Because the U.S. tax code changes constantly, the Quicken Tax Planner supports two years of tax calculations: the current year and the year prior.

For example, the Subscription Release of Quicken is currently in 2023, so its Tax Planner supports calculations for tax years 2023 and 2022. If you use that version's Tax Planner in 2023, Quicken displays your current (2023) data, but it will continue to use the tax calculations based on the 2022 IRS tax tables.

Keep in mind that Quicken's Tax Planner is not intended as a tax-calculation tool; instead, the purpose of the Planner is to give you a "snapshot" of your tax situation throughout the year.

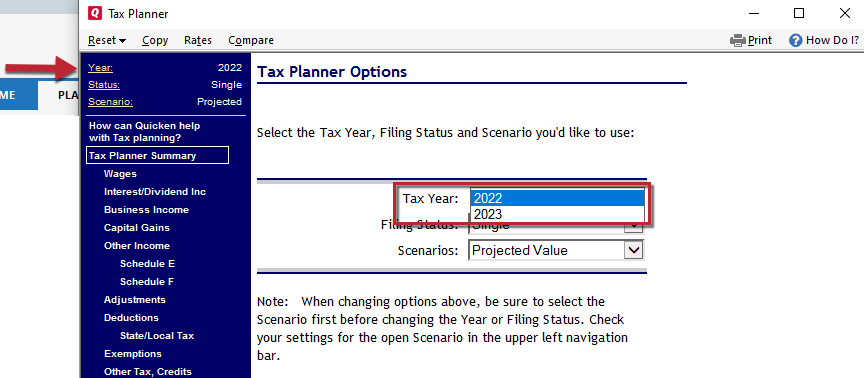

Using the previous example, if you wanted to view your 2022 data in Quicken instead of 2023, click on the link for "year" in the top left and change it to 2022.