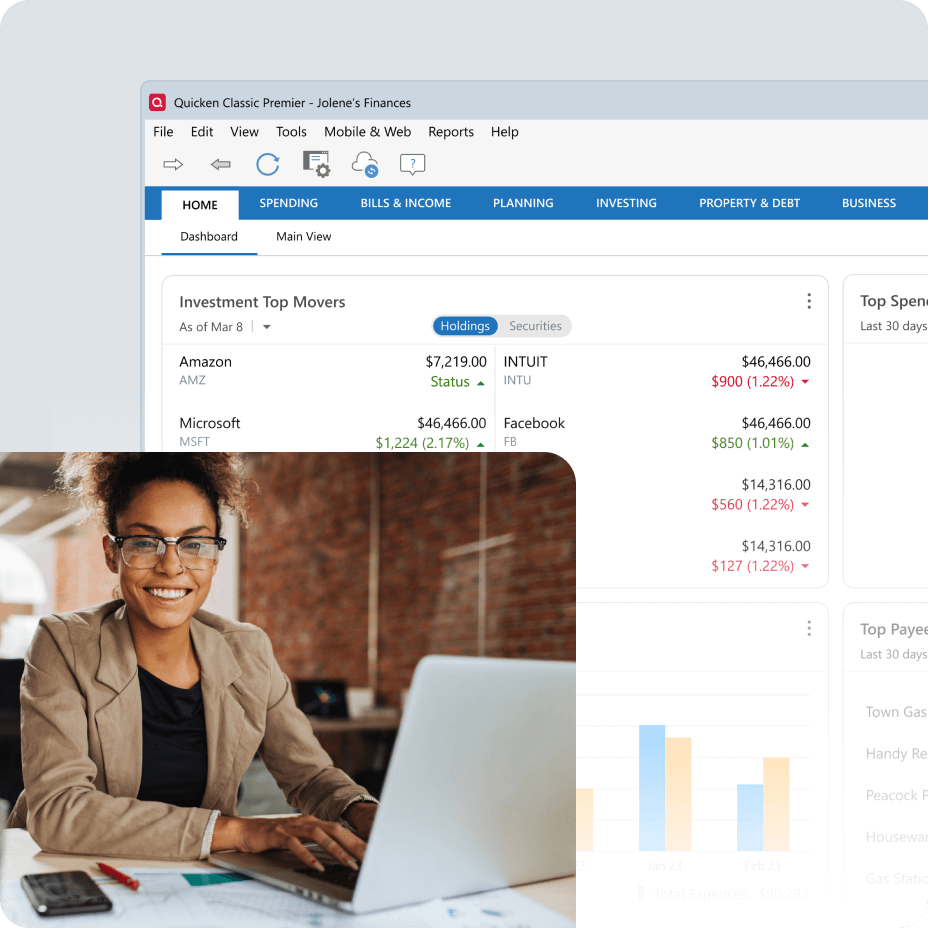

Classic Premier

-

Calculate IRR & ROI, evaluate allocations & analyze buy/sells

-

Evaluate allocations with Morningstar Portfolio X-Ray (Windows only)

-

Maximize tax efficiencies with built-in tax reports