40 Tips for Buying Your First Rental Property

Buying rental property can be a great way to earn income—whether you’re purchasing a condo, a single family home, an apartment building, or a number of properties to diversify your rental portfolio.

Today, individual investors own more than 47% of rental units in America, according to Harvard’s Joint Center for Housing Studies’ America’s Rental Housing Report. But rental property investments can be complicated, and the decisions you make when you’re starting out can determine whether you make a lot of money, barely get by, or even take a loss.

Here are 40 tips for first-time rental property buyers that will inspire you to get started.

Preparing to Buy a Rental Property

Not everybody is cut out to be a landlord. Here are some things to consider before you make a commitment.

1. Determine how much time you can spend managing properties.

Landlords are always on call. If the furnace breaks down in the middle of the night, or the toilet clogs on a three-day holiday, you’ll be the one that has to fix it. If your job is too demanding, you may need to think about hiring a rental manager—and that can make rental property investment a lot less profitable.

2. Figure out how much money you can spend.

Most people don’t want all of their personal wealth tied up in rental real estate, especially because it can take time to liquidate these assets if the need arises. Set aside at least enough to cover basic expenses for six months, then decide how much of the remainder you’re comfortable investing in rental properties.

3. Investigate financing.

When you invest with borrowed money, you increase the amount of property you can buy and magnify potential returns. Before you start looking at properties, check in with your preferred lenders to see how much you will be able to borrow.

4. Learn how to make basic repairs.

You can save a lot of money—and increase your returns from rental properties—if you can make basic repairs yourself. Local community colleges, retailers like Home Depot, and online sites including Family Handyman University and Udemy all offer courses in common home projects.

5. Get familiar with local laws and regulations.

You’ll need to be up to speed on the Fair Housing Act, which bans discrimination by race, gender and ethnic background, as well as the Fair Credit Reporting Act, which governs how you can use credit reports to screen potential renters. There may also be state or city-specific regulations that you’ll need to know about, such as zoning, rent control, safety, and environmental protection. Law firms that specialize in real estate often give seminars in local real estate law.

Scouting the Perfect Neighborhood

Location, location, location! That’s the key to profitable real estate investment. Here are some tips for finding promising neighborhoods to target for your real estate investments.

6. Look at job growth.

Some states, cities and even neighborhoods have significantly higher employment than others—creating a larger pool of credit-worthy tenants to rent your properties. Early in 2019, for instance, Midland, Texas had the biggest jump in employment of any large county in the United States, increasing payrolls by 5.8%, while Bay, Florida lost 5.9% of its jobs. You can find quarterly data on wages and employment at the Bureau of Labor Statistics. Local news coverage of plant openings and closings and new businesses can also give you an idea of which areas are growing.

7. Check out school quality.

National rating services, like GreatSchools, give you an instant read on how good the schools are in the neighborhoods you’re considering. Areas with better schools typically attract higher quality tenants—and real estate in these neighborhoods tends to appreciate faster.

8. Keep an eye on crime.

Neighborhoods with lower crime rates are more attractive to renters—and there’s less chance of theft or vandalism eroding your returns. You can check any neighborhood’s crime statistics at Neighborhood Scout.

9. Think about demographics.

Are you looking to rent single-family homes to young families? Provide student housing near a college campus? Manage upscale apartments for young professionals? The Census Bureau provides demographic information by zip code that will help you focus in on neighborhoods with the right mix of people.

10. Get a second opinion.

Attomdata.com aggregates key neighborhood data like school quality, property tax rates, appreciation rates, and crime into a single neighborhood score searchable by zip code.

Finding the Perfect Property

Successful real estate investors make money by buying properties cheaply and renting them for competitive rates. To find bargains in your area, experts say try these strategies.

11. Stay up to date with real estate listings.

Check Realtor.com for properties in the areas you’re interested in. You can screen by property type, zip code, price, and other variables.

12. Join a real estate investment club.

Real estate investment clubs can be great ways to network with other investors, learn more about investing and get access to investing opportunities. Bigger Pockets has a searchable list of real estate investment clubs to help you find one near you.

13. Go to sheriff sales.

Foreclosed properties are auctioned off at these sales. Check your county sheriff’s office for a schedule of upcoming sales and a list of properties to be auctioned.

14. Search foreclosures.

You can search the HUD Foreclosure website by zip code to find properties that are available for sale.

15. Make an offer.

See a property that’s perfect for you, but it’s not for sale? You can look up the owner at sites like US Realty Records, contact them, and make an offer.

Calculating Your Return on Investment (ROI)

Real estate investors make money in two ways: first from the income they receive in rents and second from the way a property appreciates over time. To determine whether a property will be profitable, you’ll need to complete a return on investment, or ROI, calculation that incorporates expenses, rental income, and appreciation potential. Here’s how you do it:

16. Determine cash flow.

Start with the amount that you’ll be charging for rent, then subtract expenses like financing costs, insurance, taxes, homeowner association dues, reserves for periods when the unit is vacant, maintenance, and repairs. Be sure to include an estimate of your time, because that’s an expense, too.

17. Add-In appreciation.

How much are you expecting the property to appreciate? You can get a good sense for annual housing price changes in your locale at the Attomdata.com Neighborhood Housing Index.

18. Divide by purchase price.

Divide your total net income (net cash flow plus appreciation) by your original purchase price to find your ROI. Most experts consider anything over 15% as a good rate of return.

Net income + appreciation / purchase price = ROI

19. Factor in loans.

If you borrowed to purchase your property, you subtract all financing costs—including closing costs, points and interest payments—from net income, and divide by the amount you’ve already paid down. For example, if you put $25,000 down on a $100,000 property, your denominator will be $25,000, not $100,000.

Securing Financing

Investing with borrowed money can help you secure your first rental property—but it’s crucial to get good financing. Here are tips to help you qualify for an attractively priced loan.

20. Make a substantial down payment.

Mortgage insurance isn’t generally available for investment properties, so you’ll need to put up at least a 20% down payment. If your down payment is 25% or more, you may qualify for a lower loan rate.

21. Clean up your credit rating.

Borrowers with excellent credit ratings (760 and higher) can save as much as a percentage and a half on loan rates, compared to borrowers with medium ratings (620-639), so now is a good time to check your credit rating, fix any errors, and resolve any potential issues. MyFICO.com offers a free calculator that shows how your credit score will affect your loan rate in current market conditions.

22. Shop around.

Compare loan terms and rates to get the best deal. If you already have a relationship with a bank, this can be a good place to start—but it never hurts to compare rates online, as well.

23. Consider alternative sources of credit.

You may be able to leverage the value of your primary home to buy investment real estate by taking out a home equity loan. Some borrowers even use credit cards, though because interest rates are high,

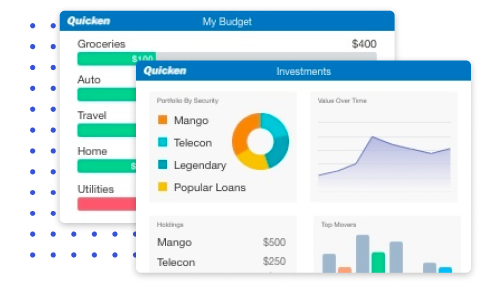

- Customize invoices & store documents

- Generate Schedule C, E & other tax reports

- Track leases, deposits, and more

Marketing Your Property

Once you’ve sealed the deal on your new property, you’ll want to make sure it’s rented as soon—and as consistently—as possible. Here are some tips for reaching potential tenants.

24. Advertise.

Get the word out through local newspapers, shopper supplements, Craigslist, and other online databases—and don’t forget low tech tactics like word-of-mouth and putting a sign on the property.

25. Take great photos.

Show your property at its best with sharp, professional photos inside and out. Take outdoor photos when the weather is good—no need to remind people of the snow they’ll be shoveling come wintertime.

26. Keep properties looking great.

An attractive rental unit advertises itself. Mow the lawn, clean up the yard, paint the trim, plant flowers in window boxes—the more aesthetically pleasing your property is, the more people will call about renting it.

Finding Good Tenants

Good tenants pay promptly, take care of your property, and stay for a long time. Bad tenants can do thousands of dollars of damage, lower your property value, frighten away their neighbors, and may ultimately have to be evicted. Here are five ways to find quality tenants for your rental properties.

27. Don’t discriminate.

As a landlord, under the Fair Housing Act, you can’t discriminate against renters by race, color, national origin, sex, family status, or disability. That means you can’t refuse to rent, charge different rents, or set different conditions to people based on these characteristics. There are exemptions for owner-occupied buildings with less than four units, single-family home rentals by an owner without an agent, and properties owned by religious groups.

28. Verify income.

Most landlords want to see consistent income that is at least three times the monthly rental fee. Ask for pay stubs, and call the prospective renter’s employer to make sure your tenant is still in good standing. If the renter is self-employed, request tax returns from the last couple of years.

29. Run credit checks.

A credit check will tell you whether your tenant pays their bills on time. It will also show you how much debt they have, and whether loan payments are likely to interfere with their ability to pay rent.

30. Ask for references.

Call the tenants’ last two landlords, if possible, to find out whether they created a problem at their last rental. Did they pay on time? Did they give 30 days’ notice before moving out? Was there damage to the property?

31. Consider Section 8.

If your property is suitable for low-income renters, you may be able to get paid directly from the government for part of the monthly rental fee by participating in HUD’s Housing Voucher Program, or Section 8. You’ll have to pass a housing quality inspection to qualify as a Section 8 renter.

32. Think about rent-to-own.

If you eventually want to sell your property, you may be able to attract very high-quality tenants by structuring your lease as a rent-to-own agreement. Under this kind of lease, the tenant has the option to buy your property at the end of a specified period. A portion of rent payments, which are typically a bit higher than a straight rental, goes into an escrow account towards eventual purchase of the property.

Since tenants have a long-term stake in the property, they tend to take better care of it. And since they lose their equity in the home if they stop making payments, they are far less likely to get behind on the rent.

33. Eviction is a last resort.

Eviction is time-consuming and expensive—the average eviction costs between $3,500 and $10,000, according to TransUnion’s Smart Move Blog— so you don’t want to do it unless you have to.

Legal experts at Nolo.com outline the process as follows: If the tenant hasn’t paid rent, you typically start with a “pay or quit” notice, which ends their tenancy with a certain period if they don’t settle their debts. Tenants who have violated other terms of the lease—a noise violation, for instance—may receive a “cure or quit” notice, which forces them to either stop the violation or move out. If the tenant hasn’t done anything wrong, you will typically have to send a 30- or 60-day notice to vacate. At the end of this period you can move the tenant out, but this part can be legally tricky, so don’t do it yourself. Get a neutral law enforcement office to do the actual eviction.

Keeping Up With The Paperwork

You’ll need to stay organized to be successful, keeping on top of taxes and administrative duties entailed in your rental business.

34. File taxes.

You’ll have to report rental income on IRS Schedule E—and if you expect to owe more than $1000 in taxes after withholding, you’ll have to make quarterly estimated payments. It’s important to keep good records of your rental income and expenses all year round, so you won’t have to scramble for information when you file.

35. Use your deductions.

As a landlord, you can deduct all kinds of expenses, including property taxes, repairs and maintenance, labor costs, and depreciation. Most tax preparation software packages will guide you through this process—but keep all your receipts and documentation in one place so you don’t miss anything.

36. Take advantage of the new pass-through deduction.

The Tax Cut and Jobs Act of 2017 added a new tax deduction that applies to most landlords. The pass-through deduction allows qualifying taxpayers to deduct up to 20% of net rental income from income taxes, starting in 2018 and continuing through 2025.

To qualify, you need to own the rental property personally or through a pass-through structure like a limited liability company or partnership, as well as be able to show a net profit and positive taxable income. Calculations are complicated, but sophisticated tax preparation software can handle them.

37. Other paperwork.

You can find standard lease agreements, rental applications, and other important documents at sites like this one.

Deciding When to Sell

When you invest in real estate, a significant part of your investment return comes from capital appreciation. To realize those gains, you have to sell your property. Here are some tips for maximizing your gains.

38. Keep an eye on market conditions.

Is job growth accelerating or slowing down in your location? Have property prices been rising or falling? A rental property located in an area with slowing economic growth may be losing value. You may want to sell now to minimize future losses.

Conversely, if your town is booming, you may prefer to continue to rent, possibly at higher prices as demand grows. Or you may want to sell now, cashing out at a competitive price.

39. Consider your liquidity needs.

Sometimes you need to sell, because you have an expense to meet or there’s a better opportunity elsewhere. If retirement is on the horizon or you have a child on the way to college, start planning your sale several years ahead. You don’t want to have to sell quickly at a bargain price.

40. Think about taxes.

You’ll have to pay capital gains when you sell a rental property. To calculate capital gains, you subtract the purchase price, minus any depreciation, from your sales price. You’ll report the sale on IRS form 4797. Capital gains taxes top out at 20%, but most taxpayers pay either zero or 15%, depending on income. High earners may owe an additional 3.8% in net investment income tax .

Investing In Rental Properties Like A Pro

Becoming a landlord takes time, money, and commitment, but when done right, rental real estate can offer you income, capital gains, and a satisfying side career. Follow our property management tips to buy, manage, and profit from your rental real estate investments to increase your chances of success.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.