5 Ways Simplifi by Quicken Lets You Track Your Money Your Way

Whether you already use Simplifi by Quicken or you’re brand new to the app, one of the things you probably care about most in a personal finance app is flexibility.

Why? Because personal finances are exactly that—personal.

Unfortunately, most personal finance apps are just the opposite. They try to squeeze your finances into somebody else’s idea of how you’re supposed to manage your money, whether you’re single and living in a rental or married in the suburbs with three kids and a mortgage.

It’s ridiculous. You shouldn’t have to change your life to fit your personal finance app. Your finance app should adapt to fit your life.

Last January, Simplifi by Quicken launched right out of the gate with fully customizable categories, tags, payee names, and more, designed to let you track your finances in any way that makes the most sense to you.

Over the past year, we’ve added tons of flexible tools and features, including the ability to create your own automation rules so you can teach the app how you want it to handle things.

Now, as we celebrate our first “appiversary,” here are 5 of the most popular ways Simplifi makes your personal finances your own.

5 Ways Simplifi Lets You Track Your Money Your Way

1. Change those weird download names

Do your online banking records tend to look like alphabet soup?

- AMZN MKTP US*YJK09GTAMZN.COM/BI

- AplPay APPLE.COM/BILINTERNET CH

- VERIZONWRLSSAPO VE

Sure, you can untangle that list if you stare at it long enough. (Usually.) But is it really worth your time to slog through that mess? Why can’t they just say:

- Amazon

- Apple

- Verizon Wireless

Now, they can. Tap any transaction and Simplifi lets you change the payee name to anything you like. Better yet, tell Simplifi to memorize that change and you’ll never have to type it again—the app can apply your change to all your existing transactions and add it to new transactions as they come in. “AMZN MKTP US*YJK09GTAMZN.COM/BI” will show up as “Amazon” every time, making it a lot easier to scan any list of payments and make sense of it at a glance.

2. Customize your categories automatically

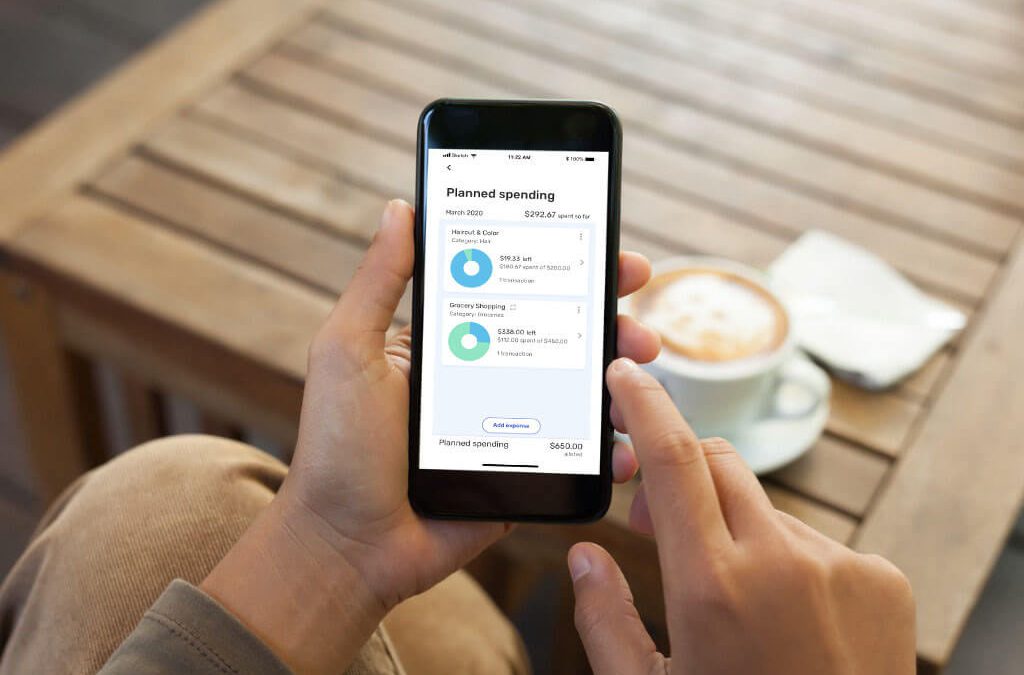

Simplifi helps you understand your unique spending habits by automatically categorizing your transactions into “buckets” like Groceries or Shopping, so you can see at a high level how much you’re spending on what. For most people, most of the time, those categories provide a great overview. But, sometimes, you might want to change them.

Simplifi makes that easy.

Let’s say most of the money you spend on Amazon is on things like books and movies, so you want your Amazon purchases to count as Entertainment instead of shopping. Use Simplifi’s new Rules feature to make that change automatic. Enter that rule once, and Simplifi will apply it every time, putting your Amazon transactions into the Entertainment category.

And, of course, you can still change individual transactions. So if you happen to order some new sheets from Amazon, you can tell Simplifi to count that purchase under Home Furnishings.

Would you rather call it Home Decorating than Home Furnishing? That’s easy too. You can edit the name of any category in the Simplifi settings.

3. Add your own tags to any transaction

The easiest way to stay on top of your spending is to get that bird’s-eye view of your categories, so you can see, for example, how much you’re spending on groceries vs carry-out. But what if you want to know something about your spending that’s more unique? Like how much you’re spending on each of your kids? Or how many weekend camping trips you can afford to take?

Simplifi lets you create your own tags to keep track of those kinds of personal things, even across categories. Create a Camping tag and add it whenever you spend money on your next trip, from buying groceries to gasoline. Each of those purchases will still show up in the right category, but it will also be tagged as part of your Camping spending.

4. Track everything you want to—and only what you want to

When it comes to your personal spending, you should be able to choose what you want to track—and what you don’t. Whether you want to know how much you’re spending at Amazon (as a payee), on Groceries (the category), or on Camping (your custom tag), Simplifi makes it easy.

Just create a watchlist and choose your payee, category, or tag. You can set a target spending amount if you want to, or you can keep an eye on that spending without setting any specific limits. Your watchlist will show up on your dashboard, so you can see that spending at a glance.

You can also customize your personal spending plan to fit your unique needs. If you add your savings goals to your plan, for example,Simplifi will help you make sure you reach them with confidence. Or you can tell Smplifi to ignore any expenses you don’t want to include in your plan, so that large, one-time bill doesn’t count against you for the month.

If you want to explore your finances in more depth, visit the reports section to customize your totals and graphs with the info you need. You can even tell Simplifi not to include certain spending that you don’t need to see, so your reports always show you what you want, when you want it.

5. Create, edit, or delete custom rules

Any time you create a new automatic rule for renaming payees or re-categorizing transactions, that rule is added to your Rules list in your settings. You can add new rules, edit your rules, or delete them whenever you like.

When you add or edit a rule, you can choose to apply it forward and backward in time, and Simplifi will update every similar transaction in your records. If you change your mind, just change the rule and apply it again.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.

About the Author

Quicken

Our mission is to help our customers lead healthy financial lives.