Quicken Product Highlights November 2021

Use Portfolio X-ray to evaluate your portfolio (Windows)

One of the key investment features Quicken offers is our Portfolio X-ray. Portfolio X-Ray is powered by Morningstar and helps you to evaluate your portfolio. It looks at your asset allocation, sector weightings, and measures your performance against benchmarks and industry indexes.

To use Portfolio X-ray, you first need to have set up your investment accounts. Be sure you are tracking your full portfolio. Portfolio X-ray is most useful when you have all of your information. You should then navigate to the Portfolio X-Ray tab and select the Get Started button.

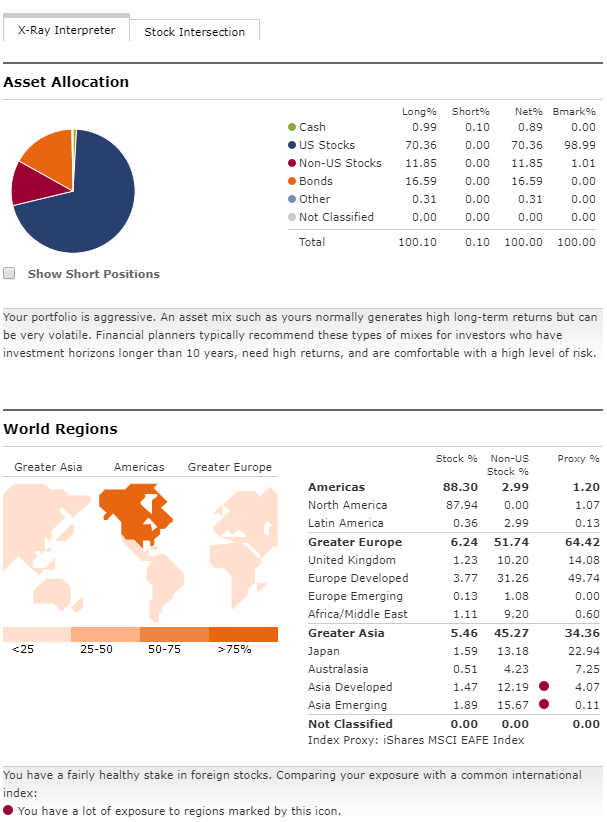

Asset Allocation

The Asset Allocation analysis will show you what areas you put your investments in, such as Cash, US Stocks, Non-US Stocks, Bonds, and other investments. Based on that information, it will let you know if your asset allocation is considered conservative, moderate, or aggressive.

World Regions

If you want to know where you are investing, geographically, World Regions shows you, whether it is the Americas, Europe, or Asia. You can also see whether you are investing in developed markets or emerging markets. The Portfolio X-ray evaluates these positions and indicates if it considers you to have a high exposure in a particular region.

Stock Sectors

The Stock Sectors analysis is great for identifying areas where your investments are concentrated. The Portfolio X-ray also identifies whether the areas you invest in are Cyclical (highly influenced by business cycles), Sensitive (moderate correlation to business cycles), or Defensive (anti-cyclical). It will also identify areas where you have high or low exposure, and let you compare yourself with either a similar investment style or the S&P 500.

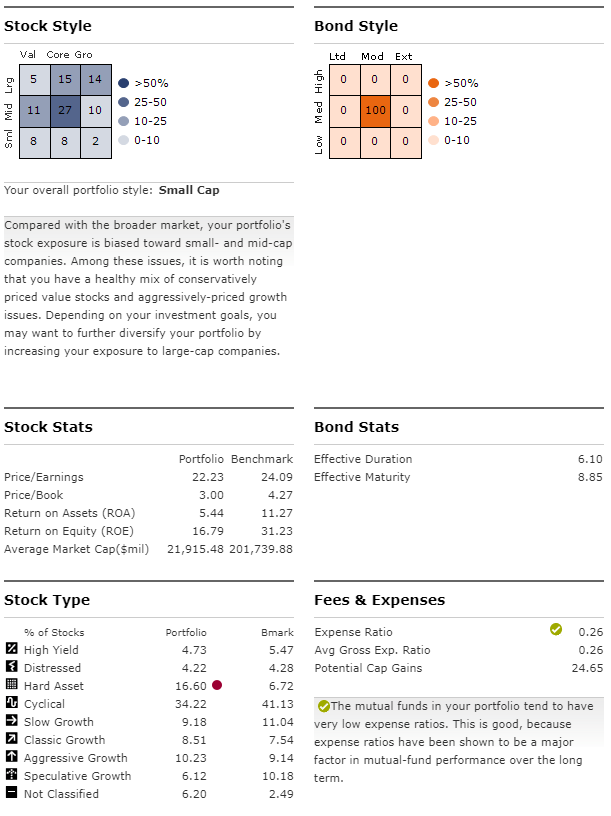

Stock Style & Bond Style

Stock Style creates a table showing where your investments land on Capitation Size (small, medium, large) and Investment Style (Value, Blend, Growth). You can see what your exposures are versus the broader market and determine your current portfolio style. The Bond Style section has a similar table based on Interest Rate Sensitivity (Limited, Moderate, Extensive) and Quality (Low, Medium, High)

Stock Stats & Bond Stats

This Stock Stats section takes a look at your portfolio versus Benchmark on the following categories: Price/Earnings, Price/Book, Return on Assets (ROS), Return on Equity (ROE), and Average Market Cap. The Bond Stats section looks at Effective Duration and Effective Maturity.

Stock Type

Stock Type shows you your stocks by company type. This helps you to determine the diversity level of your portfolio. You may, for example, find that you have a high amount of investments in Hard Assets, which are generally associated with mining and metals, or Speculative Growth, which are companies with high volatility that can have a chance to grow dramatically or but also a chance to collapse entirely.

Stock Intersection

The Stock Intersection tab provides a view of the underlying holdings in your portfolio, displayed by % of Investments, Holding Portfolio Date, and Sector. This gives you an overview of where your investments are, especially within mutual funds and ETFs.

Simple Investment Tracking lets us bring more brokerages to you (Mac)

One of the key features we’ve been working on for you is better access to investment institutions. With our next release, we will be introducing access to a new set of brokerages that use Simple Investment Tracking. This is a way of tracking your investments that is already available as an option for existing brokerage accounts.

At first, these brokerages will be made available to you using Early Access. Early Access is our tool for introducing new features that are still having the finishing touches added, but are ready for users to try out. You can opt into or out of Early Access by going to Quicken menu → Preferences and enabling Early Access.

Simple Investment Tracking tracks positions rather than individual transactions. Our new method for contacting brokerages downloads data from websites rather than using Direct Connect. It provides less detail than complete tracking but will allow us to eventually work with over 700 additional brokerages. This includes many established brokerages that we couldn’t work with before, as well as newer, non-traditional types of brokerages that have not been available using our other methods of downloading information.

Here are some examples of brokerages we expect to add soon. Please note that this is not an endorsement of these brokerages, just some examples of what is coming.

Robinhood is a brokerage that allows users to buy stocks without commission. While traditional stocks are offered, some of the nontraditional aspects of the Robinhood service include partial share purchases, ETFs, cryptocurrencies, and access to IPOs that are often not available from traditional brokerages. This opens up many opportunities for smaller investors.

Wealthfront is another brokerage we anticipate adding. Wealthfront is an automated investing service that is sometimes called a robo-advisor. Wealthfront allows its customers to build portfolios that are curated according to their needs and strategy. This includes portfolios that are tailored to individual goals such as retirement planning, college savings, and socially responsible investing.

A third brokerage that we expect to add is Fundrise. Fundrise is an investment company focused on real estate holdings. Investors can take part in the real estate market with a low cost of entry into the market. Instead of buying real estate individually, investors pool their assets. Fundrise’s main products are real estate investment trusts (REITs) that focus on income-producing real estate.

These are just a few examples of the brokerages that will be available because of Simple Investment Tracking. Not all brokerages will be added at once, but more will appear with each new release as Quicken verifies that we can correctly download and report their investment information.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.

About the Author

John Hewitt

John Hewitt is a Content Strategist for Quicken. He has many years of experience writing about personal finance and payment processing. In his spare time, he writes stories and poetry.