How to Pay Off Debt While Still Saving: 6 Steps to Success

by Jason Weiland

July 1, 2025

Pay off debt and grow savings side-by-side. Learn 6 actionable steps to clarify your finances, build a cushion, automate everything,...

Managing Debt

Three Game-Changing Updates for Quicken Simplifi

by Quicken

June 30, 2025

Run scenarios to plan your retirement, automate your tax reports, and sync credit card bills automatically. 3 new features to...

Your Family Organization Checklist: Top 9 Things to Have Ready to Share

by Quicken

June 27, 2025

Your top 9 list of essential family info to keep organized and ready to share. From medical emergencies to tax...

5 Quick Wins with LifeHub in Under 10 Minutes

by Quicken

June 26, 2025

Discover 5 quick uploads that deliver instant value, transforming how your family shares and accesses important information. Smart Add makes...

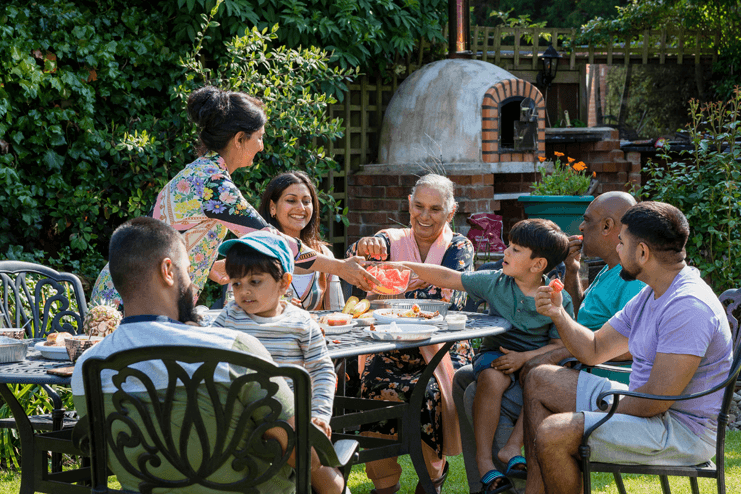

How to Budget for a Big Family: Don’t Miss These 8 Life Hacks

by Quicken

June 25, 2025

When every cost is a moving target, a rigid budget breaks fast. Learn how to build a flexible one so...

Should I Open a Joint Account? Top 8 Money Questions for Couples

by Quicken

June 24, 2025

Answer these 8 common money questions couples face about fair bills, shared goals, emergency funds, and more — and get...

A Year of Updates: What’s New in Quicken Classic for Mac

by Quicken

June 23, 2025

Investment Watchlist, Capital Gain Estimator, Zillow integration, and more. A year of Mac-native updates to your trusted desktop financial software.

A Year of Updates: What’s New in Quicken Classic for Windows

by Quicken

June 23, 2025

Tax loss harvesting, faster One Step Update, searchable preferences, and more. A year of thoughtful improvements to your trusted desktop...

Leave a Legacy, Not a Puzzle: 9 Essential Questions Every Family Should Answer

by Quicken

June 20, 2025

Are you the one who keeps the rest of your family organized? These 9 questions can help you keep your...

Three Game-Changing Updates for Quicken Business & Personal

by Quicken

June 19, 2025

Simplify quarterly taxes, save your custom reports, and attach receipts to invoices automatically. New features, built from your feedback to...

- 1

- …

- 84