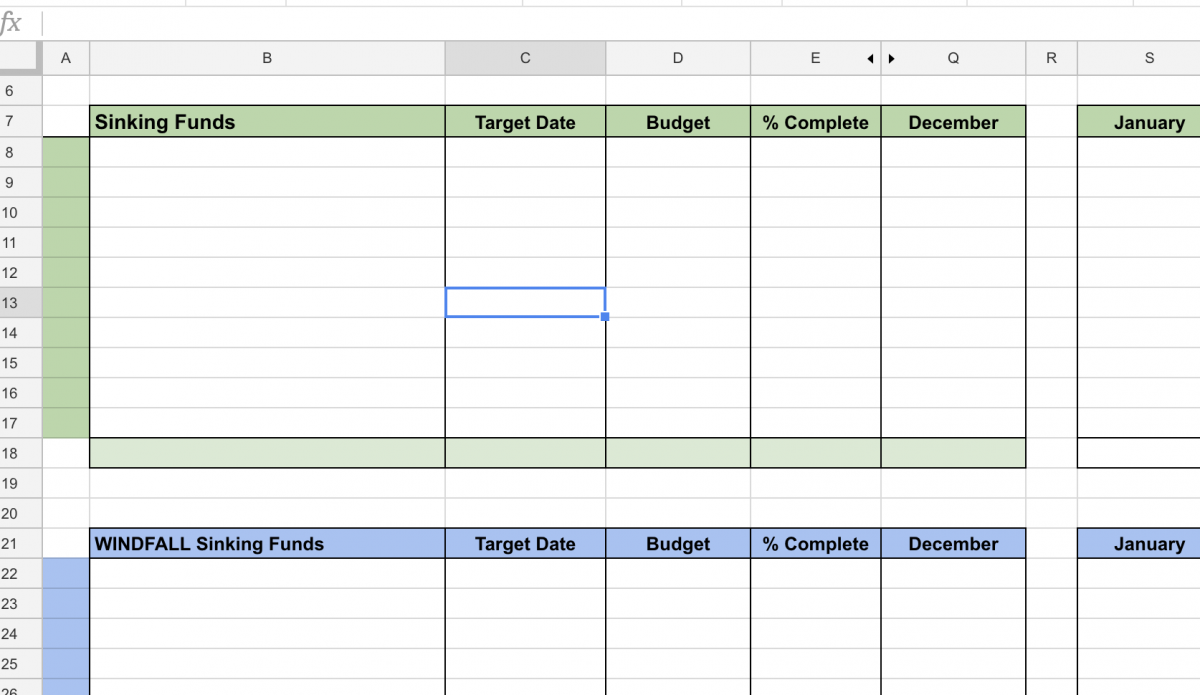

Step 3: Set up a spreadsheet to manage each category and the savings goal and target date for each. Here’s what Tucker’s spreadsheet looks like:

Source: An Organized Life

Step 4: Do the math to figure out how much you need to save each month in order to hit all your targets on time. For example, let’s say it’s January 1st and you have the following goals this year. In this scenario, you’d need to save $153.12 each month in order to hit each savings goal by the target dates:

|

Category |

Savings Goal |

Savings Date |

Monthly Amount |

|

Halloween |

$200 |

October 1st (9 months to save) |

$22.22 ($200/9) |

|

Thanksgiving |

$400 |

November 1st (10 months to save) |

$40 ($400/10) |

|

Christmas |

$1,000 |

December 1st (11 months to save) |

$90.90 ($1,000/11) |

|

Total: $153.12 |

Step 5: Set up an automatic monthly transfer from your checking account to a high-yield savings account.

Step 6: Monitor your monthly savings and adjust as necessary. If you want, you can keep track of monthly progress in your spreadsheet as Tucker does in her example above.

Step 7: When it’s time to use a fund, transfer the amount back to your checking account.

Learn more about sinking funds

To learn more about sinking funds and pick up other valuable personal finance tips, follow An Organized Life on Instagram and Facebook, and check out the blog here!

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.