8 Best Hacks for Your Simplifi Spending Plan

These 8 Spending Plan hacks take advantage of Simplifi’s extreme flexibility to help you master your cash flow and take your customized Spending Plan to a whole new level.

How to Create a Simple Personal Budget That Works (With Templates)

Need a simple personal budget? Stay on top of your spending with these 4 personal budget templates and walkthroughs that make it easy to get started.

How to Budget and Save Money with Savings Goals

Simplifi’s savings goals let you spend toward your goals while still giving you credit for the money you saved. Finally, you really can have your cake and eat it too.

Myth or Fact: 7 Rumors About Simplifi by Quicken

How well do you know the Simplifi by Quicken personal finance management app? Can you guess which of these 7 social media rumors is true?

5 Easy Ways to Get Your Financial Resolutions Back on Track

Did you know 62% of us give up on our New Year’s resolutions by February? Make your financial resolutions a permanent habit with these 5 simple tips.

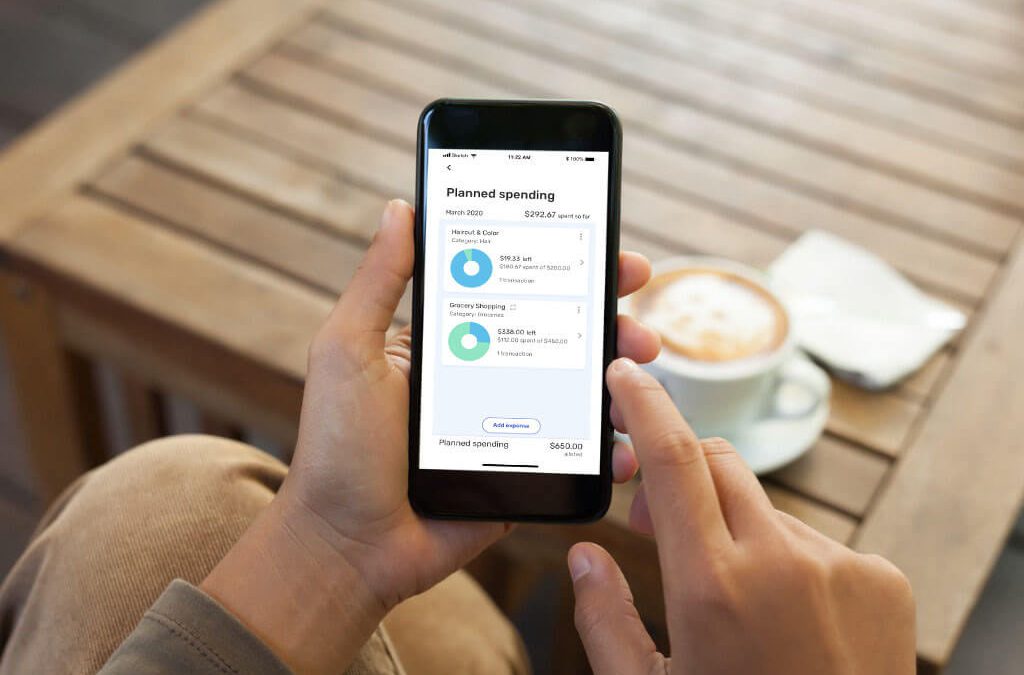

Simplifi by Quicken: The Personal Finance App For Everyone

Personal finance apps can’t be one-size-fits-all because every financial situation is unique. That’s why Simplifi by Quicken is designed to be flexible and fully customizable, so you can manage your finances the way you want to.

5 Ways Simplifi by Quicken Lets You Track Your Money Your Way

Tired of personal finance apps that try to box you in? Here are 5 great ways to make the most of Simplifi’s extreme customization capabilities.

7 Ways to Better Manage Your Spending and Improve Your Financial Well-being with Simplifi

Take control of your spending and improve your financial well-being. Use these 7 easy tips to know where you stand so you can make good choices.

Simplifi’s New Shopping Refund Tracker Helps You Stay on Top of Your Refunds

Quicken adds a shopping refund tracker feature to Simplifi to track for money from returns

Award-Winning Personal Finance App Simplifi By Quicken Raises the Bar Again

Named Best Budgeting App by The New York Times Wirecutter, Simplifi announces a new set of features and insights to help you keep your finances on track.