How to get the most out of Quicken Reports

Our Most Popular Quicken Reports—And How to Get the Most Out of Them

“Reports can help you better understand your financial picture on your own. Quicken Deluxe offers far more of these than any competitor.”—PC Mag

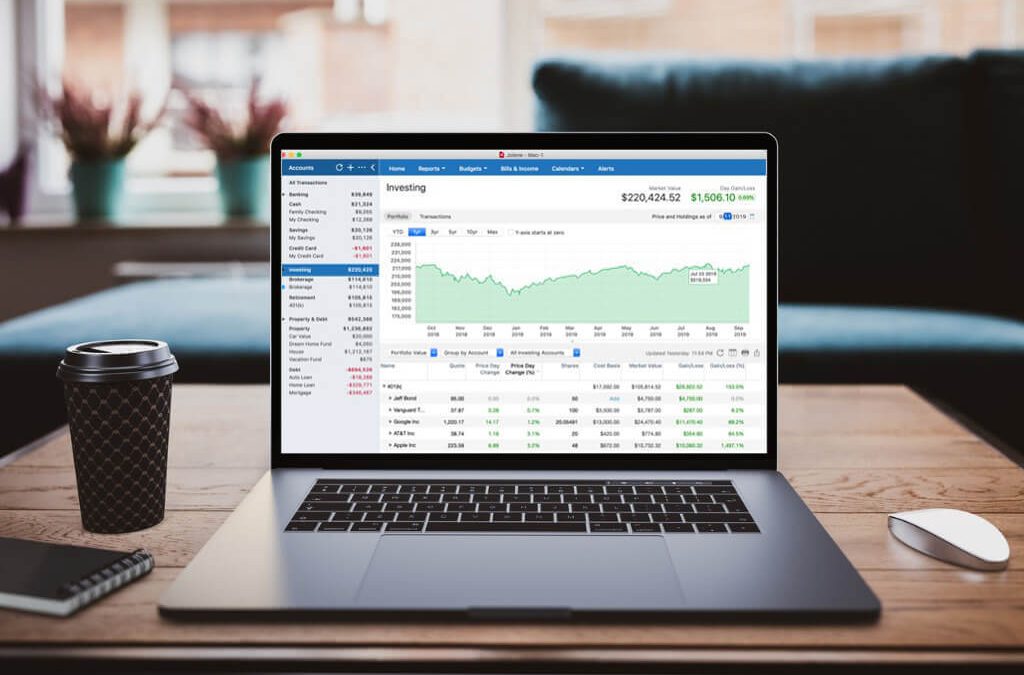

When you want to understand your financial position, there’s no substitute for robust financial reporting. Quicken reports combine the simplicity of built-in options with the power of total control and customization.

Top 5 reasons to use reports

1. Understand your cash flow.

Use reports to learn more about how your money flows in and out. How does your monthly income compare to your monthly expenses? How much are you spending on groceries every month as a family? How much have you been adding to your savings every year? Reports give you the information you need to take control of your finances.

2. Find more places to save.

Spending reports are perfect for figuring out what you’re spending your money on and where you might be able to save. Scan your spending by category to see what stands out. Are you surprised at how much you’re spending on takeout? Or how those monthly subscriptions are adding up? Reports can help you make the right choices for your lifestyle.

3. Make informed choices.

When you’re considering a specific financial move, reports can help with that too. Is it time to trade in your old car for a new one? Use reports to find out how much you spent on car maintenance and gas last year. Should you turn over one of your rental properties? Find out which ones are generating positive income and which ones are lagging behind.

4. Prepare for tax season.

When tax time rolls around, Quicken has plenty of built-in tax schedule reports. Send them to your accountant, or use them to prepare your own taxes to make that process a lot easier.

5. See how things are changing.

Reports can show you how your financial picture is changing to help you keep your plan on track. Find out whether you’re meeting your goals, see how well your investment portfolio has performed over time, track your net worth, and plan for the future.

How to access Quicken reports

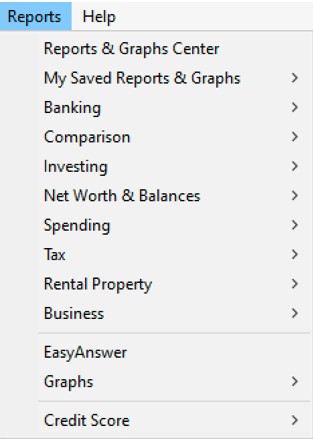

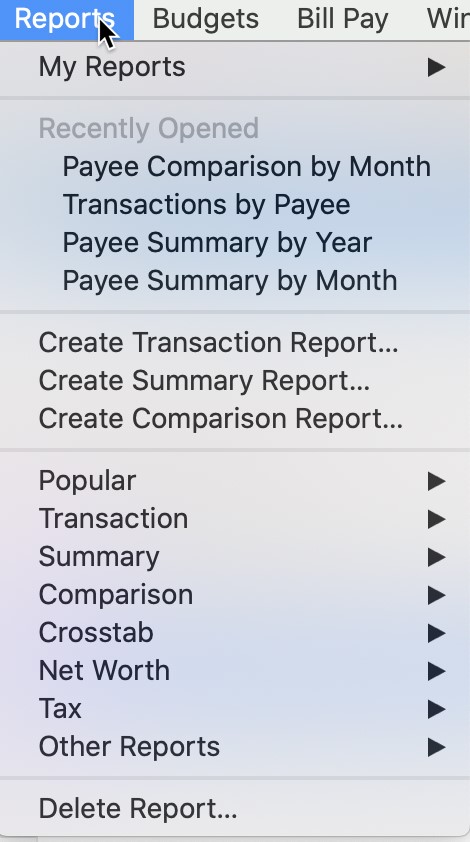

For common needs like budget and tax reports, use the Reports drop-down menu to choose from a long list of ready-to-go options—from itemizing your monthly spending to generating specific tax schedules.

Windows:

Mac:

(On Mac you can also click on Reports tab to see all the predefined and saved reports.)

If you need something more unique, start with any basic report and modify it to show you exactly what you need to know. Then save it so you can refer back to it whenever you want to.

The ability to modify any report however you want to, literally building exactly what you need, is unique to Quicken and one of our customers’ favorite features. You won’t find that kind of power and flexibility in any other app or on any other website. Period.

“No one else … comes close to providing such a wealth of guidance and tracking tools in either a software or web-based application.”—PC Mag

Top 9 most popular built-in financial reports of 2020

1. Transaction reports

Transaction reports are just what they sound like. They display your transactions down to the last detail. Track your inflows & outflows by account, by month, or even by tag, making each report completely unique to your own financial situation. Create tags for each of your kids, for each of your rental properties, or to help you keep track of transactions you want to discuss with your accountant. The choices are endless.

2. Category reports

Want to know how each of your categories is performing against your benchmarks? (Or maybe you just need to find the name of that contractor who did that work for you three years ago.) The itemized category report shows you all your inflows and outflows by category. The more you use categories to track your finances, the more Quicken can do for you.

3. Spending by category

The category summary report displays your overall spending by category so you can see the big picture (and your category totals) without getting into the details of each transaction. See how much you’ve spent on groceries this year, or track how your car expenses have changed over time. Many of our customers call this one “eye-opening.”

4. Income & expenses by category

Are you using Quicken to keep up with a small business or rental properties? If so, you can also use category reports to track how well different business segments or properties are performing. Having that kind of information at your fingertips can be critical to making the right investment decisions over the long run.

5. Payee reports

Want to know how much you’re spending on your gardener? Or how much you’ve been ordering from Amazon? Payee reports group your transactions by payee so you can see exactly where your money’s going. Find out how that spending has changed over time, across months or even years, or conduct your own experiments. Shop at one grocery store this month and a different one next month to see which one might save you money!

6. Cash flows

For a quick summary of all your inflows and outflows, the cash flow report provides the perfect bird’s-eye view. Click on any total to drill into its individual transactions, so you can easily zoom in and out of the details you want to see, without getting bogged down by things you don’t need.

7. Banking summary

Your banking summary (or accounts summary to Mac users) provides a convenient layout for all your account totals with a summary of your assets, liabilities, and net worth. It’s a great place to start for a high-level picture of all your accounts and balances in one place.

8. Net worth

Want to see how your assets, liabilities, and total net worth have stacked up over time? Run a net worth report. Be sure to connect all your accounts in Quicken to get an accurate picture of all your account balances, your overall net worth, and how they’re performing over the long run.

9. Tax Summary

Need to get ready for tax season? Run a tax summary report—also called a tax schedule report for Mac users. Quicken will kick out the schedules your accountant needs, according to the information you’ve entered. Connect all your accounts and use our built-in tax categories to get the schedules you need automatically!

Customizing reports

As great as those built-in reports are, everyone’s finances are unique. When you need to change one of our reports to work a little differently, Quicken makes it easy. Build it, tweak it, and save it just the way you want it, so you can use it again any time you need to.

“The reports feature is excellent for seeing ways to improve spending habits. This will undoubtedly be one of the best purchases of the year for me.”—JCD | Quicken Home & Business

If you’re just getting started customizing reports, here are a few things to try:

1. Change the date range.

Are you operating on a different fiscal year? Or do you want to see how your net worth has changed since the day you started using Quicken? You can change the date range on any report to see your data across a wide range of options: this month, this quarter, this year to date, last month, last 12 months, and more. Or enter your own custom dates to see any time frame you like.

2. Change the included categories.

Start with any built-in report and choose only the categories you want to see. Maybe you want to exclude automatic loan adjustments from an income report. Or exclude certain necessities from a spending report. Here are some more popular ways custom reports can show you exactly what you need to know:

- A home improvement report on that recent project

- A household expense report of your monthly spending

- A transportation cost report when deciding on that new car

- A children’s expense report for childcare, sports & other activities

- A hobby report on those “simple hobbies” that might not be so simple

3. Create custom tax reports.

Maybe you help a family member monitor their investments, but you need to exclude those transactions from your own year-end tax report. Or maybe you’ve connected your personal and business accounts to Quicken, and you need to report those earnings separately. Limit any report to just the accounts you need.

4. Create custom expense reports.

Similarly, you might need to track your personal expenses separately from your work expenses. Or you might create an “Accountant” tag that you use on any transaction you have questions about. Custom reports let you separate your transactions any way you want to.

5. Ignore unusual events.

Some life events call for unusually large transactions, but you don’t always want to see them in your income or spending over time because they throw off your overall progress in an artificial way. Simply exclude them to get a more realistic long-term view.

6. Track discretionary spending.

Create a spending report that excludes things like your car payments and mortgage to see only the spending you can control. Hone in on the things you can change to take control of your spending and increase your savings over the long run.

Want to know more?

Quicken reports for Windows

- Quicken for Windows – Creating an Income and Expense Report by Category

- Windows Net worth – How to run a Net Worth report

- Windows Tax Summary – How to run a tax summary report

Quicken reports for Mac

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.