Quicken Product Highlights April 2021

Using Categories to Track Taxable Income and Expenses (Windows)

You can use Quicken to track expenses and income related to taxes by selecting the appropriate category. The categories you can choose will depend on your version of Quicken. Some categories apply to every user. Most of these categories are related to Personal Income and Personal Expenses. Additional categories may be related to Business, Rental Property, and Investments.

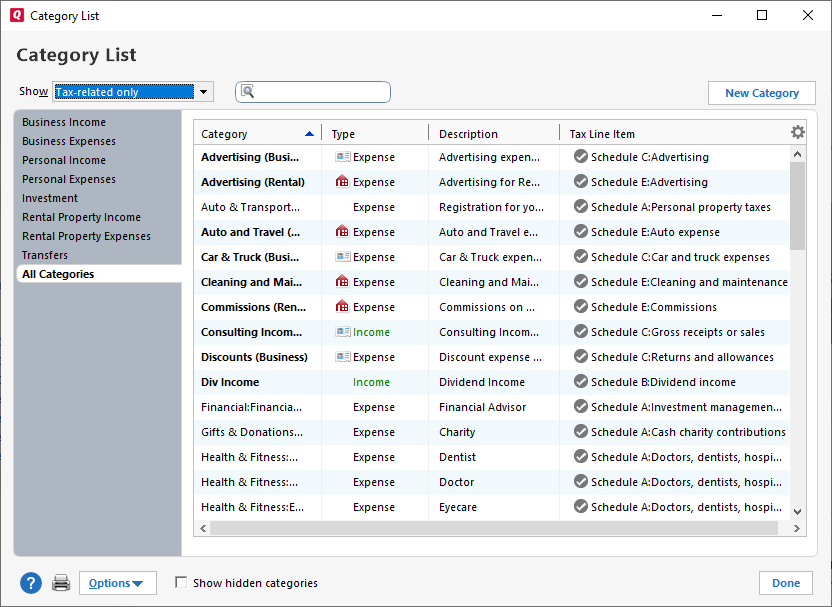

The best way to identify which categories are linked to taxes is to bring up your Category List. you can do this by selecting Tools → Category List or by pressing Ctrl + Shift + C. The Category List displays all of your available Quicken categories. To see the categories related to taxes, look at the Tax Line Item column. The information in this column not only tells you if a category has an impact on your taxes but also tells you what form and line item the category is specifically meant to be used for.

For most people, the existing categories and their tax assignments are sufficient. If you need to assign a category to a tax form line item, you can. Be sure to do your research first. Know exactly what form and line item you need to assign the category to.

You can make these changes from the Category List. To add a tax line item to an existing category, right-click on the category and select Edit. On the Edit Category screen, select the Tax Reporting tab. Select the box for Tax related category and then select the line item from the Tax line item for this category menu. You may want to enter a Tax line item description to remind yourself why this category impacts your taxes.

You can also add a new category from the Category List by selecting New Category. As part of that process, you can assign the category to a tax line item using the Tax Reporting tab.

Using Categories to Track Taxable Income and Expenses (Mac)

You can use Quicken for Mac to track expenses and income related to taxes by selecting the appropriate category. Quicken has already done the work of determining which categories are related to taxes and assigning a tax form or schedule and a tax line to those categories.

The best way to identify which categories are linked to taxes is to bring up your Category window. You can do this by selecting Window → Category or by pressing ⌘ + Shift + C. The Category window displays all of your available Quicken categories. To see the categories assigned to taxes, look at the Tax-Related column.

For most people, the existing categories and their tax assignments are sufficient. If you need to assign a category to a tax form line item, you can. Be sure to do your research first. Know exactly what form and line item you need to assign the category to.

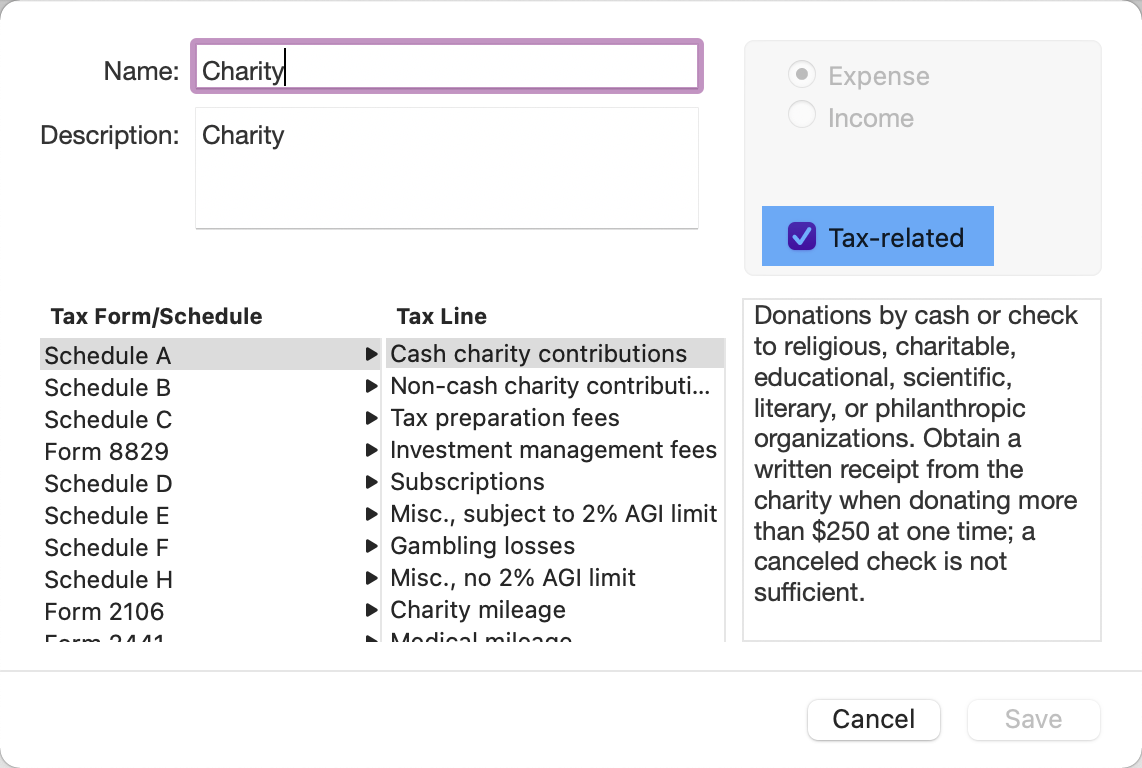

You can make these changes from the Category window. To add a tax line item to an existing category, double-click the category. On the Edit Category screen, select Tax-related, then select the correct Tax Form / Schedule and Tax Line. You may want to enter a description to remind yourself why this category impacts your taxes.

You can also add a new category from the Category window by pressing ⌘ + N. As part of that process you can assign the category to a tax line item using the Tax-Related option.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.

About the Author

John Hewitt

John Hewitt is a Content Strategist for Quicken. He has many years of experience writing about personal finance and payment processing. In his spare time, he writes stories and poetry.