Top 10 Personal Finance Tips for the Long Term

Use these practical tips to help you take control of your money and build a secure financial future.

Budgeting for Beginners

Think of budgeting as a conversation with your money — you tell it where to go instead of wondering where it went.

How to Split Finances as a Couple

Spenders vs savers. Conservatives vs. risk-takers. When it comes to money, few couples are soulmates. Create a financial plan that will satisfy you both.

10 Questions to Ask Before Writing Your Will

Only a properly written will can ensure that the assets in your estate go where you want them to, from cash gifts to complex trusts.

How to Increase Your Credit Score in 6 Months

Credit scoring is a complex science that is something of a secret to the general public. While there are variations in the scores used by different creditors, the industry-standard score is issued by FICO. Although FICO won’t divulge the exact method behind its calculations, it does publish the broad categories used for scoring, along with the percentage weight assigned to each component. You won’t be able to predict on your own the exact number of points you can increase your score over a six-month period. However, you can move your score in the right direction by improving your credit behavior across the FICO scoring categories.

How Much Should You Spend on Rent When Budgeting?

Think you’re paying too much for rent? Here’s how to find out. This easy rule can tell you how much you should spend on rent when budgeting.

How to Calculate Your Net Worth

Need to know how to calculate your net worth? We’ll walk you step by step through everything you should include.

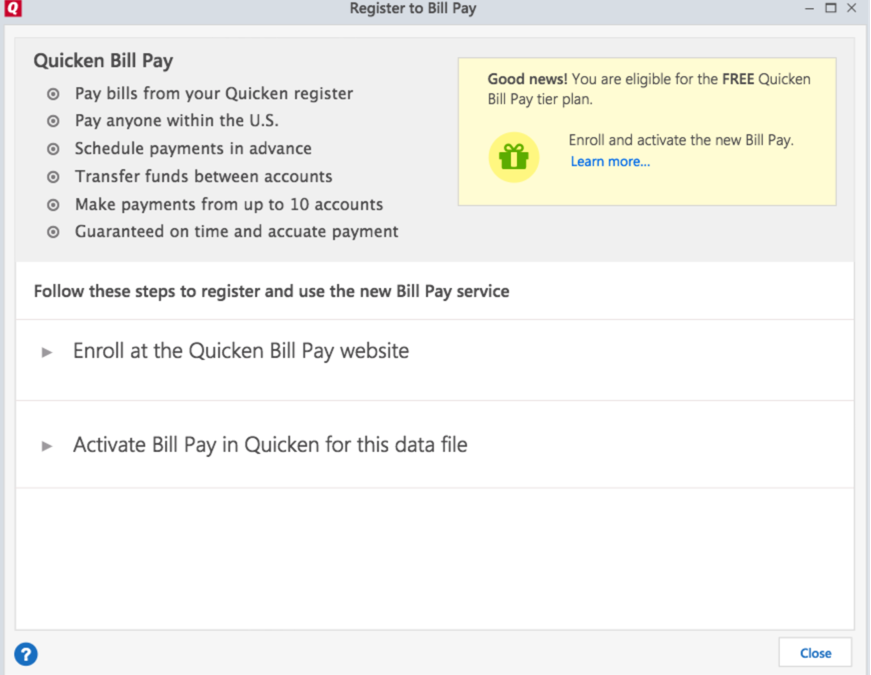

Quicken for Windows – What's New Guide

Here is a summary of the most important new features and enhancements we’ve added to Quicken this year. We really appreciate your business and work hard every day to make Quicken the best personal finance solution for you. Enjoy!

Creating a 5-Year Plan For Your Finances

The Cheshire Cat famously told Alice that if she didn’t care where she ended up, it didn’t matter which way she headed. Think about this when you contemplate making a five-year financial plan. It’s not at the top of on anyone’s fun list, but the chances of achieving your goals increase when you figure out where you want to go and lay out a road map to get there. Here are some tips to get you started.

Rules for Withdrawing from Education Savings Accounts

If your child does it right, she won’t have to pay any tax at all on money she withdraws from the Coverdell Education Savings Account (ESA) you set up for her – but she’ll be hit with regular income tax and hefty penalties if she doesn’t follow the guidelines. Here’s what you need to know.