What are Quicken Simplifi Savings Goals?

Savings Goals let you set target dates and monthly contributions for your savings, and track your progress toward your plans.

Build your savings faster by including your goals in your budget. Create and track as many as you like. Reach all your goals with confidence.

When you add a new goal, Simplifi helps you set up your target date and monthly contributions. Goals can be big or small, across any time frame.

Include your Savings Goals in your monthly Spending Plan to make sure they’re covered. Or leave them out and just save what you can, when you can.

Your savings bars update automatically, so you can see how close you are to each goal.

Life happens — borrow from one goal to cover another when priorities shift, then rebalance when you're ready.

Grow your emergency fund

Start with three months of expenses. Adjust your target as your income grows. Track every contribution and celebrate each milestone along the way.

Save up for a vacation

Your Savings Goal will keep up with the total amount you’ve saved, even when you start spending from it for things like booking your travel early.

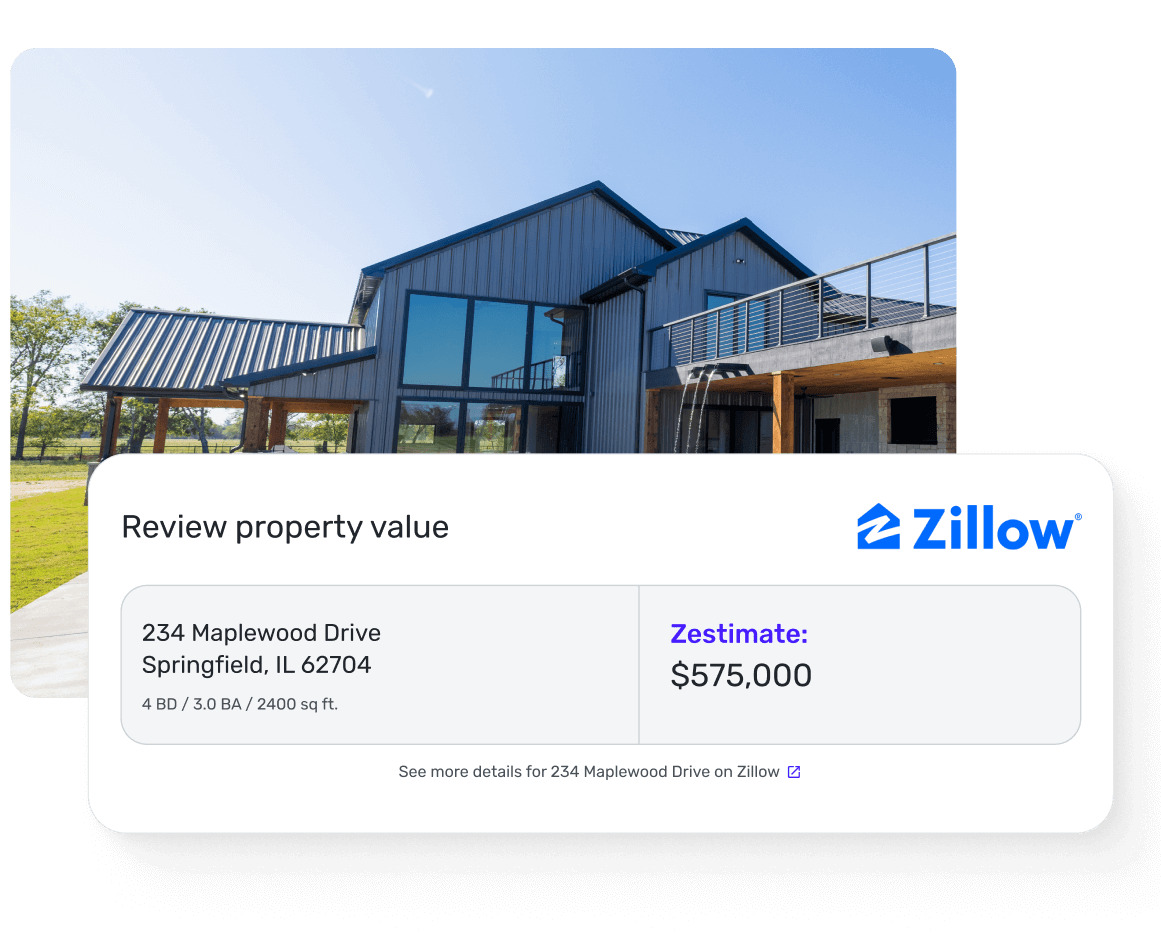

Build your down payment

For long-term savings, don’t let short-term needs set you back. If you borrow from a Savings Goal, it still counts toward what you saved, so you can pay it back later.

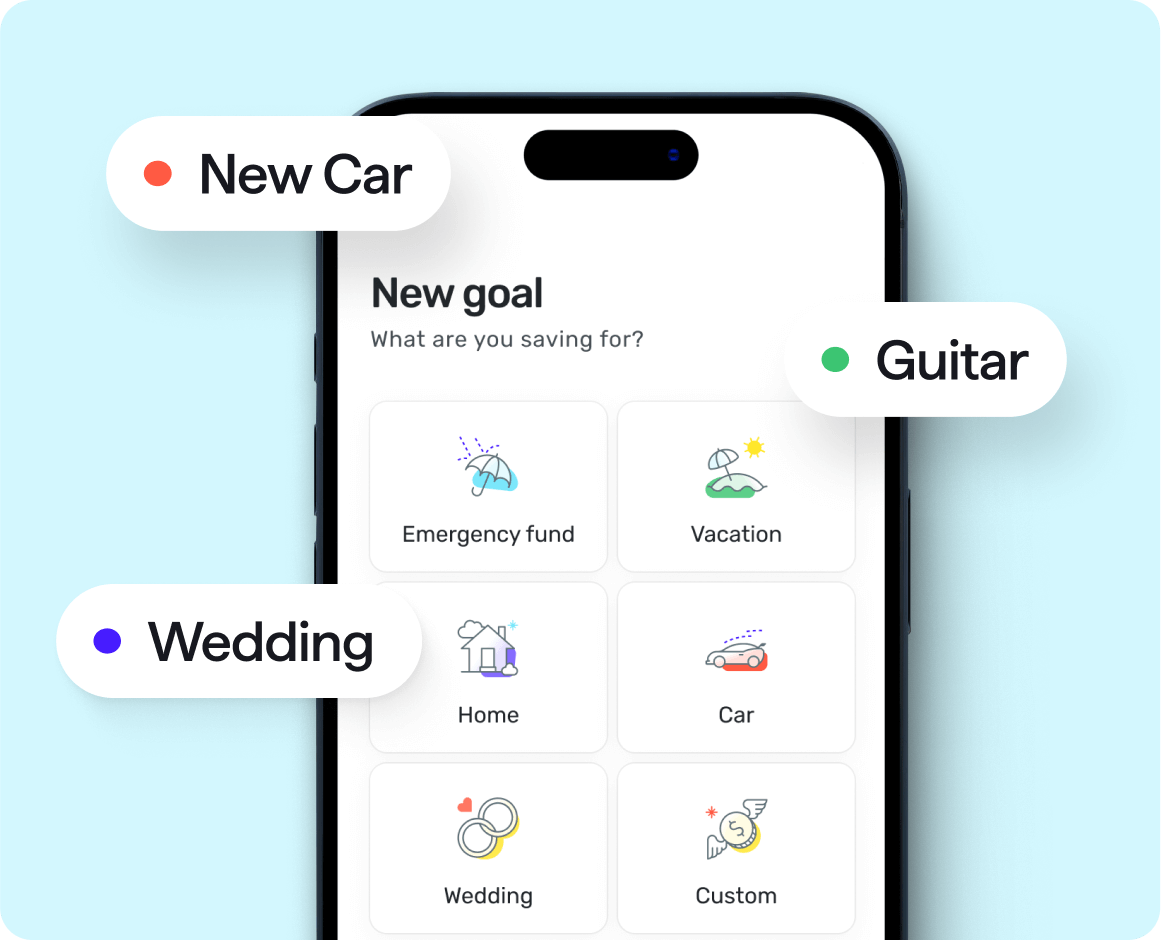

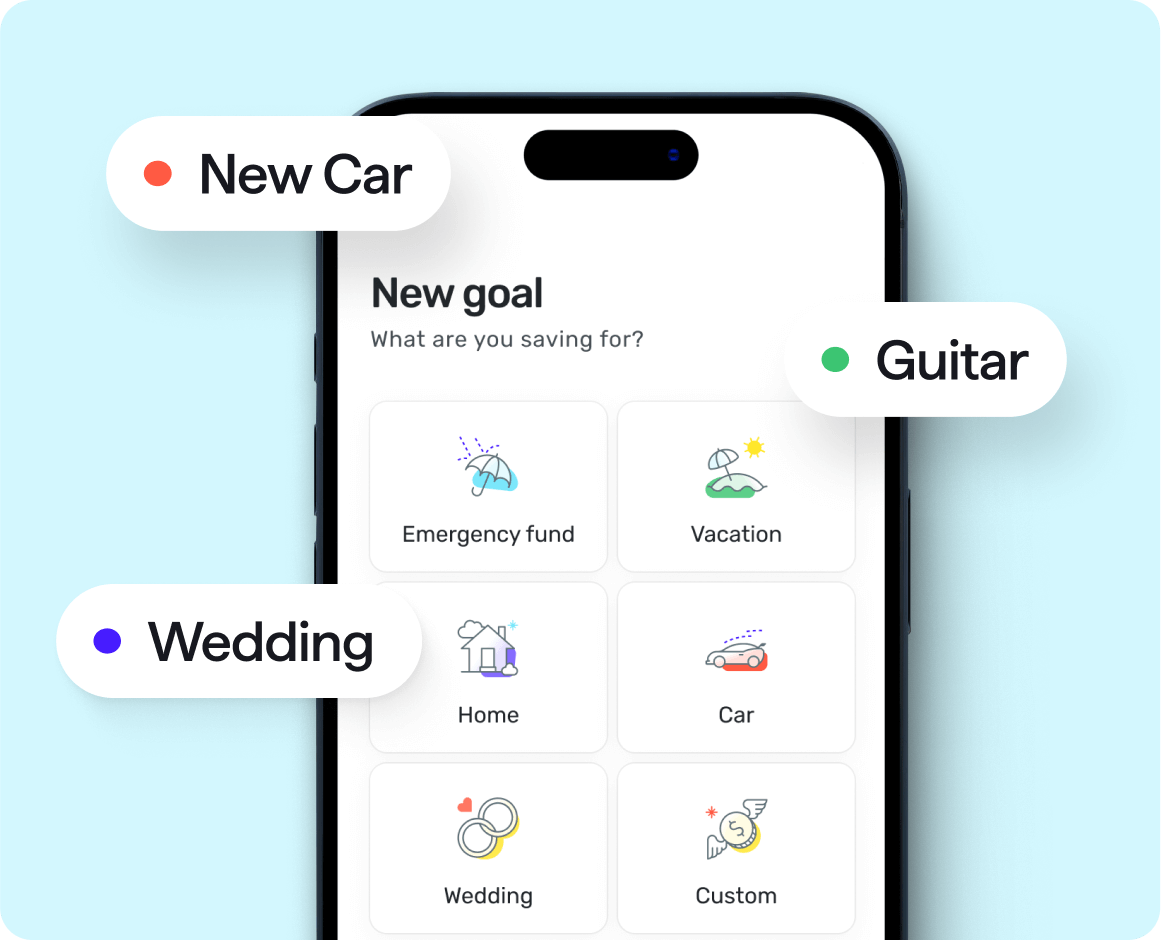

Create all the goals you want

There’s no limit to the Savings Goals you can create and track. Add as many as you like, for as much as you like. Car, renovation, guitar... save for literally anything.

Quicken Simplifi

Create unlimited Savings Goals, of any size, so you can save for anything

Build them into your budget so your savings are always covered

Savings Goals work with any banking account, even checking

How many Savings Goals can I create in Quicken Simplifi?

There’s no cap on the number of Savings Goals you can create and track in Quicken Simplifi, whether you're saving for the short term, the long term, or both. Each goal can have its own name, target amount, target date, and monthly contribution amount.

Do I need separate savings accounts for each goal?

No, Quicken Simplifi’s Savings Goals work whether or not you have a separate savings account. Just choose the account you want to track your savings in, and the app will handle the math and tracking, showing you how much you've saved toward your goals regardless of where the money physically sits.

How does withdrawing from Savings Goals work?

Quicken Simplifi offers three flexible options: spend toward the goal itself (like buying plane tickets while still saving for your vacation), withdraw from your savings for unexpected needs, or move money between your goals when priorities shift. The app tracks what you've saved, spent, and still need for each goal, preserving your progress while giving you complete flexibility to adapt as life happens.

Can I include my Savings Goals in my monthly Spending Plan?

Yes, when you set a monthly contribution amount for any goal, you can also choose to include it in your Spending Plan. If you decide to include it, the app will set that money aside each month just like it would for a monthly bill, helping you make sure you don’t spend it on other things by accident.

How does progress tracking work?

Each Savings Goal displays a visual progress bar showing how much you’ve saved, how much you’ve spent or borrowed from your goal, and how much you have left to reach it. You can easily see how close you are to your goal, with exact dollar amounts clearly displayed for how much you’ve saved and how much you have left to go.

Can I set different contribution schedules for different goals?

Absolutely. Each goal can have its own contribution schedule. For example, you could save $200 monthly for your emergency fund, $100 for a vacation, and irregular lump sum contributions for your home renovation project whenever you receive bonuses or tax refunds. The flexibility is entirely yours.

What happens if I need to pause or adjust a goal?

You can modify any aspect of your goals at any time. If you need to pause your contributions during tight months or extend your target dates, Quicken Simplifi will just recalculate your timeline based on your adjustments. There's no penalty for adapting your goals to match your circumstances.

How specific can I get with my goals?

Quicken Simplifi’s Savings Goals give you complete freedom to save for anything at all. Create goals like 🎓 Sarah's College Fund, ✈ 2025 Italy Trip, Kitchen Remodel, Holiday Gifts, or 👾 New Gaming PC. You can name your goals however you want to, and you can even use emojis to make their names stand out.

Does Simplifi suggest savings amounts or timelines?

Yes. If you enter a target date and amount, Quicken Simplifi will show you what you need to save each month. If you enter a monthly amount you want to save, the app will show you when you’ll reach your goal. Change either one, or both, to see your options and choose the plan that works best for your budget.

Can I share my Savings Goals with my partner or financial advisor?

Yes, Simplifi's secure sharing lets you grant access to trusted individuals like a partner, accountant, or financial advisor. There’s no additional fee for you or for them. Anyone you share your account with will have their own login and password, and you can revoke their access at any time.

What happens if I don’t hit my goal?

If you don’t reach your goal by the target date, don’t worry. Simplifi will keep tracking your progress and let you adjust your timeline as needed. Savings Goals are flexible, and you can always modify your plan to better suit your circumstances. The app also lets you build your Savings Goals into your budget to make sure they’re covered.