Tips for Homeowners

Thank you for choosing Quicken!

Owning your own home is one of the great American dreams. Whether you’re just sticking your toes in the water, or you took the plunge long ago, Quicken has the tools you need to evaluate and track your investment. This short guide shows you how to:

- Track your mortgage

- Create a home asset account

- Update your home value

- Monitor your home equity

- Track your tax basis

- Record home sale expenses

Track your mortgage

Why? The most basic reason to track your mortgage in Quicken is so you’ll know how much money you owe on your home. Digging a bit deeper into your payments, Quicken can also tell you how much interest you’ve paid on your mortgage over the past year, information which you’ll use when you file your taxes. Finally, knowing how much you owe on your house will help you monitor your home equity.

To set up your mortgage:

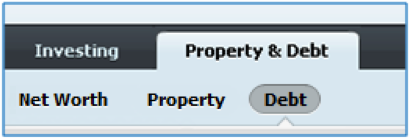

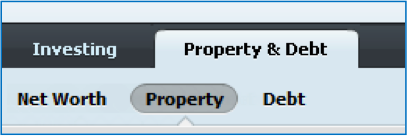

1. Click the Property & Debt tab, and then click the Debt button.

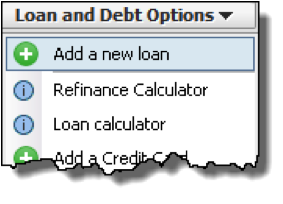

2. Choose Loan and Debt Options > Add a new loan, and fill in the information about your loan. Click the Help icon if you have questions.

Create a home asset account

We recommend that you create a home asset account. A home asset account is the Yin to your mortgage Yang. If you’re tracking a home mortgage (a liability) in Quicken, but not tracking its corresponding home value (an asset) in Quicken, you won’t get a good picture of your true net worth–something that’s pretty important. And you can use the same asset account to record any improvements you make to your home over the years, thereby reducing your tax liability when you sell (more about this in the next section).

To create a home asset account:

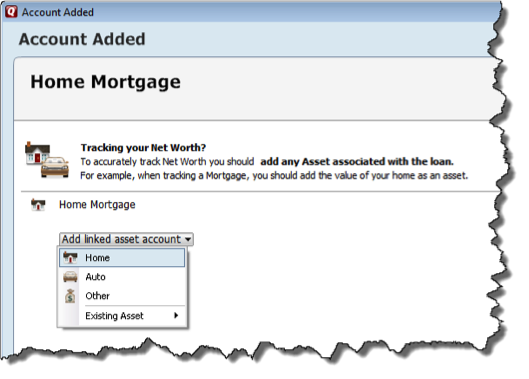

It’s pretty much automatic. When you’re done setting up your mortgage, Quicken asks if you’d like to create an asset account to go along with the loan. Here’s what to do:

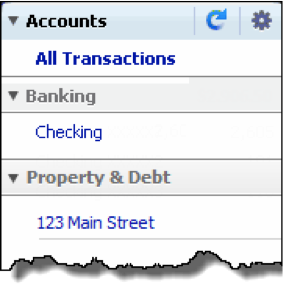

1. Click Add linked asset account, then click House. This will create a Quicken asset account that is linked to your mortgage. You’ll update the balance of this account to reflect the current market value of your home. More about that later.

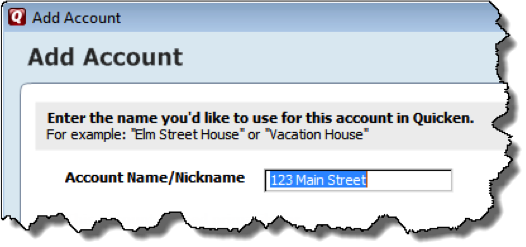

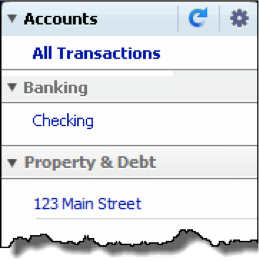

2. Name the asset account. In this example, the home address is used as the account name.

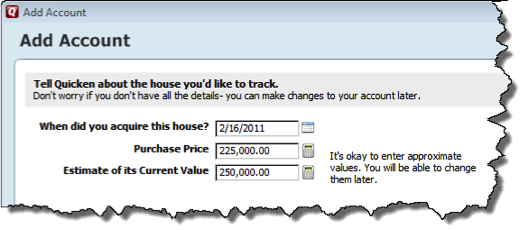

3. Enter the date you closed escrow, the original cost of your home (this is your original tax basis), and an estimate of its current value.

Note: If you didn’t create an asset account when you first set up your loan, search Quicken Help for “Link an existing house and mortgage account” to find out how to do so after the fact.

Update your home value

As time marches on (and it will!) you’ll want to update the value of your home to reflect current market conditions. Knowing this value, and knowing how much you owe on your mortgage (see above) sets the stage for monitoring your home equity (see below).

There are a number of different websites that can help you get a quick estimate of how much money your home might be worth. Once you determine that amount, here’s what to do in Quicken:

To update the market value of your home:

1. Click the asset account in the Account Bar to open its register.

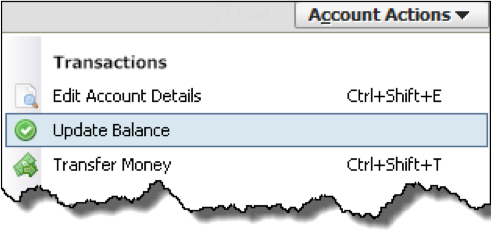

2. Choose Account Actions > Update Balance at the top of the account register.

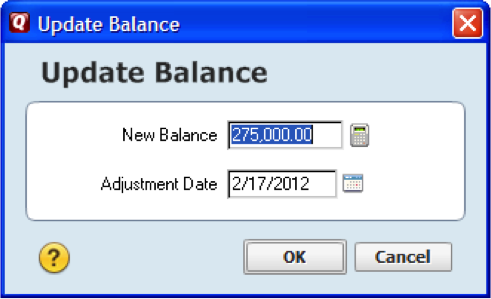

3. Enter the current market value of your home in the Update Balance window.

Note: We recommend that you update the value of your home in Quicken at least yearly to match current real estate market conditions in your area.

4. Quicken does the math and enters a transaction in the register to create an ending balance equal to your home’s current market value.

Monitor your home equity

Home equity is the difference between the market value of your home and the amount you owe on your mortgage.

If you’re tracking this information in Quicken (see above), you can easily get an approximation how much money you would gross if sold your home. You’ll also have a much more accurate picture of your net worth.

To monitor the equity in your home:

1. Click the Property & Debt tab, and then click the Property button.

2. Take a look at the snapshot for your home. Clearly displayed you’ll find the current value, mortgage balance, and equity. Nice!

Track your tax basis

The tax basis (or cost basis) of your home is the original purchase price plus what you’ve spent over the years to make capital improvements to the property. Your improvements can range from massive remodels (like adding a second story) to smaller improvements like putting on a new roof or installing automatic lawn sprinklers. But whether an improvement is large or small, it pays to track each and every one.

Here’s why:

When you sell your home, if your gain is more than $250,000 for a single taxpayer or $500,000 for a married couple filing jointly, the IRS taxes you on the difference between the sales price and your original purchase price plus improvements. The more improvements you make, the higher your tax basis in the home (this is a good thing).

Here’s an example:

Suppose you are married and you bought your home for $400,000. During the 20 years you lived in the house, you spent $100,000 on improvements (new roof, landscaping, new kitchen). You later sell the home for $1,200,000 (wow!). Uncle Sam taxes you on the sales price (1,200,000), minus the original cost plus improvements (400,000 + 100,000), minus the married exclusion (500,000). So after the sale, you have a taxable gain of $200,000, instead of $300,000. That’s a big difference!

Using the asset account you created for your home (see above), you can record home improvements as you make them, and Quicken will keep a running tab of the total.

To track the tax basis of your home:

1. In the Account Bar, click the account you used to pay for the improvement.

In this example, you paid for a new roof from your checking account. So you would click Checking in the Account Bar.

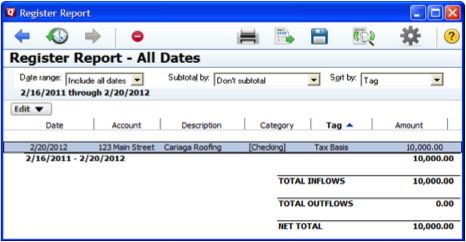

2. At the top of the account register, choose Account Actions > More Reports > Register Report.

To see just tax basis transactions, click the Customize icon in the report and select only the Tax Basis tag.

Record home sale expenses

When you sell your home, if your gain is more than $250,000 for a single taxpayer or $500,000 for a married couple filing jointly, you can deduct certain selling expenses such as repairs necessary for the sale, title insurance, survey fees, transfer taxes and recording and legal fees. Settlement fees and closing costs comprised of commissions and fees to the mortgage broker and are also deductible.

To record home sale expenses:

It’s easy. Just set up the categories you need, and then assign transactions to them. This makes importing your information into tax-preparation programs such as TurboTax a snap. Here’s how:

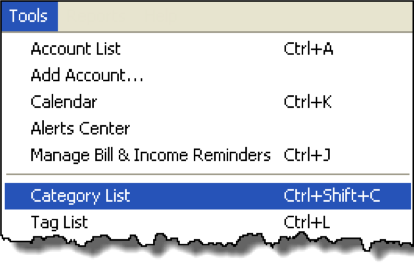

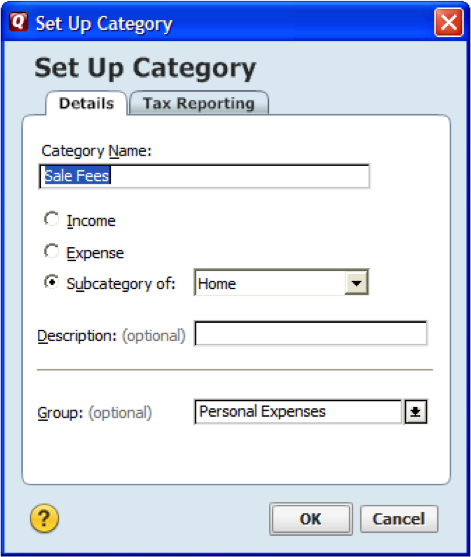

1. Choose Tools menu > Category List, then click New.

2. On the Details tab, first set up an expense category named Home, then set up the following two subcategories of Home:

Home: Sale Fees Expenses associated with the sale of the house, such as bank fees or realtor’s commissions.

Home: Sale Repair Expenses for repairs necessary for your sale. Use this category for expenses that fit the IRS definition of a fixing up expense. The expense must be incurred within a specific period after you sign the sale contract.

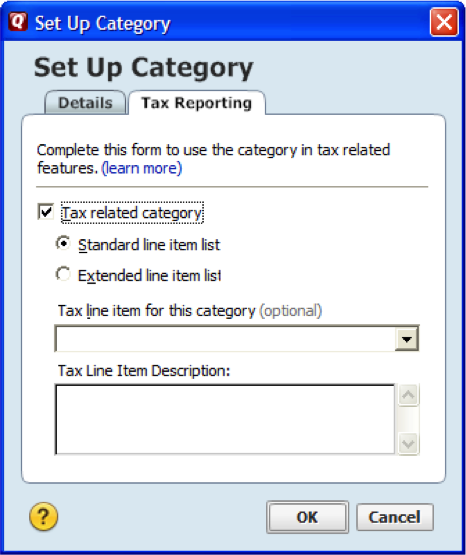

3. For each of the two subcategories, click the Tax Reporting tab.

4. Select Tax related category.

Note: You should check with your tax advisor to be sure that any expense you assign to these categories can be deducted, since tax laws are subject to change.

5. Assign categories to your qualifying transactions. If you need to add other categories, do so as described in this section.

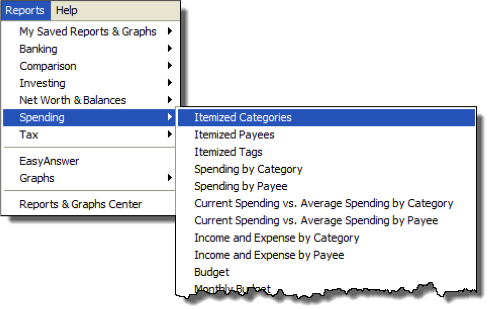

6. To report on your expenses, choose Reports > Spending > Itemized Categories.

Get help when you need it

We want to make sure you get the help you need. If after reading this guide you have questions, you can turn to the following resources.

Quicken Help

Includes explanations about how features work and steps on how to do most tasks. From the Help menu, choose Quicken Help.

Quicken Live Community

An online forum where you can get answers from other Quicken users and experts. Click the Help button in the lower right of Quicken. You can also access Live Community at qlc.intuit.com.

Quicken Support

If you run into a bug or other malfunction in Quicken, contact Support at quicken.com/support.

McGraw Hill’s Quicken: The Official Guide

Offers a more thorough intro to Quicken and all of its features. Available at many bookstores and online.

Thank you again!

We sincerely hope this short guide gets you up-and-running with Quicken. We really appreciate your business and work hard every day to make Quicken the best personal finance solution on the market.

The Quicken Team

![]()

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.