Overview

The Tax Schedule report lists all the Quicken transactions associated with tax-related categories. The report helps you get the exact figures you need to fill in your federal 1040 tax form. You can export this report to TurboTax or any tax software.

Please note, in order for Quicken to accurately maintain tax reports, you will need to assign tax line items to your Quicken categories. For more information, see Assigning tax line items to categories.

To get the Tax Schedule report

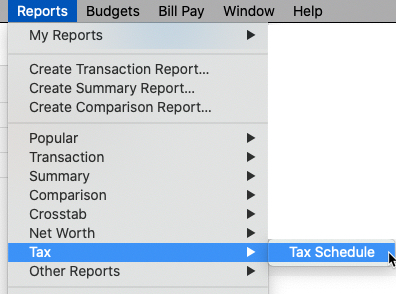

From the Reports menu, select Tax > Tax Schedule.

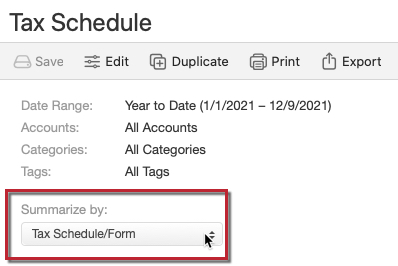

- To view the Form 1040 report, choose Tax Schedule/Form from the Summarize by list.

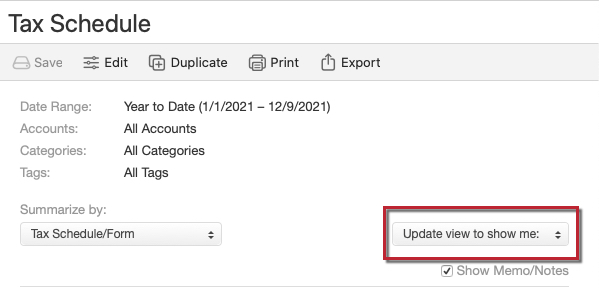

- Select the desired view from the Update view to show me list. You can also click the Show Memo/Notes checkbox if you want to include the notes you added to your investment transactions.

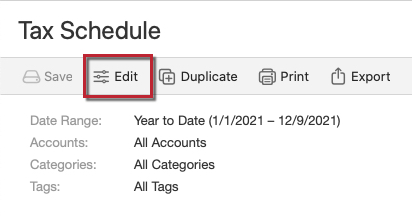

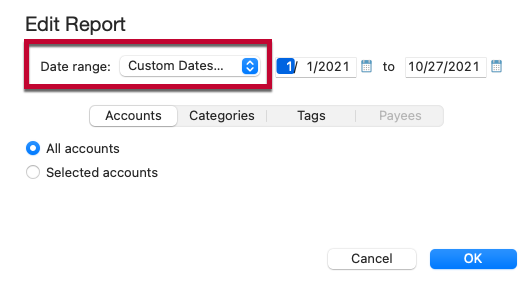

- If you want to customize the report for a specific date range, a specific account, categories, or tags, click the Edit button and select the desired options.

- If you need to change the year, you can do this in the Edit Report screen with the Date range dropdown.

To export the Tax Schedule report

- After you see the Tax Schedule report by following the steps mentioned above, click the Export button at the top of the Tax Schedule report view and select Export to TXF file.

- You can also access the Export option by going to File > Export Tax Report.

- Select the applicable tax year from the drop-down list and click Next.

- In the Save As field, provide an appropriate file name and select the location to save the report.

- Click Save to save the 1040 form in .txf format.

Note: TurboTax Online no longer supports Quicken import. To import tax information from Quicken, use the TurboTax Desktop software. Click here for additional information on how to import tax information into TurboTax.

Article ID: GEN00667