What Happens to Your 401(k) When You Quit?

When you quit your job, what should you do with your 401(k)? CFA/CPA Charles Renwick walks through it step by step and explains your options.

How to Pay Off Debt While Still Saving: 6 Steps to Success

Pay off debt and grow savings side-by-side. Learn 6 actionable steps to clarify your finances, build a cushion, automate everything, and track it easily.

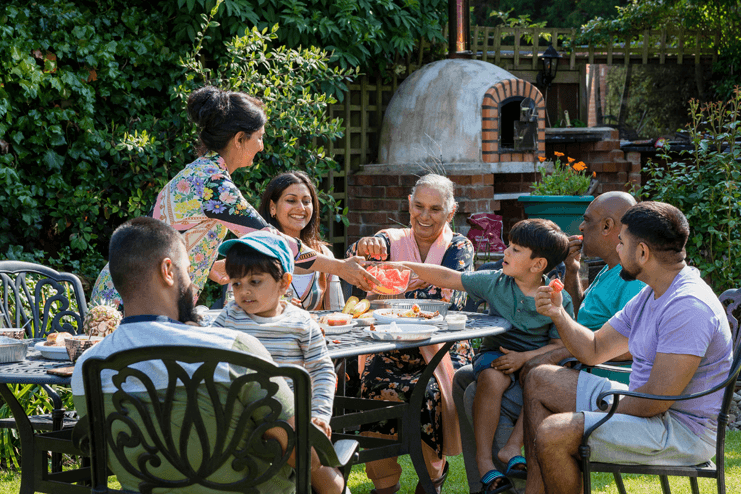

How to Budget for a Big Family: Don’t Miss These 8 Life Hacks

When every cost is a moving target, a rigid budget breaks fast. Learn how to build a flexible one so you can stay in control, with a lot less stress.

How to Split Finances as a Couple

Spenders vs savers. Conservatives vs. risk-takers. When it comes to money, few couples are soulmates. Create a financial plan that will satisfy you both.

10 Questions to Ask Before Writing Your Will

Only a properly written will can ensure that the assets in your estate go where you want them to, from cash gifts to complex trusts.

What Is a Pension: Your Quick Start Guide

Seen more often in government jobs than in the private sector, pensions differ in a few key areas from other retirement options. Learn more here.

8 Tips to Stay Productive at Work

Everyone’s more productive some days than others, but if you’re in a slump, devise a strategy for staying effective and efficient. These 8 tips can help.

The Pros and Cons of Pensions vs. Annuities

Many companies offer employees a choice between monthly annuity payments or one-time lump-sum retirement accounts from which they can draw pension payments as necessary. These two retirement options are very different and your choice can impact your future financial security.

How to Set Up Savings Goals

Using Savings Goals Quicken’s Savings Goals feature helps you save money by “hiding” funds in an account. You set up a savings goal and make contributions to it using the Savings Goals window. Although the money never leaves the source bank account, it is deducted in the account register, thus reducing the account balance in Quicken. If you can’t see the money in your account, you’re less likely to spend it.

How to Budget Your Money With Elizabeth Warren's 50-20-30 Rule

What’s the best way to slice the money pie? It’s a question many people struggle with, and there are lots of options are out there for how to make the cut. One formula that’s on the upswing is the 50-20-30 rule, one of the more workable plans for managing your money.