How to Diversify Your Portfolio

Portfolio diversification involves spreading your investment dollars across a range of asset types. This common investment strategy aims to minimize your exposure to the risks each investment poses and — hopefully — enhance your long-term performance.

Naturally, it’s easier to diversify your portfolio if you can track all your investments in one place. Quicken and Simplifi’s handy financial tools make it easy to do just that!

What is portfolio diversification, and why is it important?

Portfolio diversification is the practice of investing in a variety of assets, industries, and even geographic regions that perform differently under the same market conditions. Ideally, your portfolio should have enough variety that when the market tumbles, the gains in some assets at least partially offset losses in others.

Investment strategies incorporate diversification to reduce overall risk in constantly shifting markets. The goal is to balance risks with the potential returns that your assets can produce.

However, most investors don’t share identical financial needs — a “balanced” approach for one investor may be considered inappropriate for another. It all comes down to your goals, timeline, personal risk tolerance, and investment preferences.

An example of portfolio diversification

A well-diversified portfolio avoids highly concentrated positioning, like investing solely in one single company.

Say that you invested $10,000 in Facebook in November 2021. At the time, the company was doing well — it seemed like a slam dunk!

Then 2022 hit, and Facebook tumbled alongside the broader market. By June, Facebook had cratered 52%, which left a $10,000 investment worth just $4,800.

Diversifying with funds

Instead of investing only in Facebook, let’s say that you spread $10,000 equally across two passive index funds that follow the performance of benchmark equity indexes. $5,000 went into a fund that tracks the Nasdaq Composite; the other $5,000 went into a fund that tracks the S&P 500. Each fund invests in hundreds of stocks, spreading your dollars across industries and market caps.

Unfortunately, between November 2021 and June 2022, both funds experienced losses. The Nasdaq Composite dropped 32%, while the S&P 500 dropped about 21.5%.

However, by diversifying your portfolio, you’ve lost less than if you’d invested in Facebook alone. Instead of declining to $4,800, your account balance reads $7,325 — not bad for a volatile year!

Which asset classes should you buy?

Investing in different equities funds is a good start on your diversification journey — but it’s not enough for most investment strategies. Ideally, you should spread your money across a range of asset classes to achieve a well-balanced investment portfolio.

Stocks

Stocks are financial securities that represent ownership in a given company, such as Apple. You can profit from stocks by buying low and selling high and receiving dividends as a shareholder.

While stocks historically perform well over the long term, they’re also notably volatile and carry higher short-term risk. Risk-averse investors with shorter time horizons are especially susceptible during market volatility or economic recessions.

Bonds

Bonds, such as Treasuries, are essentially short-term loans that investors make to businesses or the government. In exchange, you’ll earn interest and receive your principal — the amount you loaned them — back at maturity. Bonds can “mature,” which means they reach expiration and become payable in months, years, or decades.

These fixed-income assets are useful to cushion against stock market volatility and earn a regular check. But with less risk comes smaller rewards: historically, stocks outperform bonds over the long term.

Cash-based accounts

Cash-based accounts include savings accounts and money market accounts as well as certificates of deposit (CDs). These accounts usually kick out smaller returns on your deposit, with many failing to match inflation. That said, they’re a great way to park funds you need to access quickly, like an emergency savings account.

Real estate

Real estate is tangible land or property with multiple investment options. You can:

- Purchase property to rent or flip

- Invest in publicly traded real estate investment trusts (REITs) that pool funds to invest

- Buy private investments

- Fund private mortgage loans to collect passive income

- Or even invest in related industries like construction

Despite its diversification potential, real estate often requires high upfront costs. This investment strategy carries its own risks, rewards, and tax implications.

Commodities

Commodities include “raw” physical assets like oil, beef, and gold that you trade using specialized contracts. Though often used to hedge against economic events, commodity assets are uniquely vulnerable to weather and geopolitical events. (In other words, they’re generally best left to advanced investors.)

Alternative assets

Alternative assets are any assets that fall outside stocks, bonds, and cash. Aside from real estate and commodities, this type of investment includes assets like art, collectibles, cryptocurrencies, private equity, hedge funds, and more.

Many alternative investments carry higher risk and the potential for greater returns, but some investments, e.g. real estate or private equity, may require high upfront costs or fees.

7 Steps to Diversifying your Portfolio

For individual investors, especially if you’re relatively new to investing, achieving a diversified portfolio can feel overwhelming. Here’s how to get started:

1. Figure out your risk tolerance

The first step is deciding how much risk you can handle based on your age, goals, and financial situation.

Higher-risk investors may include younger investors or wealthier individuals who have more time (or money) to recover from potential losses. These investors may prefer higher-risk assets like stocks, real estate, and commodities.

By contrast, lower-risk investors are generally older or less wealthy individuals with less time or money to recover from losses. Lower-risk investors may prefer fewer stocks and a greater focus on bonds and cash-based accounts.

2. Start with “safer” investments

Beginner investors may find that “safer” investments make a great foundation for long-term holdings.

Start by including fixed-income assets, such as government-issued bonds and Treasuries, to kickstart your cash flow.

From there, consider passive stock-based exchange-traded funds (ETFs) and index funds that track major indexes like the S&P 500. These funds typically pair low fees with instant diversification — up to hundreds of securities each — to generate long-term performance.

You can also invest in ETFs that target specific sectors, like healthcare or tech, or themes like clean energy and infrastructure. Though potentially more expensive, these funds provide thematic diversification.

3. Add a little risk

After establishing a solid foundation, the next type of investment to consider is one that boosts your gains. Playing it safe helps limit losses, true — but in investing, higher-risk assets often boast higher reward potential.

4. Hedge against economic events

Another diversification tactic is to hedge against specific economic risks. For instance, “gold bugs” snap up gold and silver to guard against inflation. If you think interest rates will fall, you might invest capital into bonds to enjoy higher returns.

5. Diversify within asset classes

It’s not enough to buy a bunch of different types of assets: you should also diversify within asset classes. For example, you might buy across:

- Industries (healthcare vs. tech stocks)

- Market capitalizations (large-cap vs. small-cap securities)

- Region (domestic vs. foreign stocks)

- Growth vs. value stocks

- Government- vs. corporate-issued bonds

- Duration (different maturity dates on bonds)

Diversification isn’t limited to stocks and bonds — you can buy real estate in multiple cities, different types and sizes of commodity contracts, and more.

6. Assess your portfolio risk

Once you’ve chosen an investment strategy, you’ll want to assess your portfolio risk. You can look at how volatile your portfolio returns are, their sensitivity to the broader market, and how correlated the assets are, which is how likely they are to move in the same direction.

For instance, most portfolios contain at least moderate currency and interest rate risk — the risk your assets will lose value based on currency or interest rate fluctuations. Your asset allocation also impacts your risk — if you’re overinvested in tech, for example, you stand to lose more if the tech sector crashes.

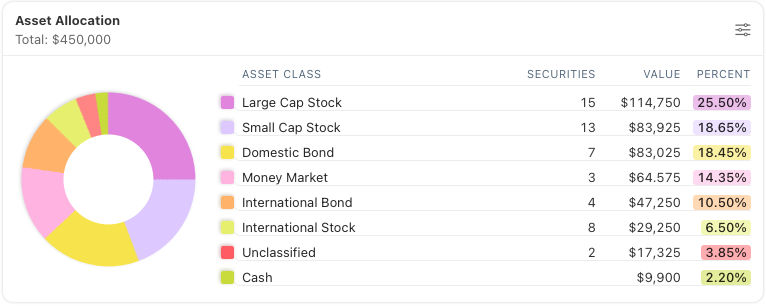

You can calculate your portfolio risk yourself if you really love math and continuously updating all your numbers by hand. For everyone else, Quicken’s investment tracking makes measuring your portfolio risk easy. Quicken gathers your investment data into a single dashboard where you can visualize your portfolio as a whole, so you can see where you’re too concentrated (or not concentrated enough!) for your own good.

7. Rebalance as needed

Rebalancing your portfolio involves buying and selling assets to keep your portfolio’s makeup in line with your goals.

Typically, when an asset or market sector over- or underperforms and throws your portfolio out of whack, rebalancing can bring you back in line. You also might rebalance when your goals change to require a more conservative or aggressive strategy. Just remember that rebalancing too often risks incurring more fees or taxes, depending on the accounts involved.

Barring sudden changes, it’s wise to rebalance regularly to align your portfolio with your goals.

Tracking a diversified portfolio

You might think spreading money across various assets makes tracking your portfolio tricky — and you’d be right. The more assets and accounts you have, the harder it is to measure your performance and calculate your constantly shifting net worth.

Quicken has an easy-to-use dashboard to unite your accounts in one place, monitor your market performance and investing costs, and track your progress. Plus, our software can help you identify concentrated positions, so you know where your money is taking extra risks.

Curious how it all works? See how Quicken can help you make better investment decisions with our comprehensive planning tools!

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.