Raising Financially Independent Children

Updated July 7, 2025

All parents want to give their kids the things they missed out on growing up. We surveyed over 2,000 adults in the U.S.—half of which we sourced from the general population and half from our community of Quicken users—to get a closer look at how parents are talking to their kids about money and the impact of their own early financial education (or lack thereof).

How can I make sure my kids are financially successful?

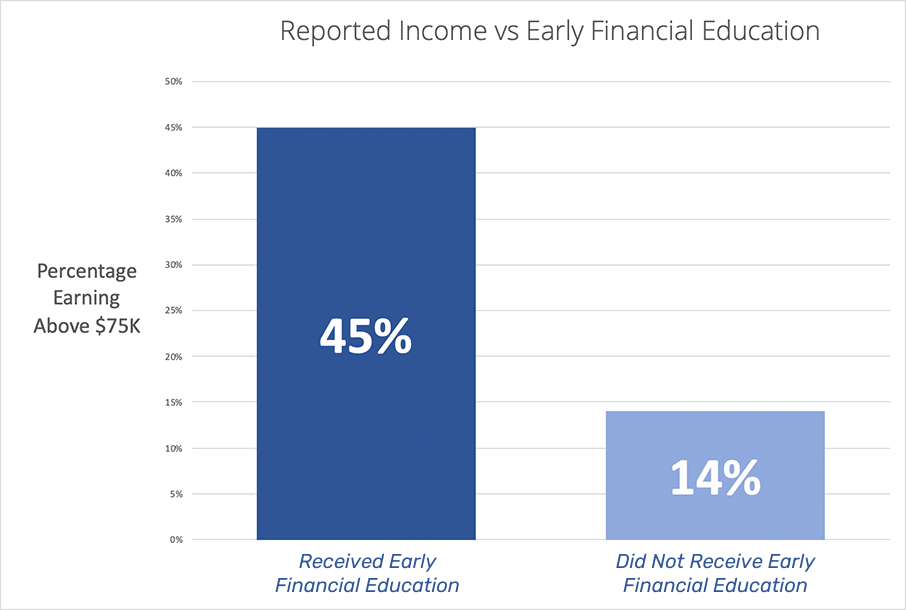

Our survey showed a clear correlation between early education in money and financial confidence and success as adults.

- People who learned about money as a child are three times as likely to have a personal annual income of $75k or higher than those who didn’t learn about money in their formative years (45% vs. 14%).

- Of those who had an early education in finance from mom and dad (65% of those surveyed), 41% reported a high level of confidence in their finances.

- But, here’s the problem: one-third of adults surveyed said that no one taught them about money when they were children. Unsurprisingly, among that group, only 13% report a high level of confidence in their finances as adults.

When we isolated the answers from our own community of Quicken users, the results showed us that the right tools can fill an early education gap.

- Quicken users are three times more likely than the general population to have “complete confidence” in their financial situation (31% vs 9%).

- While one-third of the Quicken user group also said no one taught them about money when they were children, that lack of money talk had a much more diminished impact. Even with the lack of early money talk, they were five times more likely to have a high level of confidence in their finances than the general population (65% vs. 13%).

Want to have complete confidence in your finances?

See how Quicken can help →

How does your own upbringing influence what you teach your kids?

People who were taught about money as a child are 20% more likely to prioritize teaching their own children about money.

- Those who said no one taught them about money as a child were twice as likely to delay talking to their own children about money until age 18+.

- There is evidence that financial anxiety motivates people to teach their children — people who are “not at all confident” in their current financial situation are 3x more likely to start their children’s financial education VERY young—0-2 years old (15% vs. 5% for people with confidence).

- When asked what financial lessons they wish their parents taught them when they were kids, 31% ranked investing in the number one spot on their wish list, but only 11% said they were teaching their own kids about investing. Respondents from our Quicken community also ranked investing as the number one thing they wish they’d learned early, but are three times as likely to impart investment wisdom to their own children (30% vs. 11%).

See how Quicken helps you manage your family’s investments.

Continue →

Do more kids learn about finances from Mom or Dad?

So, who is teaching the most lessons in the household?

- And who has taught the most financial lessons? Mom wins by a hair, at 38% of people saying they learned the most about handling finances from mom, vs. 37% from dad.

- Almost twice as many people (29%) say that their mom had a positive impact on their future financial health than say dad did (18%).

What percent of parents talk to their kids about finances?

Luckily for future generations, parents are much more comfortable talking money with their children. Of the parents that completed our survey, 88% have already started having conversations about personal finance with their little ones.

What are the best ways to teach kids about money?

What’s the best way to teach children about money? We asked respondents which tools their parents used to teach them and which they were using to teach their own children.

- People who learned about money as a child reported their teachers used the tried-and-true tools: allowance, a personal checking or savings account, and saving for specific purchases the most. Those tools were also the top three parents reported using to teach their own children about money.

While the top tools may not have changed much, the lessons have evolved:

- Today, parents are teaching their children about charitable giving 60% more than their own parents did, using credit cards to teach their children about money almost 50% more, and are teaching their kids about investing 85% more than the people who taught them about money did.

- Some things never change though. The piggy bank is still sitting on the shelves of childhood bedrooms, maintaining its popularity as a financial learning tool.

See how Quicken can be the tool to teach your kids about money.

Continue →

How can I teach my kids about money?

Here are five tips for imparting your financial wisdom:

- Set an example. If you’re struggling to pay your bills each month or arguing with your partner about money on a regular basis, your little ones will notice. Children are always watching, even when you don’t realize it. If you’re an example of financial responsibility, your kiddos will be more likely to follow.

- Use tools. The right tools can make a big difference. Our survey showed that 62% of the people who do not use any personal finance tools also reported a lack of confidence in their current financial situation. If your child is a visual learner consider a see-through jar for their savings so they can see their funds grow and shrink with each deposit and withdrawal. If your youngster is a numbers whiz, an investing account might be just the thing.

- Set clear boundaries. If you’re giving your child an allowance, sit down with them to discuss what that allowance should cover vs. the day-to-day expenses you cover as their parent. If you have a little one, that might mean explaining that they should use their allowance to purchase any new toys they want (outside of holiday/birthday gifts) or making sure your teenager knows that if they want to go to the movies with their friends, it’s on their dime.

- Talk early. A study by the University of Cambridge found that money habits in children are formed by the time they’re 7 years old. An early start is key to setting your kids on the path to a healthy financial future.

- Talk often. Giving your kids the tools they need for a healthy financial future isn’t a one-time conversation. Parents who talk with their kids once a week about the issue are significantly more likely to have kids who say they are smart about money.

Methodology Statement: This survey was conducted online between 5/24/19-5/25/19 among 2,256 adults in the United States.

See how Quicken helps you explain money to your family.

Continue →

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.