Overview

There are two situations that can lead to changing a Traditional IRA to a Roth IRA in Quicken. Your approach to changing the IRA in Quicken will depend on which situation applies to your account.

Situation 1

You converted your traditional IRA to a Roth IRA and need to track the change in Quicken:

If you have converted your actual IRA account to a Roth IRA account, and now need to update Quicken to properly track this change, follow these steps. Follow this method to preserve the total return and/or capital gains basis at any point in time so performance can be monitored. This is regardless of the taxability of accounts.

This scenario is for Roth conversions in which you maintain your investment in the same security. If you are not maintaining the same securities, it is best to close your old IRA account in Quicken and start a new account based on your new Roth IRA.

The procedure below maintains prior dividends with the old IRA account and starts off the new Roth security with a single lot and single entry.

Before you start

- Be sure to record the security info for your IRA before you remove it.

- If you are performing a partial security conversion, use the details of your first lot for the cost basis, average cost, and percent gain.

- For the two transactions, put "ROTH Conversion" in the memo field. This will help you track information related to this conversion.

Instructions

First, create a new Roth IRA Account.

- Select + (plus sign) on the sidebar to add your account.

- Select Offline Account.

- Select IRA.

- Choose Complete Investing and select Next

- Enter your IRA name and select Next.

- Fill out the account information. For the statement Ending Date, use the Roth Conversion date.

- Enter any relevant Cash or Money Market amounts and select Next.

- On the What securities are in this account screen, select Next. You will add securities later.

- Select Done.

- On the Add Account screen, select Roth IRA and select Next.

- Answer any remaining account questions, then select Finish.

Second, remove the shares from your traditional IRA account.

- Select the account

- Select Enter Transactions.

- In the Enter Transactions field, select Remove - Shares Removed.

- Enter the Security name and Number of shares.

- For the Transaction Date, enter the date of your Roth conversion.

- For the Memo, enter Roth Conversion.

- If you have more securities to remove, select Enter/New and repeat the process for each security, otherwise select Enter/Done.

Third, add the shares removed from your traditional IRA to your new Roth IRA account.

- Select the account.

- Select Enter Transactions.

- In the Enter Transactions field, select Add - Shares Added.

- Enter the Security name and Number of shares.

- For the Memo, enter Roth Conversion.

- For the Transaction Date and Date Acquired, enter the date of your Roth conversion.

- For the Price Paid, use the average price per share.

- For the Total Cost, use the investment amount of the shares removed.

- If you have more securities to add, select Enter/New and repeat the process for each security, otherwise select Enter/Done.

Notes

- There is no current method to view the taxable income from the conversion in a report.

- You can see the approximate Roth conversion amount by then using Group by: Accounts in the Portfolio View. Look at the Roth account market value for the converted security lot on the "as of" date of the conversion.

- You can also run an investment using the "RothConversion" memo to see each security converted. You cannot see their full value at the time of conversion for the tax year. This report can remind you of each conversion, so you can make sure you have the correct tax forms at tax time.

Situation 2

Your Roth IRA was entered as a traditional IRA in Quicken:

If your Roth IRA has always been a Roth IRA, but you tracked it in Quicken as a traditional IRA, use this method to change your account. This scenario usually happens by mistake or because the IRA was added before Quicken had specific tracking for Roth IRAs. In either case, follow these steps. Do not use this method if you converted a traditional IRA to a Roth IRA.

Instructions

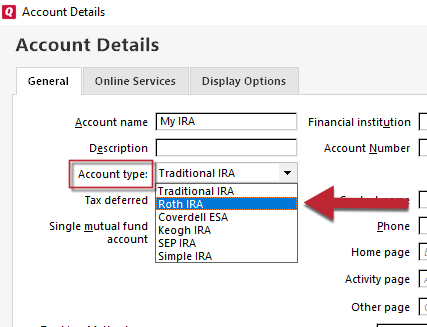

- Edit your traditional IRA account. You can do this by right-clicking on your IRA account and selecting Edit/Delete Account.

- On the Account Details screen, verify you are on the General tab, then click the dropdown list button next to Account type.

- Select Roth IRA.

- Click OK.

Your account type is now changed.