Budgeting Tools For Managing A Property Management Business

Getting into property management can be a complicated business. But you can make the work a lot easier with the right tools, says financial expert Sean Stein Smith, CPA, member of the AICPA’s National CPA Financial Literacy Commission and CGMA of Bergenfield, New Jersey.

“If apps can be used to share pictures, track personal spending and build a financial plan,” he says, “they can also certainly be used to help build and manage a rental income business, which is heavily dependent on tracking payments and expenses flowing in and out of the organization.”

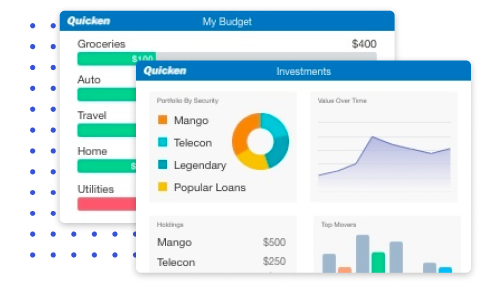

If you already use Quicken software for your personal finances, an upgrade to Quicken Rental Property Manager will give you access to all the budgeting tools you need for managing multiple rental properties.

Tracking Tenants, Vendors and Payments

Quicken’s Rental Property Manager stores the contact information for all of your tenants, suppliers and contractors, as well as contract information like lease terms, security deposits and payments. It notifies you when payments are due to vendors and rent is due from tenants. Expenses like lawn care or snow removal can be shared across different properties. If a payment is late, it can add the appropriate overdue fee. If property is damaged, you can track the cost, and the software will deduct it from the security deposit.

- Customize invoices & store documents

- Generate Schedule C, E & other tax reports

- Track leases, deposits, and more

Maintaining Profitability

Included with Quicken Rental Property Manager are several tools that track the profitability of a single property and multiple properties for past and current months. It also shows graphs and snapshots of income and expenses for future months based on your projections. Tax deductible expenses are also tracked, and the software can point you to potential tax deductions you may have overlooked.

To determine the profitability of multiple rental properties, use the Profit/Loss feature in Quicken Rental Property Manager. It gives you a snapshot of the profitability of each property, including every transaction that has been entered and those transactions you have scheduled but have yet to record. The Profit/Loss feature also reconciles income and expenses so you can instantly determine if a property is profitable or if it is costing more than it earns.

Managing Taxes

Quicken assists you in preparing the forms and schedules you need for the IRS for your property management business, including the information for Form Schedule E, Supplemental Income and Loss, to report income or losses from rental real estate. For this report, Quicken lists all of the relevant transactions, subtotaled by each tax line item. If you are using tax preparation software to do your taxes, Quicken gives you the option to export the tax-related data directly to your tax software.

A property management business can involve dozens, if not hundreds, of financial transactions every month. Using a suite of tools that helps you track these transactions not only saves you time, it gives you the resources you need to ensure your business stays in the black month after month.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.