Simplifi

-

Budget and track your spending with Spending Plan

-

Project cash flows & generate reports

-

Optimize your investments & retirement

Get forward-looking tools with real-time clarity, while keeping your essential info organized and accessible. Together, they streamline every part of your financial life.

Simplifi

Budget and track your spending with Spending Plan

Project cash flows & generate reports

Optimize your investments & retirement

Simplifi + LifeHub

Budget and track your spending with Spending Plan

Project cash flows & generate reports

Optimize your investments & retirement

Beyond your finances — organize family IDs, medical info, legal docs and more in one secure hub. Learn more

Unparalleled organization

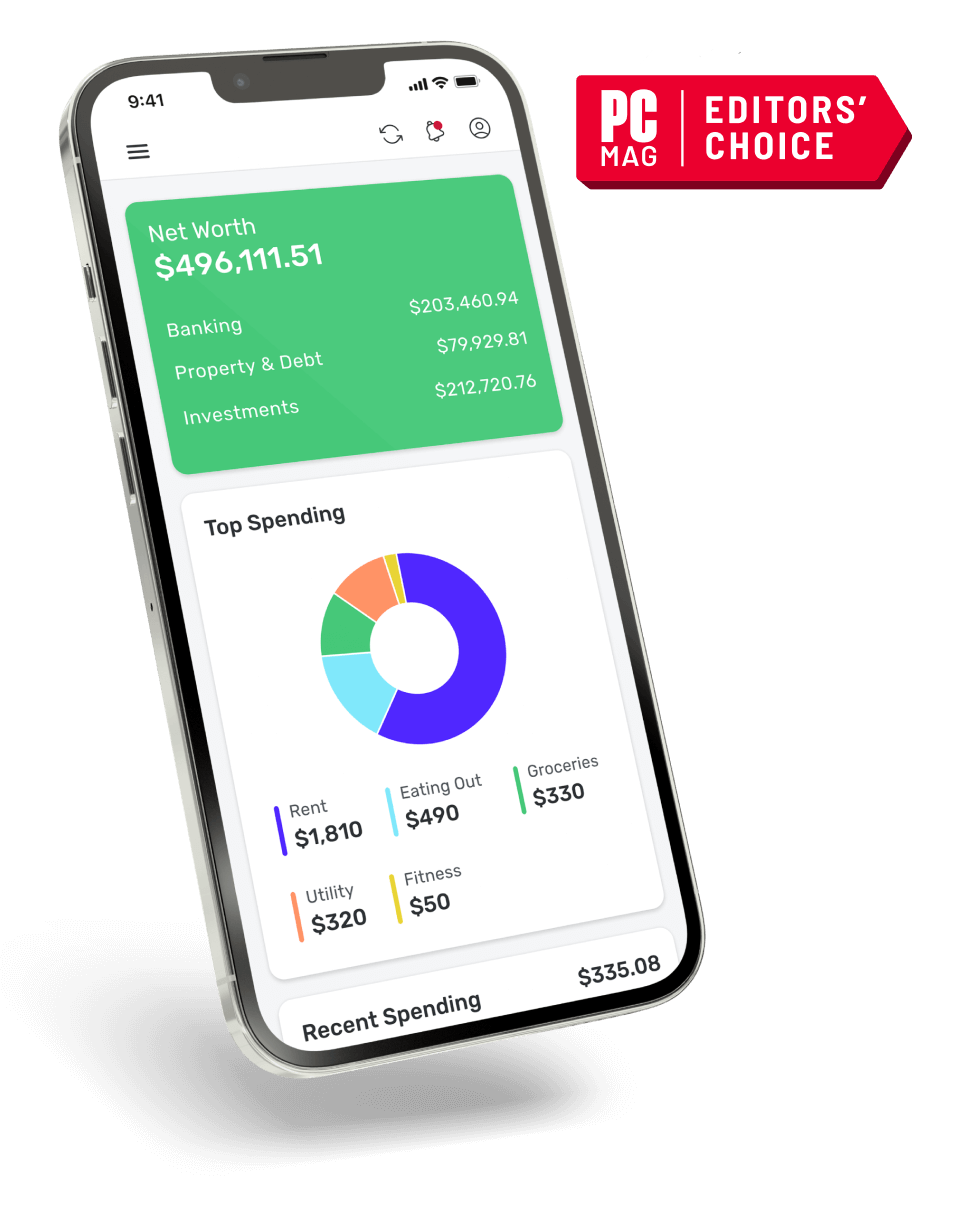

Connect all of your accounts with ease & keep your finances tidy

Less hassle, more clarity

Stay in the know with AI auto-categorization and real-time alerts.

Better insights for better decisions

Plan for today & tomorrow with in-depth, custom reports and analysis

Flexibility to fit your changing life

Easily update your goals, budgets, data, and layout. It all adjusts to you

Visualize your income, bills, subscriptions, & savings, and always know how much you have available after expenses. Treat yourself guilt-free or route it to a rainy day fund — no guesswork required. 💰

By analyzing your income & spending habits against your bills & expenses, Quicken can project future balances. Run “what-if” scenarios, & see what your future looks like, so you can plan smarter and dream bigger. 🔮

Create custom savings goals, commit cash, track progress, & see it through. Whether you’re putting money aside for retirement or saving for a kitchen remodel, Quicken Simplifi helps you get there faster. 💸

View your full portfolio in one place and turn insights into action with tools like cost basis, performance analysis, and real-time quotes. Navigate market changes like a pro and make every move count. 🎯

Create projections based on your savings, expenses, investments, retirement age, expected annual living expenses & much more. Use real insights from your own projections to fine-tune your strategy, make smarter decisions, and stay on course.

With pre-built reports and filters, Quicken Simplifi gives you better insights faster. Get categorized breakdowns of spending, saving, and income, or customize it to your needs. Future You will thank you. 🤝

Connect to over 14k financial institutions

Quicken’s connectivity is second-to-none, helping you get your finances fully and completely integrated into your account for the most accurate picture.

See where your money is going

Keep tabs on where (and how) you’re spending, automatically categorize all your transactions, and easily identify any spending issues. Adjust as necessary and keep your budget on track.

Track your upcoming bills & subscriptions

Late fees? History. With Simplifi, you can stay ahead of all your due dates for things like rent and credit card payments, and view all your subscriptions — no more forgotten ones.

Secure sharing

Credit score

Refund & return tracker

Zillow integration

Dark mode

|

|

Quicken Simplifi

|

Rocket

|

YNAB

|

|---|---|---|---|

|

Budget the way you want to |

Works with any budget style |

Limited, only available on paid |

Zero-based budgeting only |

|

Reports |

Spending, income, savings, and net worth, along with extensive customization |

Spending only, limited customization |

Spending only, limited customization |

|

Investment tools |

Performance over time, cost-basis, real-time quotes |

Limited performance analysis, only available on paid |

|

|

Projected cash flows |

|

|

|

|

Real-time alerts |

|

|

|

|

Watchlist to monitor spending |

|

Only available on paid |

|

|

Credit score tracker |

|

|

|

|

Customizable interface |

|

|

|

|

Free guided onboarding, phone & chat support |

Free guided onboarding, phone & chat support |

Chat & email support only |

Email support only |

|

|

$2.99

/month

Billed annually

|

|

|

Quicken vs Monarch

Quicken outperforms Monarch as the only personal finance app that manages all your money with foresight & proactive guidance.

Quicken vs Rocket Money

Unlike Rocket, Quicken goes beyond bills and subscriptions, giving you a complete personal finance solution to manage all your money.

Quicken vs YNAB

More than zero-based budgeting, Quicken delivers a complete view of your finances, so you can feel confident about your financial future.

Welcome aboard — we’re glad you’re here. Don’t miss a beat with Quicken’s simple data import tool and pick up right where you left things.

Quicken Simplifi

The app with most features at the lowest price

Enjoy a 30-day money-back guarantee

Simple setup will have you up & running in 30 minutes

Guided onboarding

Quicken Business & Personal

Get the all-in-one finance app made for self-employed and small business owners.

Quicken Simplifi is a powerful, easy-to-use tool for all the essentials of your financial journey. Track & categorize your spending. Get an automatic, fully customizable spending plan. Reach your savings goals. Plan for the future with projected cash flows. No matter where you are on your personal finance journey, Quicken Simplifi has you covered.

Quicken Simplifi doesn’t force you to choose a single budgeting system. Instead, it starts with your monthly income, subtracts your bills & subscriptions, and generates a personalized Spending Plan that adjusts automatically as you spend. No matter how you like to budget, the tools in Quicken Simplifi can accommodate any method you like to use — zero-based budgeting, envelope budgeting, 50-30-20, and more.

See how much you have left to spend per day for the rest of the month, calculated automatically

Add any planned spending, from groceries to birthday dinners, to set aside the money you need

Include your savings goals in your plan so you don't spend that money by mistake

Easily ignore any spending that you don't want to count toward your monthly budget

Yep! You can share your Quicken Simplifi account with your partner, financial advisor, or anyone you trust. You can add one other person with our “spaces & sharing” feature.

Trusted for over 40 years

#1 best-selling with 20+ million customers over 4 decades.

Bank-grade security

We protect your data with industry-standard 256-bit encryption.

Your privacy matters

Rest assured, we’ll never sell your personal data.

No surprise charges or ads

No hidden fees or annoying ads. What you see is what you get.

Support

Chat with a dedicated support team via phone, chat or social (actual humans too).

Quicken specialized agent

Need a little help getting going? Get a free 30 min appointment with a Quicken expert.

Learn & Grow

Our blog and interactive tools will help you grow in knowledge and confidence.

Community

Our community of coaches & users often discuss features, feedback, requests & success.