Plan Your Journey with These 21 Road Trip Essentials

by Quicken

July 11, 2025

The great American road trip is THE way to vacation for many — get ready for your next great adventure...

Personal Finance

27 Ways to Save Money & Stretch Your Income

by Quicken

July 9, 2025

Stretch your paycheck with 27 practical hacks — from meal planning and side hustles to smarter insurance and auto-pay savings...

The Average 401(k) Balance by Age — And 18 Questions to Ask

by Quicken

July 8, 2025

Get a 360° view of your retirement: 9 key questions to gauge your nest egg and 9 smart moves to...

Raising Financially Independent Children

by Quicken

July 7, 2025

All parents want to give their kids the things they missed out on growing up. We surveyed over 2,000 adults...

8 Best Hacks for Your Simplifi Spending Plan

by Quicken

July 2, 2025

These 8 Spending Plan hacks take advantage of Simplifi’s extreme flexibility to help you master your cash flow and take...

Three Game-Changing Updates for Quicken Simplifi

by Quicken

June 30, 2025

Run scenarios to plan your retirement, automate your tax reports, and sync credit card bills automatically. 3 new features to...

Your Family Organization Checklist: Top 9 Things to Have Ready to Share

by Quicken

June 27, 2025

Your top 9 list of essential family info to keep organized and ready to share. From medical emergencies to tax...

5 Quick Wins with LifeHub in Under 10 Minutes

by Quicken

June 26, 2025

Discover 5 quick uploads that deliver instant value, transforming how your family shares and accesses important information. Smart Add makes...

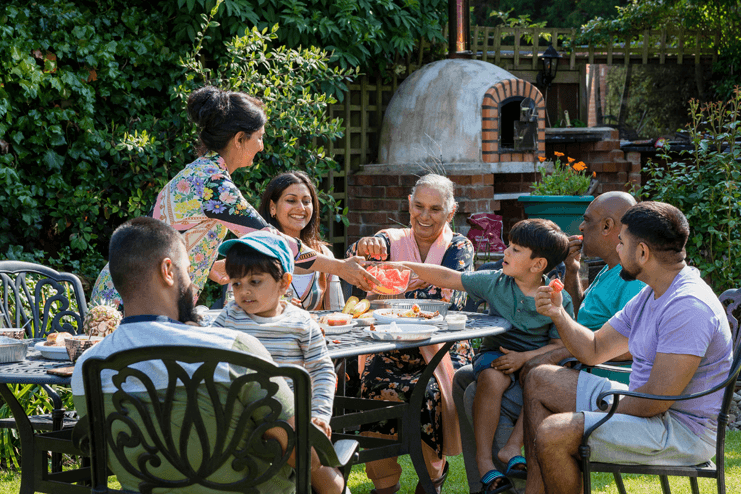

How to Budget for a Big Family: Don’t Miss These 8 Life Hacks

by Quicken

June 25, 2025

When every cost is a moving target, a rigid budget breaks fast. Learn how to build a flexible one so...

Should I Open a Joint Account? Top 8 Money Questions for Couples

by Quicken

June 24, 2025

Answer these 8 common money questions couples face about fair bills, shared goals, emergency funds, and more — and get...

A Year of Updates: What’s New in Quicken Classic for Mac

by Quicken

June 23, 2025

Investment Watchlist, Capital Gain Estimator, Zillow integration, and more. A year of Mac-native updates to your trusted desktop financial software.

A Year of Updates: What’s New in Quicken Classic for Windows

by Quicken

June 23, 2025

Tax loss harvesting, faster One Step Update, searchable preferences, and more. A year of thoughtful improvements to your trusted desktop...

Leave a Legacy, Not a Puzzle: 9 Essential Questions Every Family Should Answer

by Quicken

June 20, 2025

Are you the one who keeps the rest of your family organized? These 9 questions can help you keep your...

Three Game-Changing Updates for Quicken Business & Personal

by Quicken

June 19, 2025

Simplify quarterly taxes, save your custom reports, and attach receipts to invoices automatically. New features, built from your feedback to...

How to Use Quicken Simplifi with Any Kind of Budget

by Quicken

June 11, 2025

No matter if you budget with the 50/30/20 method, practice zero-based budgeting, use the envelope system, or any combination, Quicken...

Want to Retire Early? Start Here.

by Quicken

June 10, 2025

Want to retire early? Build your dreams, retire early, and claim your financial freedom. Take the first step right now...

Travel Like a Pro with These 21 Budget Travel Tips

by Quicken

June 9, 2025

Did you know you can travel the world and see the sights without breaking the bank? Check out these 21...

9 Gen Z Money-Saving Tips, Tricks & Tools You Need to Know

by Quicken

June 4, 2025

Saving money in today’s world doesn’t mean you need to study AI. It’s easier to look at what Gen Z...