Join Our Simple Investing Beta in Quicken for Windows

The new Simple Investing feature in Quicken for Windows offers an easy, high-level way to track your investments. Access the public beta through your Quicken preferences to see how it works.

What Is Simple Investing?

Simple Investing is an alternative dashboard and feature set for investors who don’t need the full suite of power-investing tools that Quicken offers.

Quicken has been in continuous development for more than 3 decades, adding new investment tools regularly—tools many of our customers depend on to manage their complex portfolios.

But some investors want a simpler version of that portfolio information. They don’t need the complexity that comes with our full set of investment tools and features.

For these investors, Quicken is pleased to introduce Simple Investing, an easier way to track and view your investments.

Note: If you like the dashboard view from Simple Investing but you want to have full transaction history available, you can still get the new view from the “Dashboard” tab under “Investing.” You can view all of your accounts together or one at a time.

What Happens if I Turn on the Simple Investing Beta?

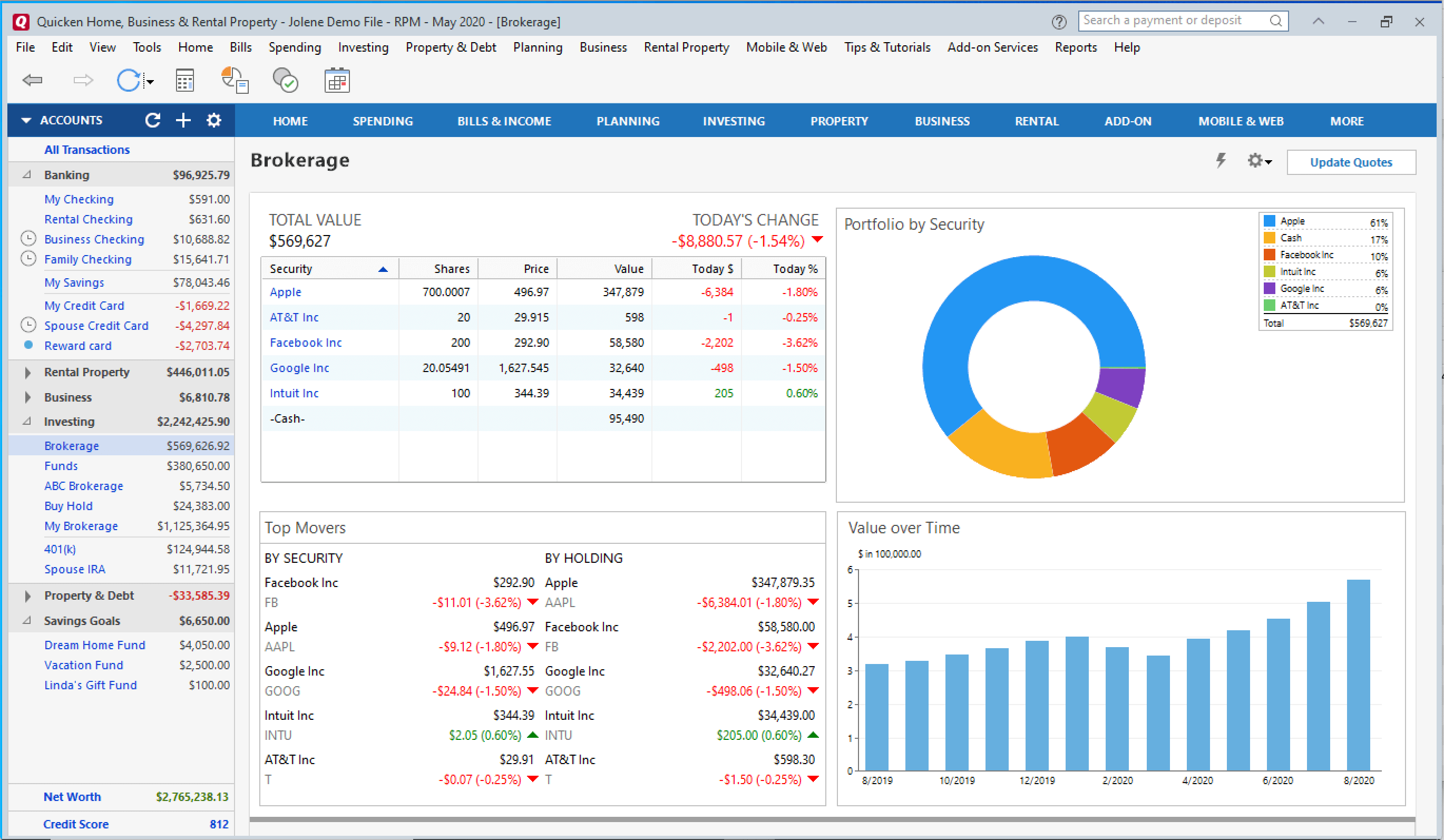

When you turn on the Simple Investing beta in Quicken for Windows, you’ll see a new dashboard that’s designed to give you a bird’s-eye view of your holdings.

Instead of seeing a Quicken account register, you’ll have a new Account Summary that displays your portfolio value, net worth, day change, and investment returns over time.

For every investment account you connect to Quicken, each One Step Update will automatically download the current position reported by the account. Whether you buy or sell, Quicken will show you your new position with one click.

It’s the easiest way to keep tabs on your investments, without having to enter any details about how you got where you are today. Since Simple Investing only tracks your positions and not individual transactions, you won’t be able to calculate capital gains and losses, or your investment income. But Simple Investing will still show you how your investment positions and values have changed over time.

If you decide you’d like to switch back to Quicken’s traditional investing tab (now called Complete Investing), with our full set of investing tools and features, simply turn the beta off at any time.

Things to Know Before You Try the Beta

- When you switch to Simple Investing, any existing placeholder transactions will be converted to Add Shares transactions, so you don’t have to worry about reconciling them with the past. Simple investing will just pick up wherever you are today. (This conversion will not be undone if you switch back to Complete Investing.)

- Quicken will no longer download and track individual transactions (buys, sells, splits, dividend income, etc.) Instead, it will only report the holdings in each account. If you’ve never connected your investment accounts before, or if you don’t like keeping track of those individual transactions, this makes things a lot easier.

- For connected accounts, Quicken will always make the positions and balances of a Simple Investing account match whatever we download from the brokerage, overwriting anything you might have entered in the Quicken register. If you’ve been having trouble making things match up, Simple Investing eliminates that problem.

- If you turn off the Simple Investing beta in preferences, any accounts that you’d previously set to use Simple Investing will revert back to Complete Investing mode.

How to Turn on the Simple Investing Beta

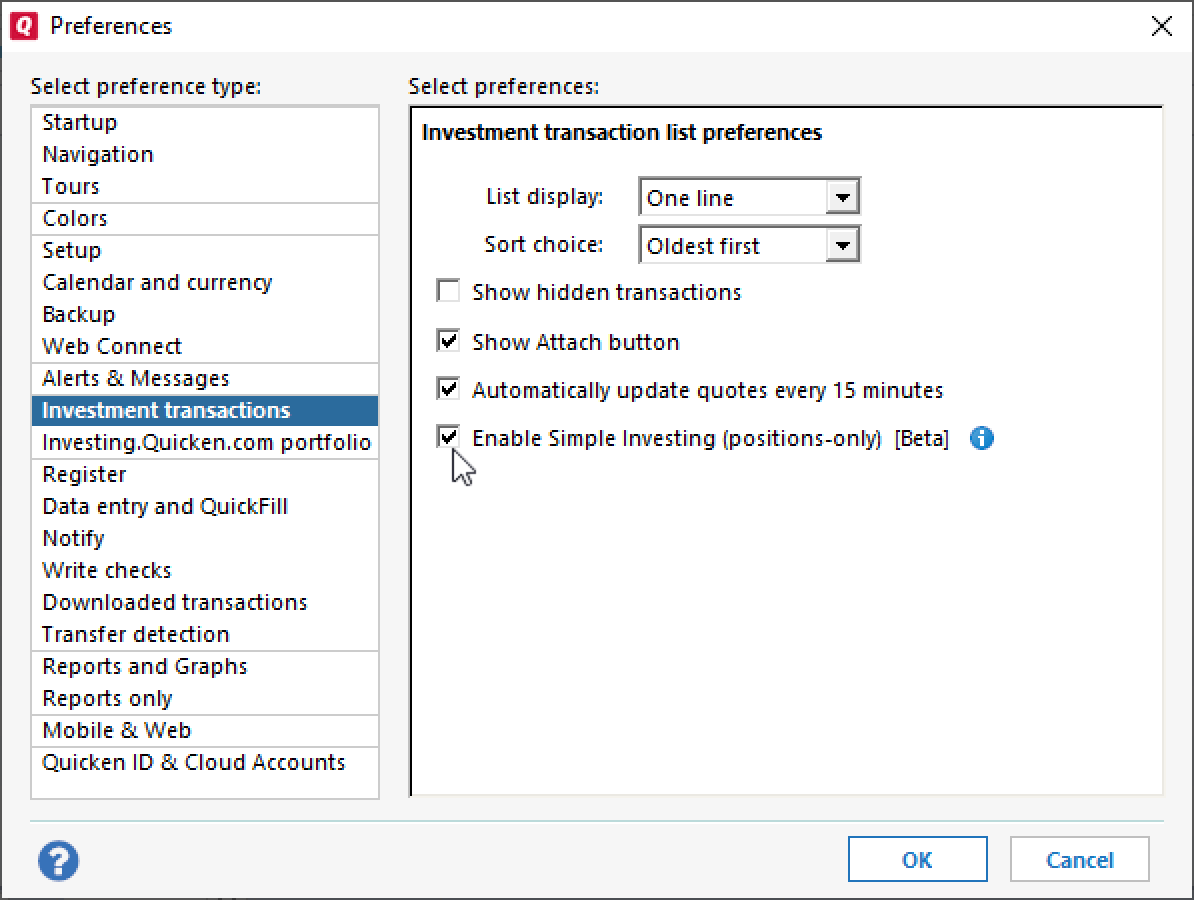

To access Simple Investing, go to Edit->Preferences->Investment transactions and select Enable Simple Investing (positions only).

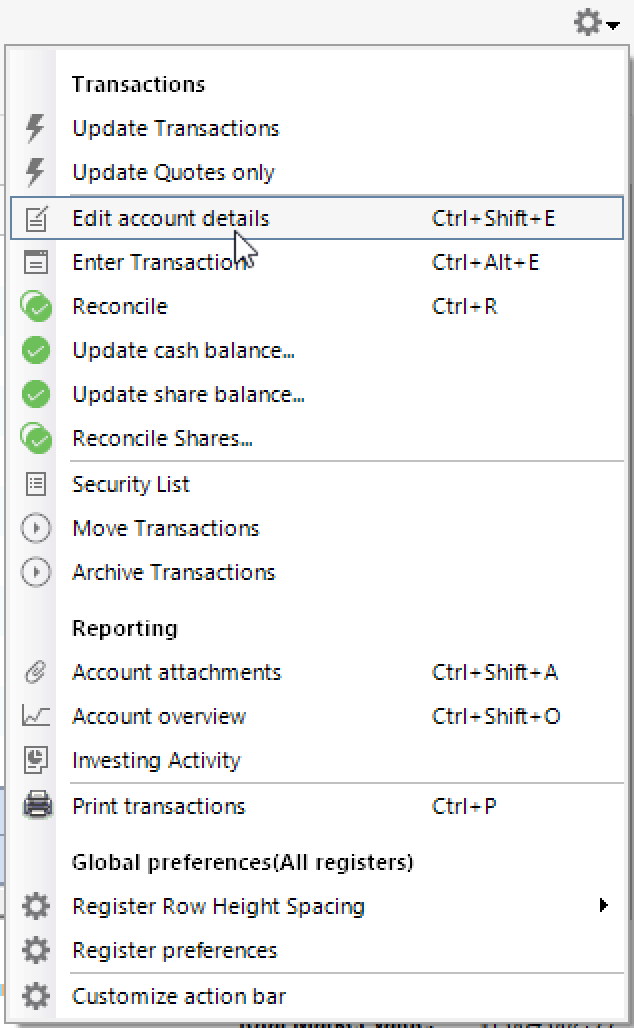

After you enable the beta feature, go to any investing register (or add a new account), click the register action menu and choose Edit account details. You can also choose this by right-clicking on the account name in your account bar.

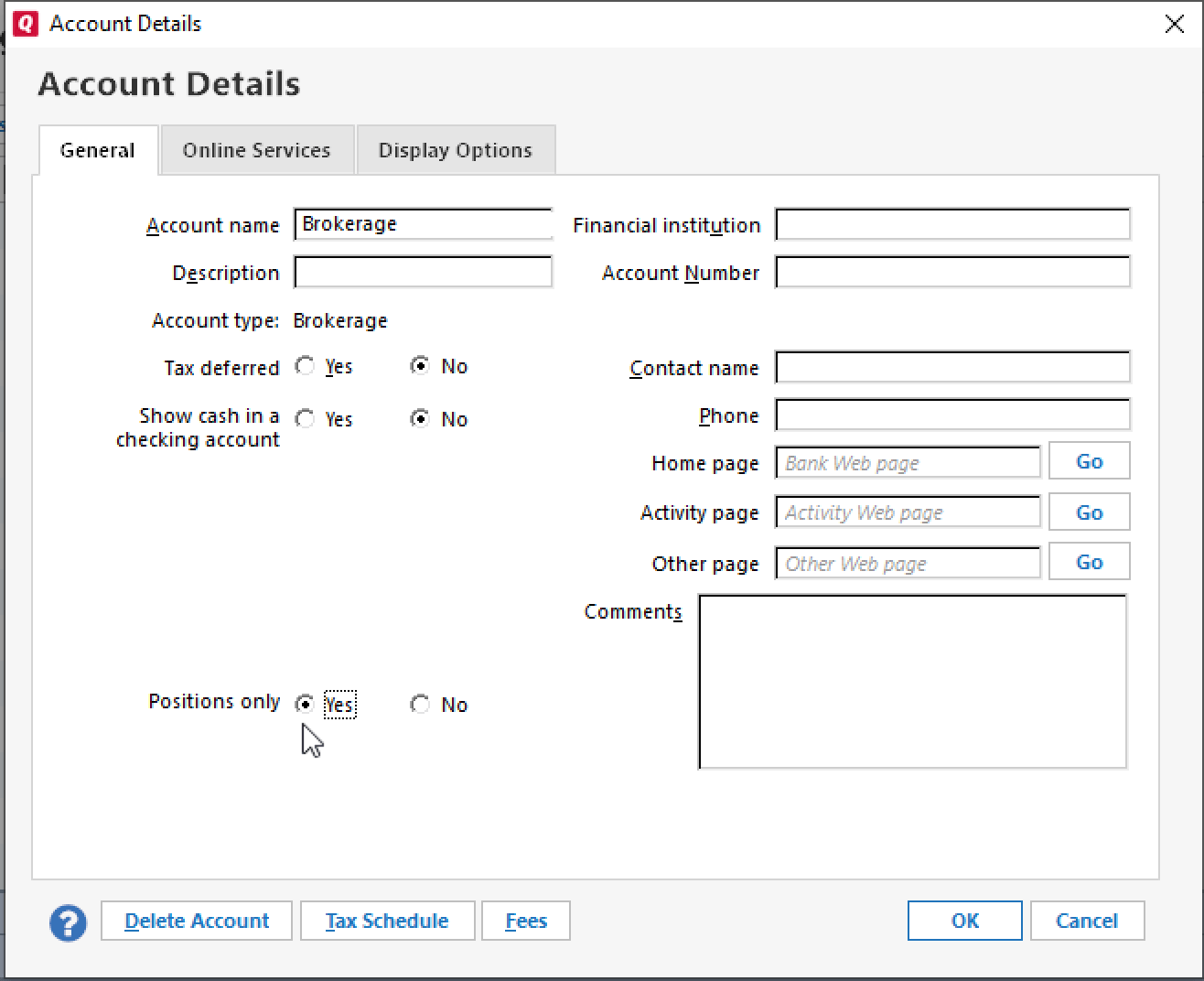

On the Edit Account Details window, click Simple – Positions only.

Now, when you click on this account in the Account Bar, you’ll see an investing dashboard view instead of a normal transaction register.

Whenever you do a One Step Update, this account will be included. You can also click the Update Quotes button at any time to get the latest prices.

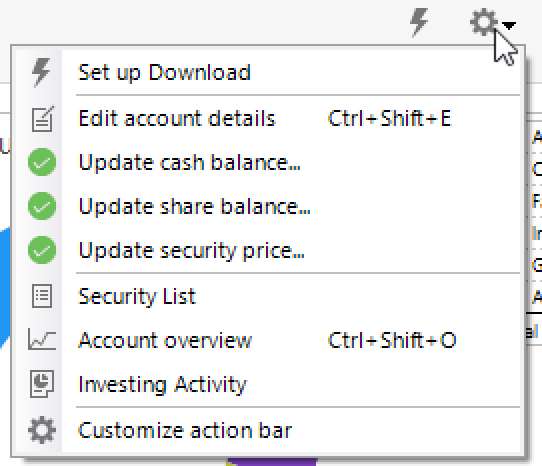

If you need to, you can update your positions manually via the simplified action menu :

Using Update cash balance, Update share balance and Update security price, you can easily set either the current or the past balance, position, and value for any securities you track manually.

How to Give Quicken Your Beta Feedback

If you decide to try the Simple Investing Beta, we’d love to hear your feedback. Please join our Quicken Community forums and visit the Simple Investing topic.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.