Comprehensive financial management, simplified.

Get all the information you need, right when you need it, to make the best choices for your money.

Connect all your financial accounts

Get a better budget & save more money

Customize your financial views

Get started on your own or with an expert

All Quicken plans

Find the right plan for your financial goals

Personal

Business

Select the best fit for your finances

Quicken Simplifi

Starting at$2. 39 $3.99 40% off /monthBilled annually.

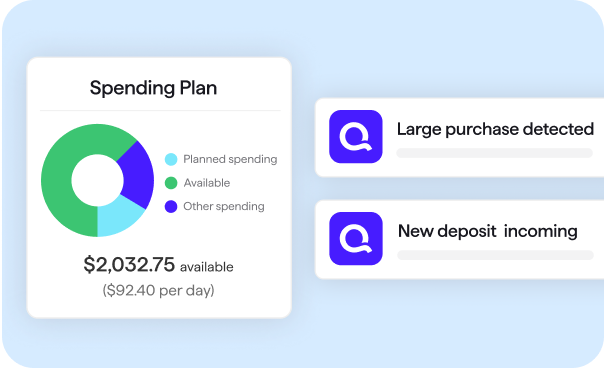

- Save more money

- Always know what you have left to spend or save

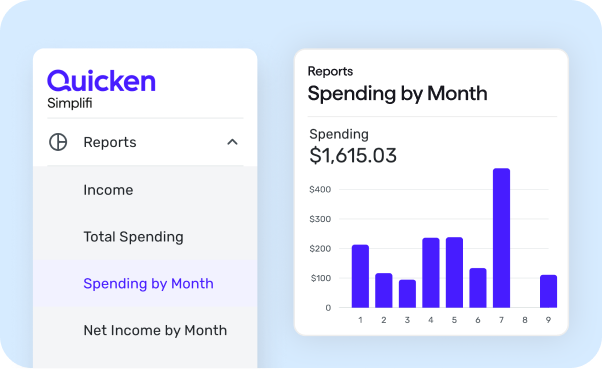

- Get insights with real time alerts & reports

- Customize your transactions

Quicken Classic Premier

Starting at$4. 19 $6.99 40% off /monthBilled annually.

- Best-in-class investing tools

- Built-in tax reports

- Reconcile to the penny

- Track & pay bills in Quicken

- Set budgets, manage debt, create a retirement plan

Quicken Classic Business & Personal

Starting at$5. 99 $9.99 40% off /monthBilled annually.

- Manage business, rental & personal finances

- Optimize for taxes

- Keep documents organized

- Reports: P&L, cash flow, tax schedules, and much more

Over 20 million better financial lives built, and counting

Trusted for over 40 years

#1 best-selling with 20+ million customers over 4 decades.Bank-grade security

We protect your data with industry-standard 256-bit encryption.