Windows

Windows Mac

MacWhat’s happening?

PayPal is transitioning all accounts to a new connection method. If you have PayPal accounts, you will need to take action to maintain your transaction download in Quicken.

- Checking and savings accounts will transition to a new online banking connection with Quicken, called EWC+.

- Other accounts, such as credit cards, will remain on the current EWC connection type, but, will need to be transitioned to a new PayPal EWC financial institution in Quicken.

- If you have accounts other than checking and savings with PayPal, you will need to follow two steps to reauthorize your accounts for download into Quicken.

For Checking and Savings accounts

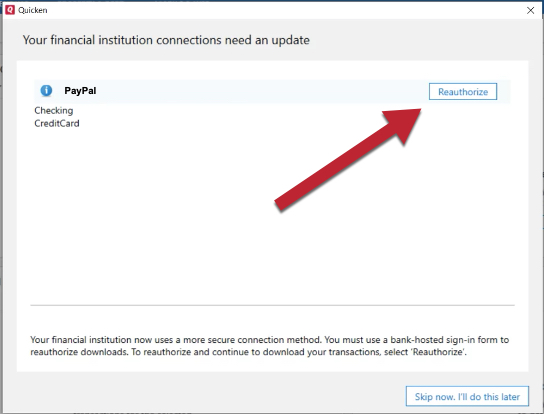

When you update your accounts in Quicken, you will be prompted to change to the new EWC+ connection method.

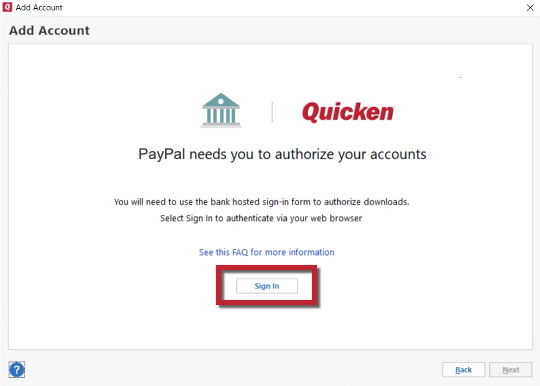

All you need to do is sign in with your PayPal credentials when prompted to establish a connection.

After you sign in, choose to Link your account(s) to your existing accounts in Quicken.

Note: If you want to track any of these accounts in Quicken, even in a different Quicken file, be sure to check all of your PayPal accounts during this process.

For Credit Card and Other account types

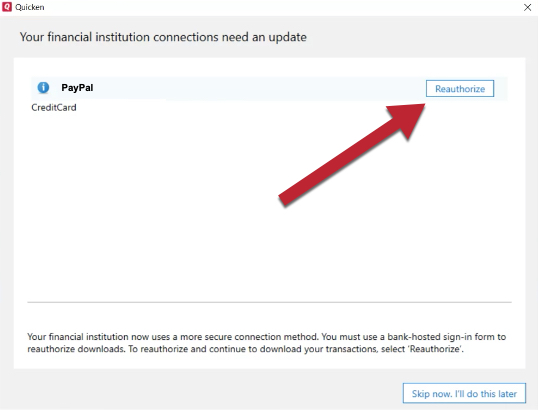

First, you'll be prompted to reauthorize your account(s).

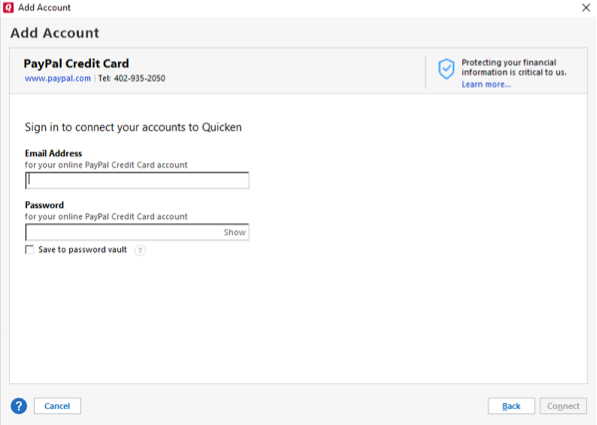

After that, this process is just like adding a regular EWC account to Quicken. When prompted, enter your PayPal username and password.

When the accounts are found, be sure to Link them to your existing Quicken accounts.

If you have a combination of accounts

You will first be prompted to authorize your Checking and Savings account types. During the process, you may see all of your PayPal accounts listed, but when the process completes, you’ll see that only your Checking or Savings accounts have been authorized. Then, just follow the steps above for your Credit card and Other account types to add your remaining accounts.

Troubleshooting

I see all of my accounts listed when I try to connect to EWC+, but not all of them are added:

If you have a combination of account types, you may see accounts during the EWC+ authorization process that aren’t added to your Quicken file. Just follow the instructions above “For Credit Card and Other account types” to add the rest of your PayPal accounts.

If you did authorize all of your accounts during the authorization process, double-check that the missing accounts aren’t under a different username, such as a spouse’s, account.

I can’t add my PayPal accounts in my other Quicken file:

If you didn’t select all of your accounts for authorization during the EWC+ authorization process, PayPal considers these accounts to be unauthorized to add to Quicken. Just follow the steps here to reauthorize all of your accounts.

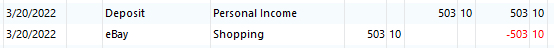

I’m seeing more deposit and expense transactions with EWC+.

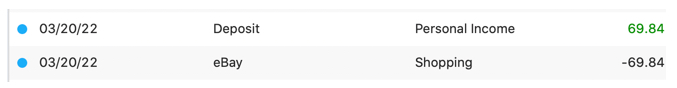

Because EWC+ includes more accurate information, money movement will now display differently in Quicken.

In the example above, a user makes a purchase and money needs to be moved into the account to cover the purchase, there will now be a transfer in (+ amount) and then the purchase will occur (- amount).

I’m missing transactions with EWC+.

You may see differences between when transactions appear on the PayPal website and when they appear in Quicken. This is due to the fact EWC+ now provides more accurate information related to the clearing status of transactions. Transactions do not download into Quicken until they have cleared with PayPal.

There may be up to a 10-day delay before transactions are fully finalized and download into Quicken.

I’m still having problems downloading my transactions after following the steps above.

We can help—please contact Quicken Support.

What’s happening?

PayPal is transitioning all accounts to a new connection method. If you have PayPal accounts, you will need to take action to maintain your transaction download in Quicken.

- Checking and savings accounts will transition to a new online banking connection with Quicken.

- Other accounts, such as credit cards, will remain on the current Quicken Connect connection type, but will need to be transitioned to a new PayPal financial institution in Quicken.

- If you have accounts other than checking and savings with PayPal, you will need to follow two steps to reauthorize your accounts for download into Quicken.

For Checking and Savings accounts

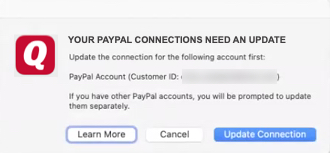

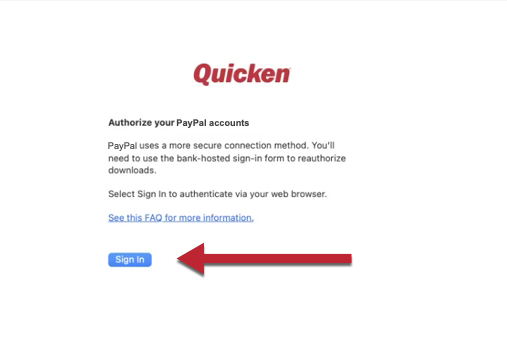

When you update your accounts in Quicken, you will be prompted to change to the new connection method.

All you need to do is sign in with your PayPal credentials when prompted to establish a connection.

After you sign in, choose to Link your account(s) to your existing accounts in Quicken.

Note: If you want to track any of these accounts in Quicken, even in a different Quicken file, be sure to check all of your PayPal accounts during this process.

For Credit Card and Other account types

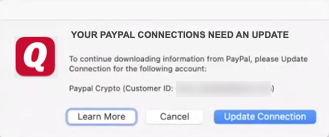

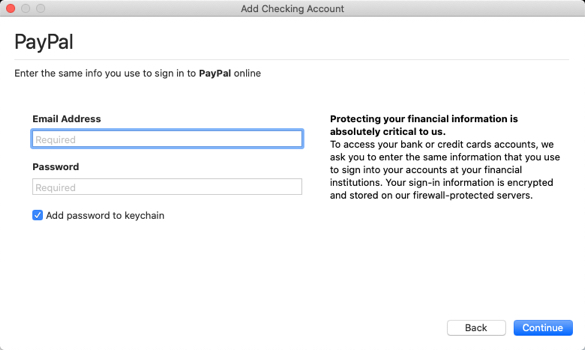

First, you'll be prompted to reauthorize your account(s).

After that, this process is just like adding a regular Quicken Connect account to Quicken. When prompted, enter your PayPal username and password.

When the accounts are found, be sure to Link them to your existing Quicken accounts.

If you have a combination of accounts

You will first be prompted to authorize your Checking and Savings account types. During the process, you may see all of your PayPal accounts listed, but when the process completes, you’ll see that only your Checking or Savings accounts have been authorized. Then, just follow the steps above for your Credit card and Other account types to add your remaining accounts.

Troubleshooting

I see all of my accounts listed when I try to connect to the new connection method, but not all of them are added:

If you havee a combination of account types, you may see accounts during the authorization process that aren’t added to your Quicken file. Just follow the instructions above “For Credit Card and Other account types” to add the rest of your PayPal accounts.

If you did authorize all of your accounts during the authorization process, double-check that the missing accounts aren’t under a different username, such as a spouse’s, account.

I can’t add my PayPal accounts in my other Quicken file:

If you didn’t select all of your accounts for authorization during the authorization process, PayPal considers these accounts to be unauthorized to add to Quicken. Just follow the steps here to reauthorize all of your accounts.

I’m seeing more deposit and expense transactions with the new connection method.

Because the new PayPal connection method includes more accurate information, money movement will now display differently in Quicken.

In the example above, a user makes a purchase and money needs to be moved into the account to cover the purchase, there will now be a transfer in (+ amount) and then the purchase will occur (- amount).

I’m missing transactions with the new connection method.

You may see differences between when transactions appear on the PayPal website and when they appear in Quicken. This is due to the fact the new connection method now provides more accurate information related to the clearing status of transactions. Transactions do not download into Quicken until they have cleared with PayPal.

There may be up to a 10-day delay before transactions are fully finalized and download into Quicken.

I’m still having problems downloading my transactions after following the steps above.

We can help—please contact Quicken Support.