How to Save for Holiday Spending

Along with the joy of the holiday season come increases in spending. According to Danny Payne, a certified financial planner practicing in southern California, “Gifts or holiday spending is quite possibly the most overlooked expense that can derail a budget.” Therefore, nailing this budget item…

Financial Planning Tips All Travelers Should Consider

When you travel, you don’t want to be distracted by money problems. You definitely don’t want to miss a great event or experience because you didn’t plan your finances well. Nora Dunn, a financial planner turned full-time world traveler, knows firsthand that planning travel costs…

Budgeting 101: Saving to Buy Your First House

Buying a home is the largest purchase many people will make during their lifetime, so it’s important to have a clear idea of how you are going to pay for the home. Budgeting for your first home means saving enough for the down payment and other purchase costs, but also budgeting for life after you make the big move.

Budgeting Tips for Your Honeymoon

More than a million newly married couples take a honeymoon each year, according to the Real Size Bride website’s 2016 report. Paying for a honeymoon right after a wedding can put a strain on anyone’s finances, but budgeting too tightly can spoil the magic. If you plan and budget carefully, it’s easier to afford a honeymoon you’ll remember without coming home to a pile of bills you can’t forget.

How to Budget for Your First Child

Even if you’re careful with money, having a child isn’t cheap. Raising your first child from birth to age 17 can cost well over $200,000 total, according to Fidelity Investments. “The baby is going to cost a lot more than you ever imagine,” says certified public accountant Cheryl Smith. “It’s going to take more money than you think, but you’re happily going to spend that money.” Making room in the budget for these new expenses can help ease the transition to parenthood.

How to Save for Short-Term Financial Goals

Determine your financial objectives Saving is always easier if you have a plan. When starting your short-term savings program, try to think of real-life expenses that you’d like to have covered. Vacations are a great example. Generally, you’ll know how much time off you have…

Taking Financial Inventory: Examining Your Spending Habits

Understanding how and where you spend your money is a big step toward hitting your financial goals. Even if you do not fall victim to the problem of having “month left at the end of the money,” you may not be mindfully spending or saving…

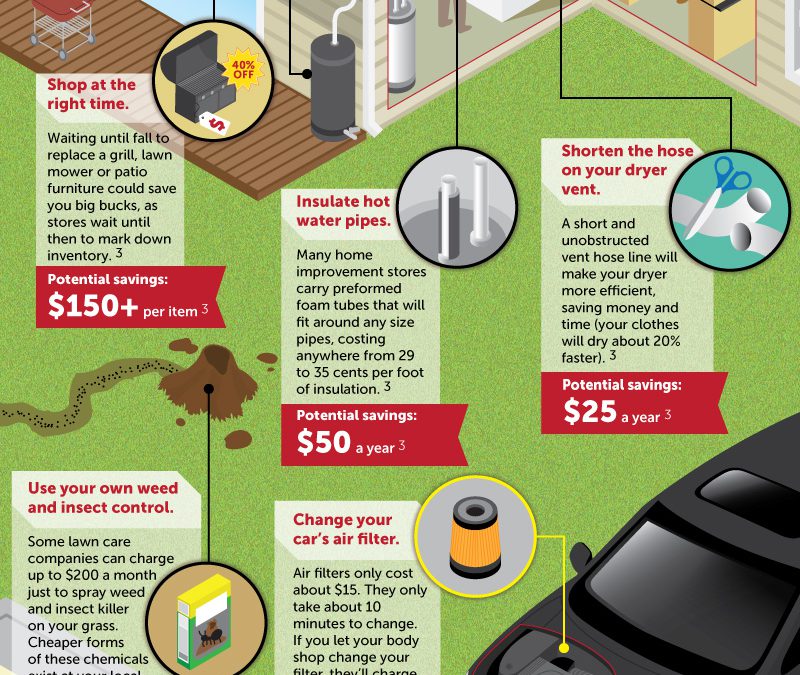

DIY Tasks That Save (And Some That Don't) [Infographic]

With a lot of Americans tightening their belts and spending less on home and car repairs, do-it-yourself tasks are rising in popularity. There are a lot that can save you money but there are a few that can only waste your time.

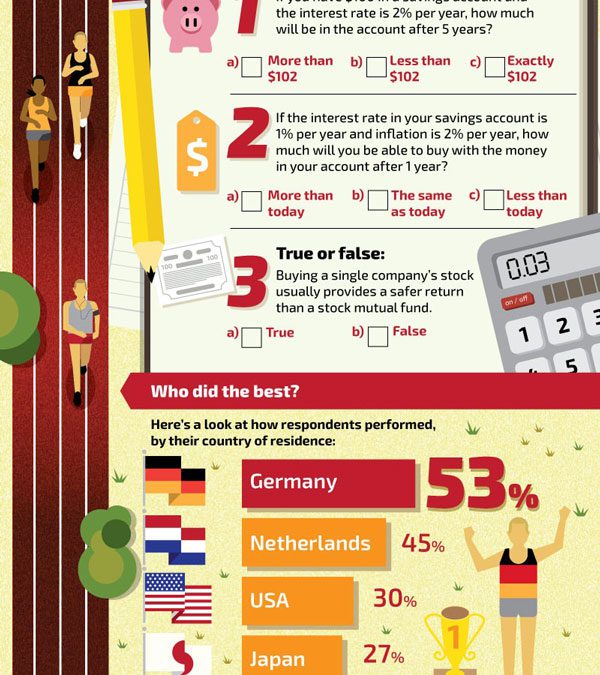

Financial Fitness: Staying on Track [Infographic]

INFOGRAPHIC: There are many reasons why people have trouble sticking to a budget. They give in too easily to impulse, they’re consumed by debt, or sometimes they don’t have a steady income.

Should You Withdraw Funds from Your 401k to Buy a House?

Access to Funds One circumstance in which a 401(k) loan might benefit you, according to Joseph A. Cannova, a Certified Financial Planner and Certified Public Accountant practicing in Toms River, New Jersey, is if you have bad credit. With a 401(k) loan, there’s no credit…