What Is a Credit Score?

Your credit score is a three-digit number that represents how well you’ve handled credit in the past and how likely you are to repay future debts. Your credit score is calculated from the information found in your credit report, which includes your trade lines — your loans, credit cards and other debts, inquiries from when you’ve applied for credit in the past, and public records like bankruptcies and collections.

Different Credit Scores

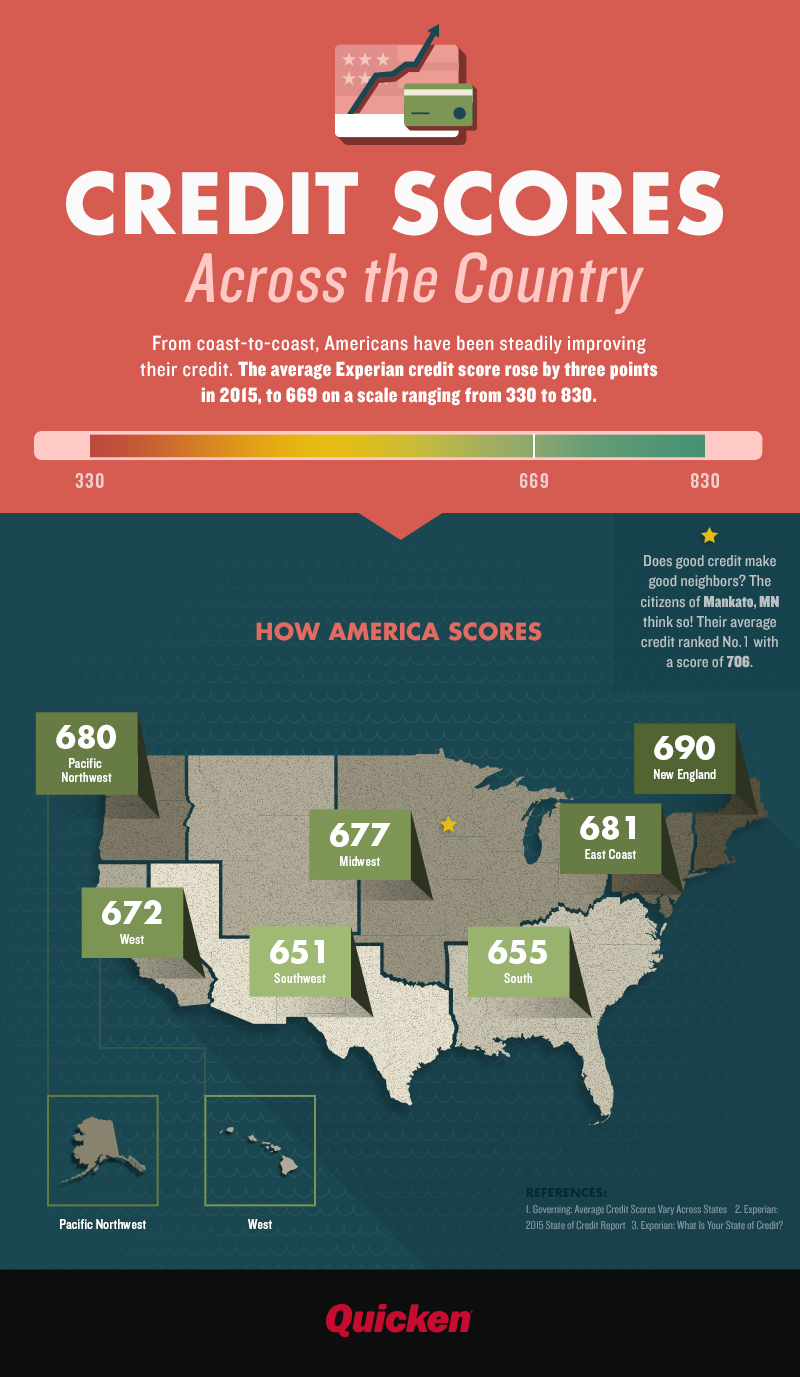

As if credit scoring weren’t complicated enough already, different companies have different formulas for calculating your credit score. The most widely used score is calculated using a formula from the Fair Isaac Corporation, known as the FICO score, which ranges from 300 to 850, with a higher score being better. The Experian credit score, on the other hand, ranges from 330 to 830.

Deciding Factors

The FICO score looks at five factors, each weighted differently, to figure your score. Your payment history counts for 35 percent and examines whether you’ve paid your debts on time in the past. Weighted at 30 percent, the amounts you owe looks at not only the raw dollar amounts of your debt, but also how much you owe relative to your credit limits. How long you’ve had credit (and longer is better) counts for 15 percent. Finally, the last 20 percent is divided evenly by the variety of credit you’ve used and the amount of new credit you’ve applied for.

Impact of Credit Scores

The most obvious impact of your credit score is when you go to apply for new credit, such as a mortgage, car loan or credit card. The better your score, the more likely you are to be approved and to get a lower interest rate. Your credit score may also affect your applications for a rental apartment or house. If you haven’t shown you can pay debts on time, your perspective landlord might be less interested in having you as a tenant. Finally, your employer won’t see your credit score, but it can use your credit report (with your permission) as part of it’s decision to hire or promote you.

What Doesn’t Affect Your Score

Your credit score doesn’t take into account any information not found in your credit report or anything that doesn’t predict how likely you are to repay future debts. So, things like your retirement account balance, other investment or savings accounts, or the value of your assets like your house or car, won’t count toward your credit score. In addition, your credit score isn’t affected by your age, gender, race, where you live or your current employment or income level.

Click image to see full infographic

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.