Overview

The first time you create an invoices/receivables account, Quicken creates an account called *Sales Tax* to track the tax you charge your customers. If you handle more than one tax rate, you need to create a separate liability account for each rate and use the correct account with each invoice.

This feature requires Quicken Home & Business.

To create a new sales tax account

- Open the invoice/receivables account that you want to use.

- In the invoices/receivables register, select the invoice for which you want to track tax charges, and then double-click the word --Form-- in the Category field.

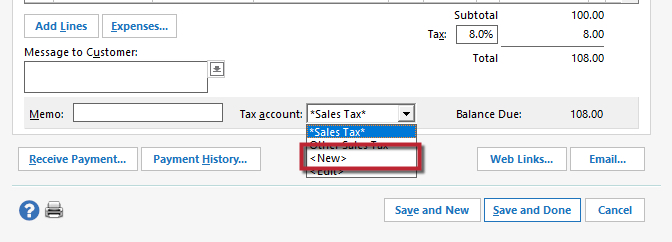

- At the bottom of the invoice form, from the Tax Account list, select New.

- In the Create Tax Account dialog, enter an account name, description, and tax rate.

- Use a name that makes sense to you, like Tax-San Mateo (for the tax rate of a particular county).

- Click OK.

To change the sales tax account on an invoice

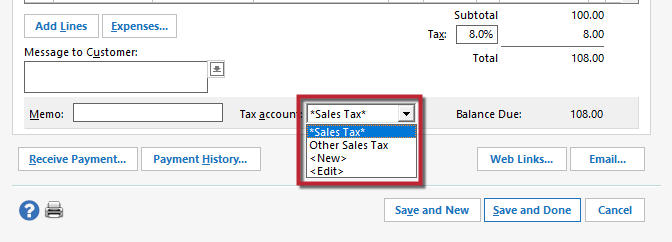

If you create additional sales tax accounts, use this option to select the default account for a particular invoice.

- Open the account for which you want to change the default sales tax account.

- In the invoices/receivables register, select the invoice for which you want to track tax charges, and then double-click the word --Form-- in the Category field.

- At the bottom of the invoice form, in the Tax Account field, select an existing tax account to be the default or create a new one.

- Click Save and Done.

To edit the tax rate in a sales tax account

- Open an invoice/receivables account.

- In the invoices/receivables register, select an invoice and double-click the word --Form-- in the Category field.

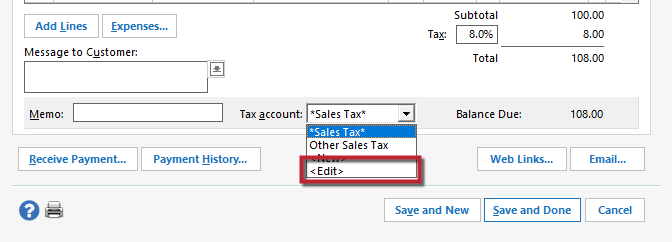

- At the bottom of the invoice form, from the Tax Account list, select Edit.

- In the Create Tax Account dialog, enter the new tax rate.

- Click OK.

Article ID: HOW23879