What is the Retirement Planner?

The Retirement Planner lets you model your path to retirement. Project your balances as you change contributions, interest & more.

Peer into the future. Plan the retirement you want with up to 15 key variables. Chart your path, and track your progress to stay on course.

How much do you want to have saved when you retire? Run your options to see how to get there, and when.

Make informed decisions

Considering a job with a lower 401(k) match? Wondering if you can retire early? The Retirement Planner helps you make big decisions with confidence.

Life is full of surprises. Don’t let them derail your retirement. Plan your way through tough scenarios, model any setbacks, and find new ways to stay on track.

Start with the essentials

Add information about your age, savings, and contributions to get an initial sense of your path to retirement.

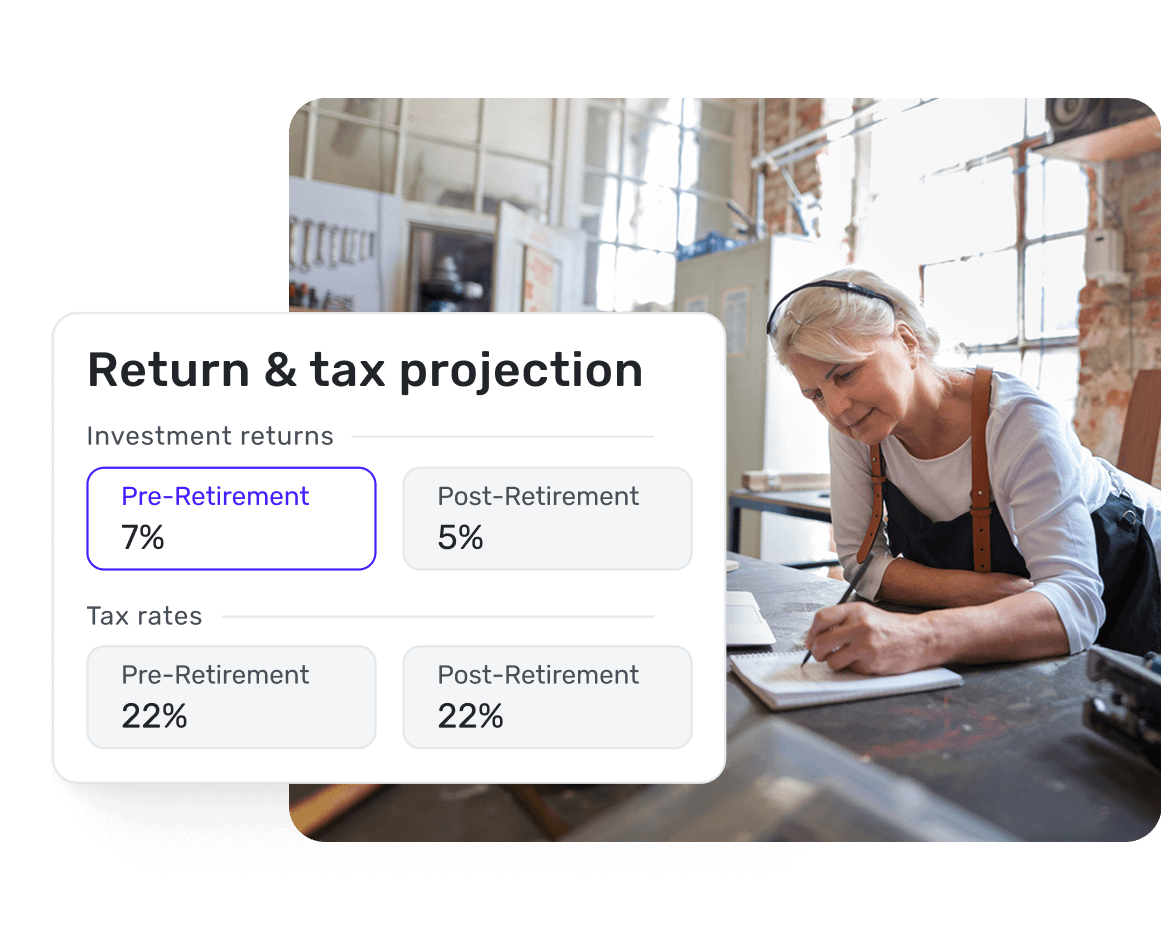

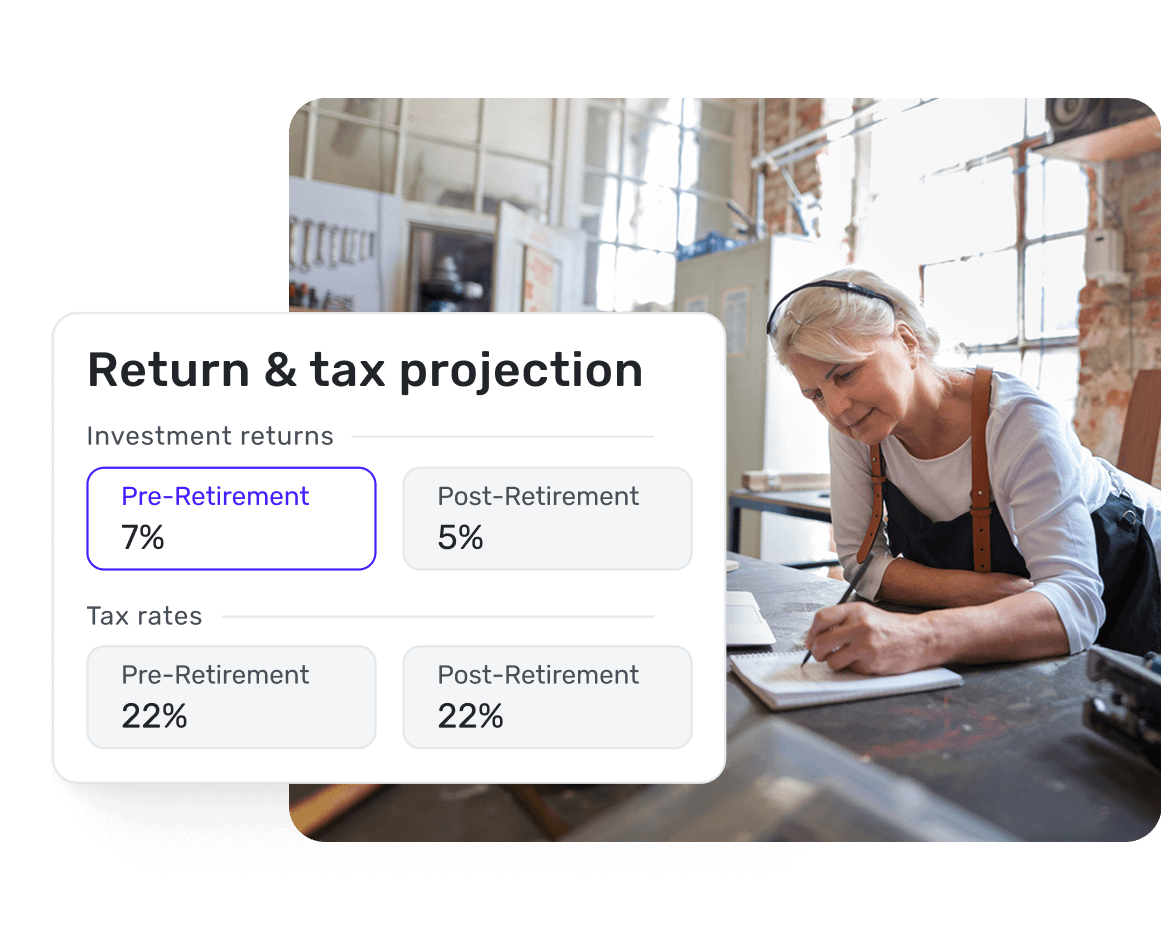

Add tax rates, investment returns, and more

Model tax rates and investment returns both before and after retirement, annual contribution increases, and more for comprehensive projections you can trust.

Adjust anything & everything along the way

Track your progress and run scenarios whenever you like. Adapt your plan to new situations, whether it’s a raise, a tough market, or just changing priorities.

Quicken Simplifi

Plan ahead for your retirement, years or even decades before you get there

Input up to 15 key variables to shape your plan in as much detail as you like

Track your progress, so you can see where you are today and where you’re headed

Quicken Business & Personal

Have a small business or freelance income?

What is the Quicken Simplifi Retirement Planner?

The Quicken Simplifi Retirement Planner is a built-in financial projection tool that helps you forecast your retirement savings trajectory to determine if you’re on track for a financially secure retirement. It uses detailed inputs about your current financial situation, savings rates, and expected returns to generate projections showing how much you’ll save in time for retirement and how long those savings will last based on your planned retirement age and expected expenses.

What specific inputs can I customize in the Retirement Planner?

The Retirement Planner includes two tabs: Basic and Advanced. Users can easily switch back and forth to decide how much information they’d like to add to their projections. The Basic tab allows you to input and adjust 10 key variables that can affect your retirement. The Advanced tab adds 5 more, for a total of 15.

The basic planner includes:

Your current age

Current investments

Annual contributions

Target retirement age

Life expectancy (with linked calculator for estimates)

Annual living expenses in retirement

Annual retirement income (Social Security, pensions)

Investment returns

Pre-retirement tax rate

Post-retirement tax rate

The advanced planner splits current investments into:

Already taxed investment balance (Roth IRAs, brokerage accounts)

Tax-deferred investment balance (traditional IRAs, 401(k)s)

It also splits contributions into:

Annual taxable contributions to after-tax accounts

Annual tax-deferred contributions to pre-tax accounts

Expected annual increase of contributions

It splits investment returns into:

Pre-retirement investment returns

Post-retirement investment returns

And it adds:

Inflation rate (default 3%, fully adjustable)

Can I model different retirement scenarios?

Yes, the Retirement Planner is designed for scenario testing. You can adjust any variable to see how changes impact your projections, whether that's retiring earlier or later, increasing contributions, adjusting expected returns, or changing your planned retirement expenses. Each adjustment updates your projections, letting you compare different strategies.

How does the planner account for inflation?

The retirement planner includes an adjustable inflation rate (defaulting to 3%) that applies to your projected living expenses throughout retirement. This ensures your purchasing power calculations remain realistic over potentially decades of retirement. You can modify this rate based on your own expectations or historical trends.

How are investment returns calculated differently before and after retirement?

The Advanced tab of the planner includes separate rates for pre-retirement and post-retirement returns, reflecting the common strategy of shifting to more conservative investments as you approach and enter retirement. Pre-retirement returns might assume a growth-oriented portfolio, while post-retirement returns typically reflect a more balanced or income-focused allocation. You can adjust both rates in the planner to see how each rate of return affects your plan.

Can I include Social Security and pension income?

Yes, the annual retirement income field lets you input expected Social Security benefits, pension payments, or any other non-investment income you'll receive in retirement. This income offsets your annual living expenses in the calculations, extending how long your savings will last.

How does Simplifi's Retirement Planner differ from standalone retirement calculators?

Unlike basic online calculators, Simplifi's Retirement Planner is part of a comprehensive financial management system. It exists alongside real-time tracking of your actual accounts, spending patterns, and investment performance. This context helps you make more informed assumptions and track whether you're actually hitting the contribution targets you've modeled.

Does the Retirement Planner provide specific investment advice?

No, the Retirement Planner is a projection tool that helps you model different scenarios based on your inputs. It doesn't recommend specific investments, asset allocations, or contribution amounts. Instead, it shows you the mathematical outcomes of the assumptions you provide, empowering you to make informed decisions about your retirement strategy.

Can the planner handle early retirement scenarios?

Yes, you can set any retirement age you choose, including early retirement scenarios. The planner will calculate whether your savings and investment returns can sustain your expected expenses throughout your retirement, accounting for the longer retirement period.

Can I share my retirement projections with my partner or accountant?

Quicken Simplifi includes secure sharing features that let you grant access to a trusted partner, financial advisor, or tax professional. The Retirement Planner projections exist within your broader Simplifi account, which means authorized users can view them alongside your complete financial picture.