Overview

When you balance, or reconcile, an account, you compare your Quicken account records against your current bank statement and resolve any differences between the two. However, you may encounter some issues when attempting to reconcile an account.

What if some of my transactions are missing?

If you choose to reconcile to an Online Balance, and you have transactions you entered manually into Quicken, but they are not showing up in your Statement Summary, there are a few possible reasons for this:

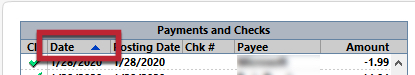

The sort order in the Reconcile window may have been changed Confirm that the sort order in the Reconcile window is by date; just click the top of the Date column in the Reconcile window. It's possible the transactions are there, but not where you thought they'd be.

How can we help?

✖Still need help? Contact Us

You haven’t downloaded your latest transactions yet You need to have downloaded your transactions into Quicken for them to show up when you reconcile to an Online Balance. If you think this could be the problem, open your account, click the Account Actions icon, and then choose Update Now.

You’ve downloaded your latest transactions, but you haven’t accepted them into the register yet Transactions that haven’t been accepted into the register yet appear in the Downloaded Transactions tab at the bottom of the register. You have to accept them into the register before they will appear in the Statement Summary.

The missing transaction hasn’t cleared your bank yet Sometimes it takes a few days between when you initiate a transaction and when it clears your bank. It won’t download into Quicken until it clears. If your missing transaction is one that is dated recently, it might not have cleared your bank yet.

Account Doesn't Reconcile When Reconciling For the First Time

When you began the reconciliation process, did the opening balance in Quicken's Reconcile Bank Statement window match the opening balance on your bank statement?

Yes, my opening balance is correct

See

No, my opening balance is wrong If this is your first time reconciling your bank statement with Quicken, and the opening balance in your register doesn't match your statement, change the opening balance entry in Quicken so that it matches your statement. Then continue with your reconciliation. When you're done reconciling, Quicken adds an adjusting transaction to match up your records with your bank records.

Account Doesn't Reconcile After Reconciling Month Prior

When you began the reconciliation process, did the opening balance in Quicken's Reconcile Bank Statement window match your bank statement?

Yes, my opening balance is correct.

See

No, my opening balance is wrong In this case, a register entry related to a reconciled transaction has changed. You may have:

Inadvertently changed or deleted a previously reconciled transaction. Once a transaction is reconciled, its reconciled status should not be changed.

Entered a new transaction in the register and marked it reconciled in the Clr column without going through the reconciliation process.

Marked an existing transaction as reconciled in the Clr column without going through the reconciliation process. Your reconciliation's opening balance is not the same as the opening balance entry in your register. Your reconciliation's opening balance is the sum of all reconciled transactions in the register. Any change to the reconciled status of any transaction in your register changes your reconciliation's opening balance.

What if Quicken asks if I want to manually reconcile an account?

Changing a reconciled transaction affects future reconciliations. Quicken lets you know if you're about to change a reconciled transaction and asks you to confirm the change.

Your ability to change transactions after they are entered or even reconciled gives you complete control of your financial records. However, if you want to protect your data from accidental or unauthorized changes, Quicken lets you assign passwords to keep it secure.