Financial Dos and Don'ts of Remodeling

Most people buy a home that’s already built, not one that’s custom-made for them, so it’s normal for home and condo owners to want to remodel things to their liking. Remodeling projects often aren’t cheap, but you can keep your expenses down by planning ahead. If you’re thinking about sprucing things up a bit, check out the following dos and don’ts before you write a big check.

How Once-Weekly Meal Prep Saves on Groceries

The average American spends $1,200 a year on fast food, as reported by the Daily Mail. That may not sound like a big chunk of your annual budget, but it’s $4,800 for a family of four – more than enough to fund a vacation instead of wolfing down food that’s not even particularly good for you. Cooking meals at home is far cheaper once you get organized and make the time.

Enhance Your Career Skills for Free

Perhaps you’re re-entering the workforce after taking time off to raise a family, or you’ve managed to nab a job at a company you’ve been eyeing for years. Maybe you’re just looking for a career change. Either way, a number of free online programs and courses can help you hone your business skills and increase your self-confidence. That promotion may be just around the corner.

Should You Ever Cancel a Credit Card?

You may want to simplify your financial life by closing some of your accounts if you’ve built up a collection of credit cards. Keeping a credit card open, even if you don’t use it, will usually positively impact your credit score. However, in some circumstances, you may have a good reason to cancel a card to help your or your financial peace of mind.

Common Ways Consumers Waste Money

Date: November 16, 2016

How Credit Card Balance Transfers Work

If you’re tired of paying extremely high interest rates on your credit card balance, a balance transfer might be for you. You might even qualify for a special low introductory rate if you have a good credit score. Even if your credit isn’t perfect, you might still be able to get a lower than the rate charged by your current card.

Are You Saving Too Much?

Date: November 15, 2016

Easy Ways to Start Investing with Little Money

The sooner you start investing, the sooner your money can begin working for you. With the proliferation of employer-sponsored plans and discount brokerages, you don’t need tens of thousands of dollars to get in the investing game. A variety of opportunities exist if you’re able to set aside even $50 a month.

Why Love May Hinge on Your Credit Score

Credit scores were originally developed to help lenders gauge how likely a person is to pay back a loan. In a first-of-its-kind study by the Federal Reserve Board, researchers found evidence that your has predictive value when it comes to relationships forming and potentially separating as well.

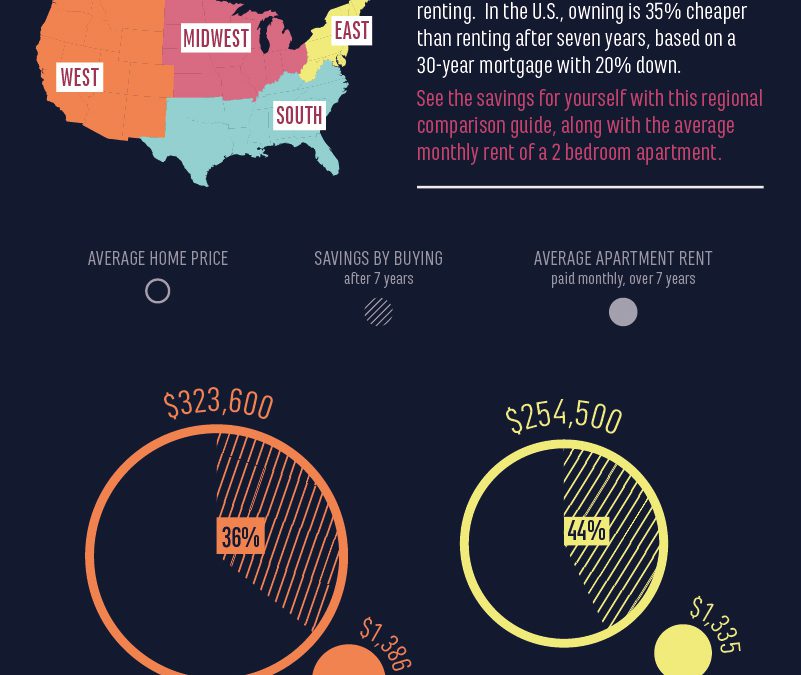

Renting vs Buying: A Regional Guide [Infographic]

Buying a house is almost always cheaper than renting. In the U.S., owning is 35% cheaper than renting after seven years, based on a 30-year mortgage with 20% down.