How does Quicken Business & Personal help improve cash flow?

One-click invoices and payment links help you get paid faster, and you can see cash flow projections up to a year in advance.

Get paid faster, see your cash flow in real time, and project them into the future, so you can make informed choices for your business.

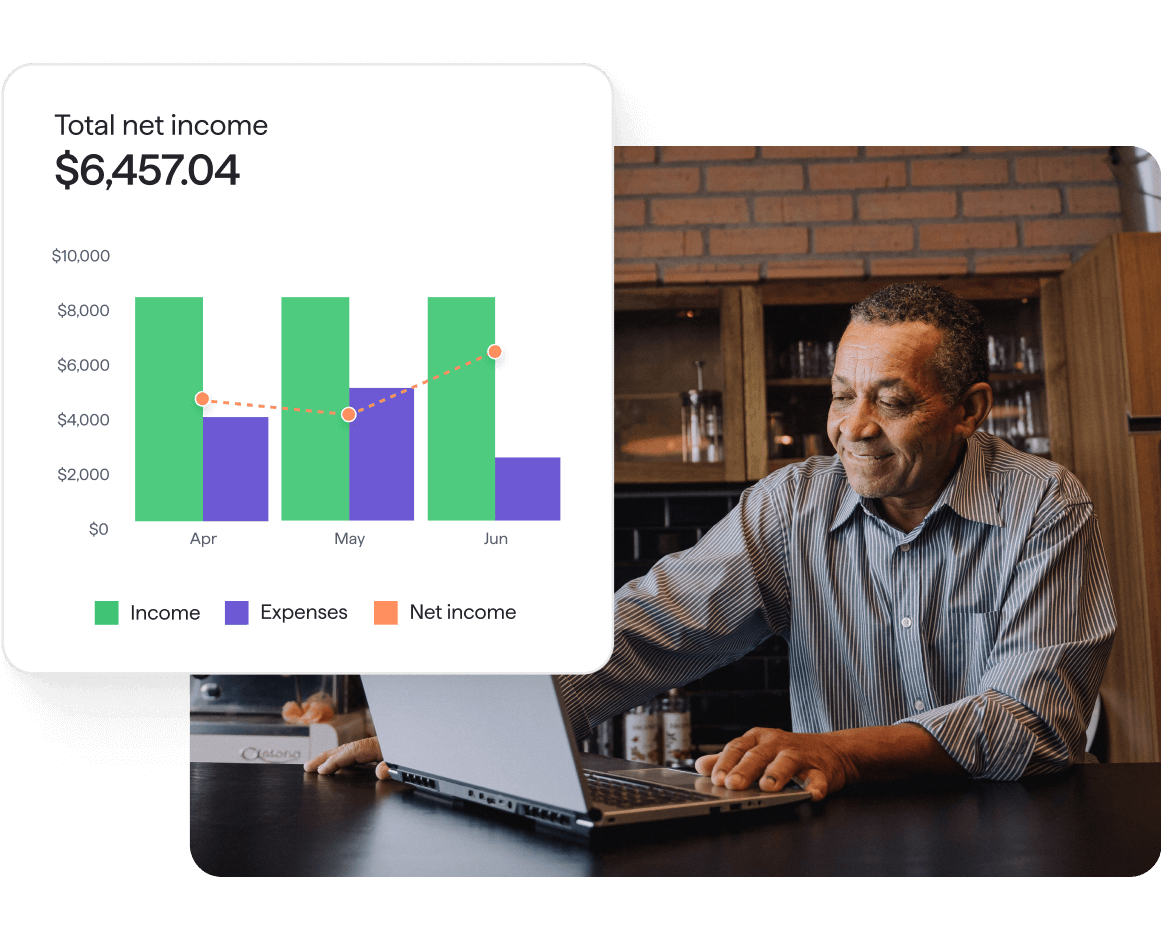

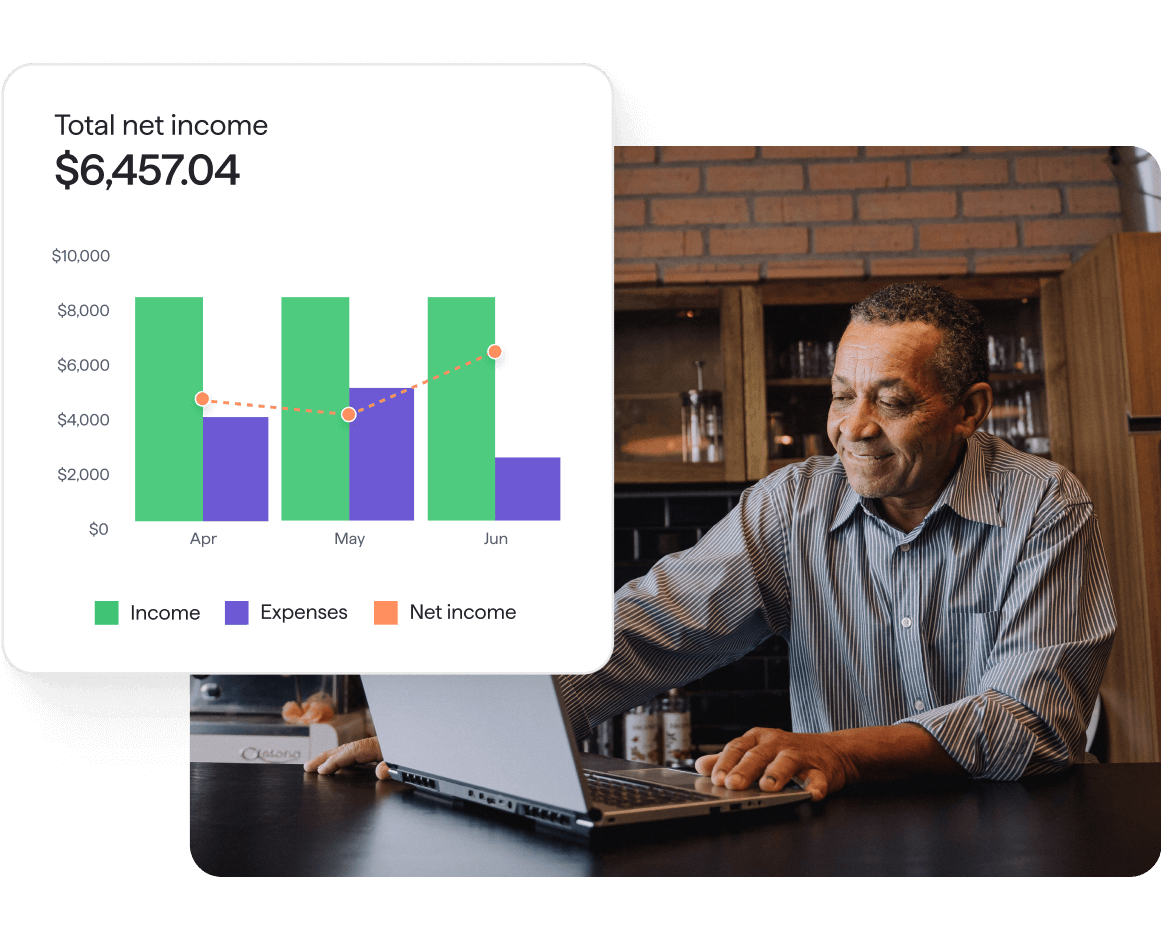

Visualize your business & personal cash flow over any time frame, up to a year in advance. See how income and expenses will line up, so you can tackle any shortfalls and capitalize on opportunities.

Get a heads-up display of every invoice by status. See who’s paid and who hasn’t, without any hunting or hassle, so those unpaid invoices never slip through the cracks.

Spent the day on a project? Bought landscaping plants for a client? When you create an invoice, any time & expenses you’ve tagged fall into place automatically, so you can get that invoice out fast.

Send customized, branded invoices with payment links included. So easy, your clients can just tap and pay. Speed up the payment process and get that money into your account, without the manual work.

Automate your bookkeeping

Quicken connects to over 14,000 banks and financial institutions, for maximum efficiency. Income & expenses appear in your app automatically, saving you hours of time.

See all your cash flow in real time

Quicken connects to your business & personal accounts. Every dollar that flow in or out is captured in your dashboard, so you can see your finances at a glance.

Get unlimited financial reports

Run all the reports you need, filtered however you like. Monitor the health of your business & personal finances. Reports for taxes, investing, performance & more.

Quicken Business & Personal

See business & personal cash flow, up to a year in advance

Monitor all your upcoming business & personal income and expenses in one place

Automate your bookkeeping

Get paid faster

Quicken Simplifi

Don’t have a business or freelance income?

How does cash flow projection work?

When you bring up a cash flow projection for a given account, Quicken Business & Personal starts with the current balance in that account, so it always begins with your cash position today. Then, it uses your list of recurring income and expenses, finds the transactions associated with that particular account, and shows you how your account will change as those specific transactions flow in and out on their expected dates.

How far ahead can I see with cash flow projections?

View cash projections weeks or months ahead, up to a year in advance. You’ll see when recurring income will arrive and when recurring expenses will go out. This gives you plenty of time to address any low points before they happen and also take advantage of any high cash positions to save, invest, or make larger purchases, whether for your business or in your personal life.

What if I don't have a Stripe account for invoicing?

You can sign up for a Stripe account for free. Stripe only charges you when your clients pay you through the platform. As of September, 2025, Stripe charges 2.9% plus $0.30 per card payment and 0.8% (max $5) per bank payment. The direct integration with Stripe makes invoice matching automatic and lets you see transactions as soon as Stripe registers them instead of waiting for them to hit your bank account.

What if I want to use a different payment method for my clients?

You can use any payment provider with Quicken Business & Personal. You can also accept cash or check payments. Once payments are deposited in your connected bank account, the app will import those transactions and you can match them to the right invoices. You can split the transaction if it covers more than one project, client, or invoice.

What if I have more than one business?

Quicken Business & Personal is perfect for small business owners, freelancers, and self-employed individuals with more than one business. You can manage up to 10 businesses separately, using the same Quicken Business & Personal subscription, at no additional charge.