5 Ways to Keep Your Money in Order After You Get Married

Getting married is one of the most exciting moments in our adult lives. But things can turn sour on the financial front if you haven’t expressed your shared goals. After all, a marriage is a partnership, and like any partnership, it takes good communication to succeed. If you’re not discussing your finances, something is wrong. We asked financial experts to share a few topics to go over with your spouse after the big day has ended.

1. Discuss the Big Picture

If you’ve yet to do this, now’s the time, says Autumn Campbell of Upperline Financial Planning in New Orleans.

“It will be important to decide whether to keep assets and debts separate or whether to combine them when applicable,” she says.

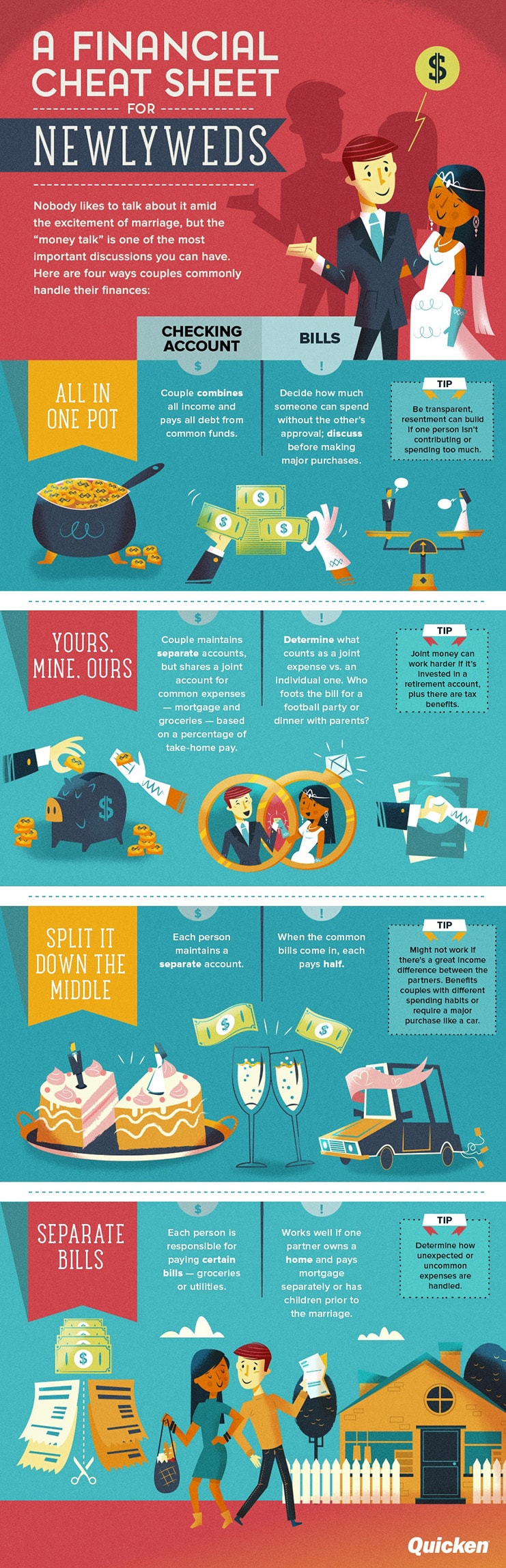

Some couples choose to keep individual accounts for personal spending and create a joint account for shared expenses. Whatever method you choose, “clear communication about expectations will be beneficial as you move forward with your life together.”

2. Define Your Values

“Whether some values are jointly held or perhaps only held by one spouse, that clarification will help in making decisions,” says Campbell. “For example, one couple may value paying off the highest interest rate debts first, regardless of owner, while another couple may value each member taking responsibility for debts separately.”

It’s also important to set joint expectations for retirement planning and emergency savings, which will come into play later on. Remember, these decisions don’t have to be set in stone, says Campbell. “What is most important is that both partners share their preferences to have agreement from both sides, so expectations will be more appreciated and sustainable.”

3. Make Budgeting an Ongoing Conversation

“Budgeting will be an ongoing conversation within the marriage, as circumstances such as income, health care needs, family support and hobbies will change,” says Campbell. That’s fine, but what’s most important is that the communication is clear.

As you consider your budget together, keep current and future expenses in mind like children, retirement and vacations. “There is no A in budgeting,” says Campbell, “so be sure to be kind to each other. This new stage in life will take some adjustment and appreciating [your budgets] for the benefits they bring will help your marriage remain a happy one.”

4. Prioritize Paying off Debt

Nothing can bring a marriage down like being saddled with debt. So “if you have debt for things like credit cards and student loans, prioritize paying it off,” says Robert Dowling, a certified financial planner with Modera Wealth Management in Westwood, New Jersey. This will help you improve your credit — total debt is one of the main factors credit bureaus look at when determining your credit score — which in turn will make it easier for you to get things your family needs such as a mortgage, car loan and credit card.

5. Evaluate Your Life Insurance

If you plan on having a family, getting additional life insurance is something to think about, says Dowling. Putting coverage in place to ensure your loved ones remain financially secure takes considerable planning, so be sure to research your options carefully. Do you want to pay for childcare, cover future college expenses or create an inheritance? Knowing your goals ahead of time will help you come to a confident conclusion.

Click image to see full infographic

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.

About the Author

Jeanine Skowronski

Jeanine Skowronski is the executive editor of Credit.com. Her work has been featured by The Wall Street Journal, American Banker, TheStreet, Newsweek, Business Insider, Yahoo Finance, MSN, Fox Business, Forbes, CNBC and various other online publications. Follow her at @JeanineSko